Oracle 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

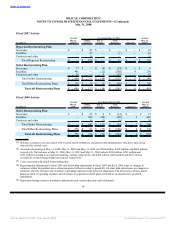

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

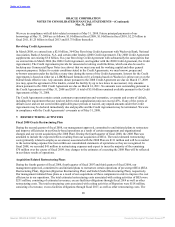

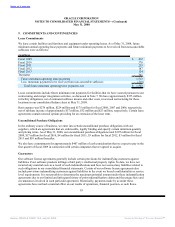

Pre-Acquisition Contingencies

We have evaluated and continue to evaluate pre-acquisition contingencies relating to BEA that existed as of the

acquisition date. If these pre-acquisition contingencies become probable in nature and estimable during the remainder

of the purchase price allocation period, amounts recorded for such matters will be made in the purchase price

allocation period and, subsequent to the purchase price allocation period, in our results of operations.

Agile Software Corporation

We acquired Agile Software Corporation to expand our offering of product life cycle management solutions on

July 16, 2007 by means of a merger of Agile with one of our wholly owned subsidiaries such that Agile became a

wholly owned subsidiary of Oracle. We have included the financial results of Agile in our consolidated financial

results effective July 16, 2007.

The total purchase price for Agile was $492 million which consisted of $471 million in cash paid to acquire the

outstanding common stock of Agile, $14 million for the fair value of Agile options assumed and $7 million for

transaction costs. In allocating the purchase price based on estimated fair values, we recorded approximately

$105 million of goodwill, $198 million of identifiable intangible assets, $184 million of net tangible assets and

$5 million of in-process research and development. The preliminary allocation of the purchase price was based upon

a preliminary valuation and our estimates and assumptions are subject to change. The primary areas of the purchase

price allocation that are not yet finalized relate to certain legal matters, income and non-income based taxes and

residual goodwill.

Other Fiscal 2008 Acquisitions

Our other fiscal 2008 acquisitions were not significant individually or in the aggregate.

In the fourth quarter of fiscal 2008 and first quarter of fiscal 2009, we agreed to acquire a number of companies for

estimated total cash consideration of $407 million. We expect these transactions to close in the first quarter of fiscal

2009.

Fiscal 2007 Acquisitions

Hyperion Solutions Corporation

On April 13, 2007, we acquired majority ownership of Hyperion Solutions Corporation by means of a cash tender

offer and, subsequently, completed a merger of Hyperion with one of our wholly owned subsidiaries such that

Hyperion became a wholly owned subsidiary of Oracle on April 19, 2007. We acquired Hyperion to expand our

offerings of enterprise performance management and business intelligence software solutions.

The total purchase price for Hyperion was $3.2 billion which consisted of $3,171 million in cash paid to acquire the

outstanding common stock of Hyperion, $51 million for the fair value of Hyperion options assumed and restricted

stock awards exchanged and $27 million for acquisition related transaction costs. In allocating the purchase price

based on estimated fair values, we recorded approximately $1,638 million of goodwill, $1,460 million of identifiable

intangible assets, $95 million of net tangible assets and $56 million of in-process research and development.

i-flex solutions limited

During fiscal 2007 and fiscal 2006, we acquired interests in and increased our ownership of i-flex solutions limited

by means of share purchase agreements, an open offer to acquire shares and open market purchases. We acquired a

majority ownership in i-flex to expand our offerings of software solutions and services to the financial services

industry.

83

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠