Oracle 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

net operating loss carryforwards of approximately $2.1 billion, which expire between fiscal 2009 and fiscal

2027, and are subject to limitations on their utilization. We have tax credit carryforwards of approximately

$240 million, which are subject to limitations on their utilization. Approximately $117 million of these tax

credit carryforwards are not currently subject to expiration dates. The remainder, approximately $123 million,

expires in various years between fiscal 2010 and fiscal 2026.

On June 1, 2007, we adopted FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, an

Interpretation of FASB Statement No. 109 (FIN 48). FIN 48 contains a two-step approach to recognizing and

measuring uncertain tax positions accounted for in accordance with FASB Statement No. 109, Accounting for

Income Taxes. The first step is to evaluate the tax position taken or expected to be taken in a tax return by

determining if the weight of available evidence indicates that it is more likely than not that, on evaluation of

the technical merits, the tax position will be sustained on audit, including resolution of any related appeals or

litigation processes. The second step is to measure the tax benefit as the largest amount that is more than 50%

likely to be realized upon ultimate settlement.

The adoption of FIN 48 resulted in an increase to our retained earnings of $3 million and also resulted in us

changing the classification of our unrecognized tax benefits from current to non-current during fiscal 2008.

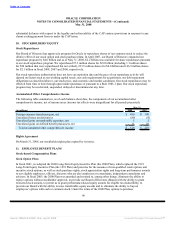

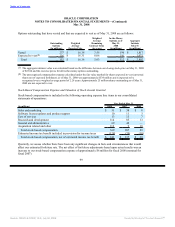

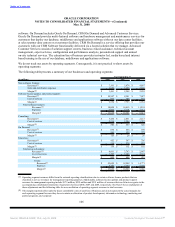

The aggregate changes in the balance of our gross unrecognized tax benefits were as follows:

Year Ended

(in millions) May 31, 2008

Gross unrecognized tax benefits as of June 1, 2007 (FIN 48 adoption date) $ 1,251

Increases related to tax positions from prior fiscal years, including acquisitions 256

Decreases related to tax positions from prior fiscal years (5)

Increases related to tax positions taken during fiscal 2008 180

Settlements with tax authorities (20)

Lapses of statutes of limitation (24)

Other 55

Total gross unrecognized tax benefits as of May 31, 2008 $ 1,693

As of May 31, 2008, $799 million of unrecognized benefits would affect our effective tax rate if realized. We

believe the amount of unrecognized tax benefits as of May 31, 2008 that would affect our effective tax rate if

realized after the adoption of Statement 141(R) in fiscal 2010 to be approximately $1.2 billion. We

recognized interest and penalties related to uncertain tax positions in our provision for income taxes line of

our consolidated statements of operations of $30 million during fiscal 2008. The gross amount of interest and

penalties accrued as of May 31, 2008 was $366 million.

Domestically, U.S. federal and state taxing authorities are currently examining income tax returns of Oracle

and various acquired entities for years through fiscal 2006. Many issues are at an advanced stage in the

examination process, the most significant of which include the deductibility of certain royalty payments,

issues related to certain capital gains and losses, Foreign Sales Corporation/Extraterritorial Income

exemptions, stewardship deductions and foreign tax credits taken. Other issues are related to years with

expiring statutes of limitation. With all of these domestic audit issues considered in the aggregate, we believe

it was reasonably possible that, as of May 31, 2008, the unrecognized tax benefits related to these audits could

either increase as much as $68 million or decrease (whether by payment, release, or a combination of both) in

the next 12 months by as much as $293 million ($246 million net of offsetting tax benefits). Our U.S. federal

and, with some exceptions, our state income tax returns have been examined for all years prior to fiscal 2000,

and we are no longer subject to audit for those periods.

Internationally, tax authorities for numerous non-U.S. jurisdictions are also examining returns affecting

unrecognized tax benefits. We believe it was reasonably possible that, as of May 31, 2008, the gross

unrecognized tax

104

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠