Oracle 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

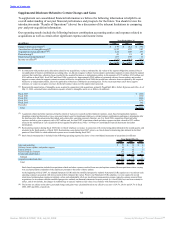

Table of Contents

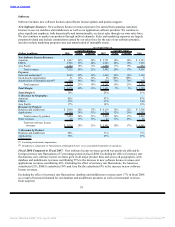

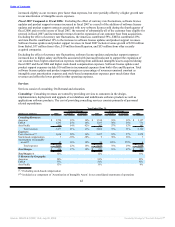

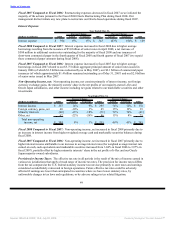

companies. Hyperion products contributed $103 million, BEA products contributed $93 million, Stellent products

contributed $37 million, Tangosol products contributed $18 million and other recently acquired products contributed

$2 million to the total database and middleware revenues growth in fiscal 2008.

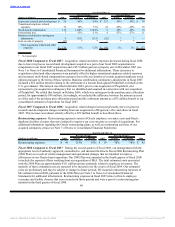

On a constant currency basis, applications revenues increased 33% in fiscal 2008 due to continued strengthening of

our competitive position in the applications software segment of the software industry as a result of our broad

portfolio of product offerings to a diverse customer base and incremental revenues from acquired companies.

Hyperion products contributed $199 million, Agile products contributed $58 million, Metasolv products contributed

$14 million, and other recently acquired products contributed $42 million to the total applications revenue growth in

fiscal 2008.

New software license revenues earned from transactions over $0.5 million grew by 42% in fiscal 2008 and increased

from 46% of new software license revenues in fiscal 2007 to 51% in fiscal 2008.

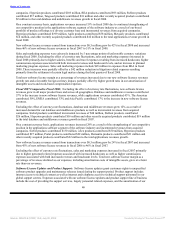

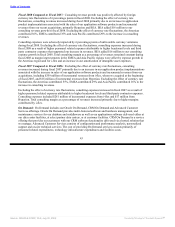

Sales and marketing expenses were adversely impacted by 5 percentage points of unfavorable currency variations

during fiscal 2008. Excluding the effect of currency rate fluctuations, sales and marketing expenses increased in

fiscal 2008 primarily due to higher salaries, benefits and travel expenses resulting from increased headcount, higher

commissions expenses associated with both increased revenues and headcount levels, and an increase in planned

marketing program expenses. Sales and marketing expenses include $45 million in expenses from BEA in fiscal

2008. These increases were partially offset by a $42 million reduction in litigation related expenses resulting

primarily from the settlement of certain legal matters during the third quarter of fiscal 2008.

Total new software license margin as a percentage of revenues increased due to our new software licenses revenues

growth rate and a favorable foreign currency impact, partially offset by higher growth rates in our amortization of

intangible assets and stock-based compensation expenses.

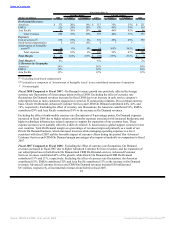

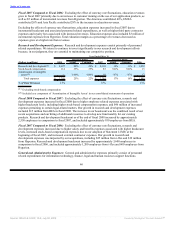

Fiscal 2007 Compared to Fiscal 2006: Excluding the effect of currency rate fluctuations, new software license

revenues grew in all major product lines and across all geographies. Database and middleware revenues contributed

57% to the increase in new software license revenues, while applications revenues contributed 43%. The Americas

contributed 50%, EMEA contributed 33% and Asia Pacific contributed 17% to the increase in new software license

revenues.

Excluding the effect of currency rate fluctuations, database and middleware revenues grew 12% as a result of

increased demand for our database and middleware products as well as incremental revenues from acquired

companies. Siebel products contributed incremental revenues of $48 million, Stellent products contributed

$26 million, Hyperion products contributed $16 million and other recently acquired products contributed $19 million

to the total database and middleware revenues growth in fiscal 2007.

On a constant currency basis, applications revenues increased 29% as a result of the strengthening of our competitive

position in the applications software segment of the software industry and incremental revenues from acquired

companies. Siebel products contributed $130 million, i-flex products contributed $50 million, Hyperion products

contributed $27 million, Portal products contributed $22 million, Demantra products contributed $21 million and

other recently acquired products contributed $22 million to the total applications revenues growth.

New software license revenues earned from transactions over $0.5 million grew by 24% in fiscal 2007 and increased

from 45% of new software license revenues in fiscal 2006 to 46% in fiscal 2007.

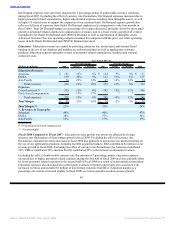

Excluding the effect of currency rate fluctuations, sales and marketing expenses increased in fiscal 2007 primarily

due to higher personnel related expenses associated with increased headcount, as well as higher commissions

expenses associated with both increased revenues and headcount levels. Total new software license margin as a

percentage of revenues declined as our expenses, including amortization costs of intangible assets, grew at a faster

rate than our revenues.

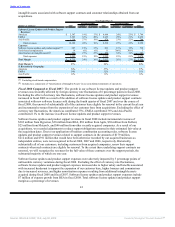

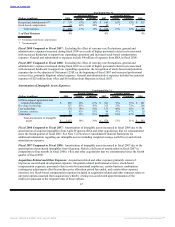

Software License Updates and Product Support: Software license updates grant customers rights to unspecified

software product upgrades and maintenance releases issued during the support period. Product support includes

internet access to technical content as well as internet and telephone access to technical support personnel in our

global support centers. Expenses associated with our software license updates and product support line of business

include the cost of providing the support services, largely personnel related expenses, and the amortization of our

40

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠