Oracle 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

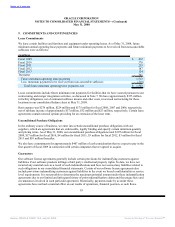

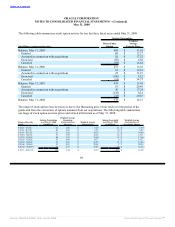

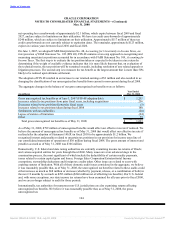

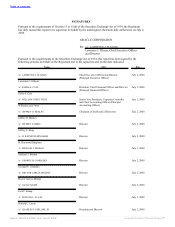

The components of the deferred tax assets and liabilities consist of the following:

May 31,

(in millions) 2008 2007

Deferred tax liabilities:

Unrealized gain on stock $ (130) $ (130)

Unremitted earnings of foreign subsidiaries (110) (38)

Acquired intangible assets (2,143) (1,756)

Other (49) —

Total deferred tax liabilities (2,432) (1,924)

Deferred tax assets:

Accruals and allowances 436 417

Employee compensation and benefits 435 270

Differences in timing of revenue recognition 176 166

Depreciation and amortization 206 85

Tax credit and net operating loss carryforwards 1,315 935

Other — 91

Total deferred tax assets 2,568 1,964

Valuation allowance (190) (166)

Net deferred tax liability $ (54) $ (126)

Recorded as:

Current deferred tax assets $ 853 $ 968

Non-current deferred tax assets (in other assets) 360 47

Current deferred tax liabilities (in other current liabilities) (49) (20)

Non-current deferred tax liabilities (1,218) (1,121)

Net deferred tax liability $ (54) $ (126)

We provide for United States income taxes on the undistributed earnings and the other outside basis

temporary differences of foreign subsidiaries unless they are considered indefinitely reinvested outside the

United States. At May 31, 2008, the amount of temporary differences related to undistributed earnings and

other outside basis temporary differences of investments in foreign subsidiaries upon which United States

income taxes have not been provided was approximately $7.2 billion and $4.7 billion, respectively. If these

undistributed earnings were repatriated to the United States, or if the other outside basis differences were

recognized in a taxable transaction, they would generate foreign tax credits that would reduce the federal tax

liability associated with the foreign dividend or the otherwise taxable transaction. Assuming a full utilization

of the foreign tax credits, the potential deferred tax liability associated with these temporary differences of

undistributed earnings and other outside basis temporary differences would be approximately $1.7 billion and

$1.5 billion, respectively.

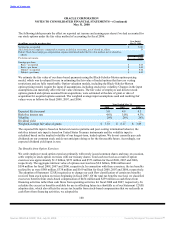

The valuation allowance was $190 million at May 31, 2008 and $166 million at May 31, 2007. The net

increase is primarily attributable to deferred taxes of acquired entities, principally state attributes.

Substantially all of the valuation allowance relates to tax assets established in purchase accounting. Any

subsequent reduction of that portion of the valuation allowance and the recognition of the associated tax

benefits will be applied to reduce goodwill and then to intangible assets established pursuant to the related

acquisition through fiscal 2009, and will be recorded to our provision for income taxes upon our adoption of

Statement 141(R) in fiscal 2010.

At May 31, 2008, we had federal net operating loss carryforwards of approximately $1.5 billion. These losses

expire in various years between fiscal 2014 and fiscal 2027, and are subject to limitations on their utilization.

We have state

103

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠