LensCrafters 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 90 |ANNUAL REPORT 2008

performance targets as defined by the plan will not be achieved. Accordingly no compensation expense

plan has been recorded in 2008 for this plan.

The fair value of the stock options granted was estimated at the date of grant using a binomial lattice

model. The following table presents the weighted - average assumptions used in the valuation and the

resulting weighted average fair value per option granted:

2008 2007 2006

PSP Plan I Plan II

(a) (b)

Dividend yield 1.65% - 1.33% 1.33%

Risk-free interest rate 3.96% - 3.88% 3.89%

Expected option life (years) 2.10 - 5.36 5.53

Expected volatility 30.41% - 26.63% 26.63%

Weighted average fair value (Euro) 17.67 - 6.15 5.8

(a) Stock Performance Plan issued in July 2006 for a total of 9,500,000 options granted

(b) Stock Performance Plan issued in July 2006 for a total of 3,500,000 options granted

As of December 31, 2008 there was Euro 14.8 million of total unrecognized compensation cost related to

non-vested share-based compensation arrangements; that cost is expected to be recognized over a

period of 5 years.

Cash received from option exercises under all share-based arrangements and actual tax benefits realized

for the tax deductions from option exercises are disclosed in the consolidated statements of shareholders’

equity.

12. SHAREHOLDERS’ EQUITY

In May 2008 and June 2007, the Company’s Annual Shareholders Meetings approved cash dividends of

Euro 223.6 million and Euro 191.1 million, respectively. These amounts became payable in May 2008 and

June 2007, respectively. Italian law requires that five percent of net income be retained as a legal reserve

until this reserve is equal to one-fifth of the issued share capital. As such, this legal reserve is not available

for dividends to the shareholders. Legal reserves of the Italian entities included in retained earnings were

Euro 5.6 million and Euro 5.5 million at December 31, 2008 and 2007, respectively.

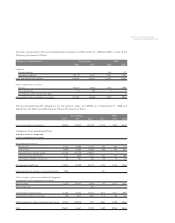

Luxottica Group’s legal reserve roll-forward for fiscal period 2006-2008 is detailed as follows (thousands of

Euro):

January 1, 2006 5,477

Increase in fiscal year 2006 36

December 31, 2006 5,513

Increase in fiscal year 2007 23

December 31, 2007 5,536

Increase in fiscal year 2008 18

December 31, 2008 5,554