LensCrafters 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 98 |ANNUAL REPORT 2008

sub-lease agreements with LensCrafters violate the TOA. The suit seeks recovery of a civil penalty of up

to US$ 1,000 for each day of a violation of the TOA, injunctive relief, punitive damages, and attorneys’

fees and costs. In August 2008, plaintiffs filed a first amended complaint, adding claims for fraudulent

inducement and breach of contract. In October 2008, plaintiffs filed a second amended complaint

seeking to certify the case as a class action on behalf of all current and former LensCrafters’ sub-lease

optometrists. Luxottica Group S.p.A. filed a motion to dismiss for lack of personal jurisdiction in October

2008. That motion is currently pending. The case was transferred to the Western District of Texas, Austin

Division, in January, 2009, pursuant to the defendants’ motion to transfer venue. Although the Company

believes that its operational practices in Texas comply with Texas law, if this action results in an adverse

decision, LensCrafters may have to modify its activities in Texas. Further, LensCrafters and Luxottica

Group might be required to pay statutory damages, the amount of which might have a material adverse

effect on the Company’s operating results, financial condition and cash flow.

Costs associated with this litigation for the year ended December 31, 2008 were not material.

Management believes, based in part on advice from counsel, that no estimate of the range of possible

losses, if any, can be made at this time.

The Company is a defendant in various other lawsuits arising in the ordinary course of business. It is the

opinion of the management of the Company that it has meritorious defenses against all such outstanding

claims, which the Company will vigorously pursue, and that the outcome of such claims, individually or in

the aggregate, will not have a material adverse effect on the Company’s consolidated financial position or

results of operations.

16. FAIR VALUES

Certain assets and liabilities of the Company are recorded at fair value on a recurring basis while others

are recorded at fair value based on specific events. SFAS No. 157 specifies a hierarchy of valuation

techniques consisting of three levels:

•Level 1 - Inputs are quoted prices in an active markets for identical assets or liabilities

•Level 2 - Inputs are quoted for similar assets or liabilities in an active market, quoted prices for identical

or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are

observable (for example interest rates and yield curves observable at common quoted intervals) or

market-corroborated inputs

•Level 3 - Unobservable inputs used observable inputs are not available in situations when there is little,

if any market activity for the asset or liability

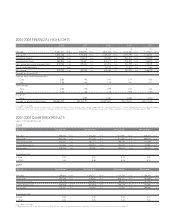

At December 31, 2008 the fair value of the Company’s financial assets and liabilities measured on a

recurring basis are as follows (thousands of Euro):

Fair value measurements

at reporting date using

Description Balance sheet classification December 31, 2008 Level 1 - Level 2 - Level 3 -

Marketable securities Prepaid expenses and other 23,550 23,550

Foreign Exchange Contracts Prepaid expenses and other 7,712 7,712

Interest Rate Derivatives Other assets 138 138

Interest Rate Derivatives Other long term liabilities 64,213 64,213

Foreign Exchange Contracts Other accrued expenses 5,022 5,022

As of December 31, 2008 the Company did not have any Level 3 fair value measurements.

The Company maintains policies and procedures with the aim of valuing the fair value of assets and

liabilities using the best and most relevant data available.