LensCrafters 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

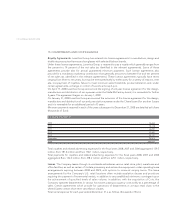

The Lux Plan’s investment policy defines the target allocation as mentioned in the above table as well as

a range of possible allocations. The range of allocation to equity securities is 58% to 72% and the range

of allocation to debt securities is 32% to 38%. The actual allocation percentages at any given time may vary

from the targeted amounts due to changes in stock and bond valuations as well as timing of contributions

to, and benefit payments from, the pension plan trusts. Beginning in September 2008, the global capital

markets took a downward turn and have since become extremely volatile. This volatility is evident in the

year-end market values of plan assets. Upon direction from the plan’s administrator, the Luxottica Group’s

Employee Retirement Income Security Act of 1974 (“ERISA”) Plans Compliance and Investment

Committee, it was decided to refrain from an actual rebalancing of the plan’s assets until the markets

become more stable.

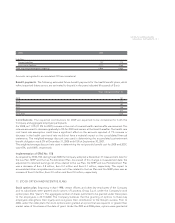

Plan assets are invested in diversified portfolios consisting of an array of asset classes within the above

target allocations and using a combination of active strategies. Active strategies employ multiple

investment management firms. Risk is controlled through diversification among asset classes, managers,

styles, market capitalization (equity investments), and individual securities. Certain transactions and

securities are not authorized to be conducted or held in the pension trusts, such as ownership of real

estate other than real estate investment trusts, commodity contracts, and American Depositary Receipts

(“ADRs”) or common stock of the Company. Risk is further controlled both at the asset class and manager

level by assigning benchmarks and excess return targets. The investment managers are monitored on an

ongoing basis to evaluate performance against the established market benchmarks and return targets.

The defined benefit pension plans have an investment policy that was developed to serve as a

management tool to provide the framework within which the fiduciary’s investment decisions are made,

establish standards to measure investment manager’s performance, outline the roles and responsibilities

of the various parties involved, and describe the ongoing review process.

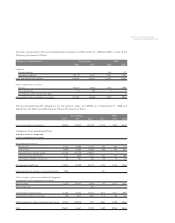

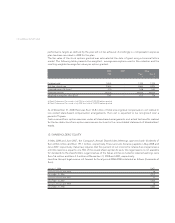

Benefit Payments. The following estimated future benefit payments, which reflect expected future

service, are expected to be paid in the years indicated (thousands of Euro):

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |85 <

Pension Supplemental

plan plans

2009 10,677 442

2010 11,314 560

2011 12,395 558

2012 13,670 948

2013 15,276 1,179

2014-2018 92,668 4,746

Contributions. The Company expects to contribute Euro 26.9 million to its pension plan and Euro 0.4

million to the SERP in 2009.

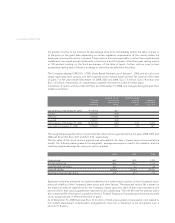

Other benefits. The Company provides certain postemployment medical, disability, and life insurance

benefits. The Company’s accrued liability related to this obligation as of December 31, 2008 and 2007, was

Euro 1.6 million and Euro 1.4 million, respectively, and is included in other long term liabilities on the

consolidated balance sheets.

The Company sponsors a tax incentive savings plan covering all full-time employees. The Company makes

quarterly contributions in cash to the plan based on a percentage of employees’ contributions.

Additionally, the Company may make an annual discretionary contribution to the plan, which may be made

in the Parent Company’s ADRs or cash. Aggregate contributions made to the tax incentive savings plan by

the Company were Euro 8.8 million and Euro 8.1 million for fiscal 2008 and 2007, respectively. For fiscal

2008 and 2007, these contributions did not include a discretionary match.