LensCrafters 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

terms of this amendment and transfer agreement, among other things, reduced the total facility

amount from US$ 500.0 million to US$ 150.0 million, effective on July 1, 2008, and provided for a final

maturity date that is 18 months from the effective date of the agreement. From July 1, 2008, interest

accrues at LIBOR (as defined in the agreement) plus 0.60 percent (4.6525 percent as of December

31,2008). As of December 31, 2008 US$ 150.0 million was borrowed under this facility.

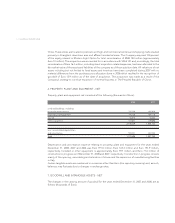

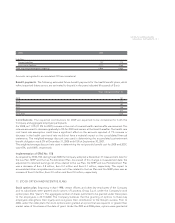

Long-term debt, including capital lease obligations, matures in the years subsequent to December 31,

2008 as follows (thousands of Euro):

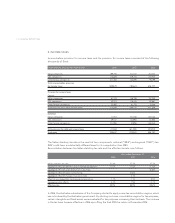

10. EMPLOYEE BENEFITS

Liability for Termination Indemnities. With regards to staff leaving indemnities (“TFR”), Italian law

provides for severance payments to employees upon dismissal, resignation, retirement of other

termination of employment. TFR, through December 31, 2006, was considered an unfunded defined

benefit plan. Therefore, through December 31, 2006, the Company accounted for the defined benefit plan

in accordance with EITF 88-1, “Determination of Vested Benefit Obligation for a Defined Benefit Pension

Plan,” using the option to record the vested benefit obligation, which is the actuarial present value of the

vested benefits to which the employee would be entitled if the employee retired, resigned or were

terminated as of the date of the financial statements..

Effective January 1, 2007, the TFR system was reformed, and under the new law, employees are given the

ability to choose where the TFR compensation is invested, whereas such compensation otherwise would

be directed to the National Social Security Institute or Pension Funds. As a result, contributions under the

reformed TFR system are accounted for as a defined contribution plan. The liability accrued until

December 31, 2006 continues to be considered a defined benefit plan, therefore each year, the Company

adjusts its accrual based upon headcount and inflation and excluding the changes in compensation level.

There are also some termination indemnities in other countries which are provided through payroll tax and

other social contributions in accordance with local statutory requirements. The related charges to earnings

for the years ended December 31, 2008, 2007 and 2006 were Euro 17.9 million, Euro 15.4 million and Euro

12.9 million respectively.

Qualified Pension Plans. During fiscal years 2008, 2007, and 2006, the Company continued to sponsor a

qualified noncontributory defined benefit pension plan, the Luxottica Group Pension Plan (“Lux Plan”),

which provides for the payment of benefits to eligible past and present employees of the Company upon

retirement. Pension benefits are accrued based on length of service and annual compensation under a

cash balance formula.

The Lux Plan was amended effective January 1, 2006, granting eligibility to associates who work in the Cole

Vision stores, field management, and the related labs and distribution centers. Additionally, the Company

amended the pension accrual formula for the Cole associates, as well as all new hires for the Company.

The new formula has a more gradual benefit accrual pattern and incorporates changes to the vesting

schedule as required by the Pension Plan Protection Act of 2006.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |81 <

Years ended December 31

2009 286,213

2010 260,601

2011 257,978

2012 511,564

2013 1,305,686

Thereafter 183,460

Total 2,805,502