LensCrafters 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59 <

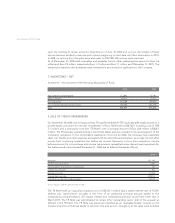

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Organization. Luxottica Group S.p.A. and its subsidiaries (collectively “Luxottica Group” or the

“Company”) operate in two industry segments: (1) manufacturing and wholesale distribution and (2) retail

distribution.

Through its manufacturing and wholesale distribution operations, Luxottica Group is engaged in the

design, manufacturing, wholesale distribution and marketing of house brand and designer lines of mid to

premium-priced prescription frames and sunglasses, and, with the acquisition of Oakley Inc. (“Oakley”) in

November 2007, the Company, through various Oakley subsidiaries, is a designer, manufacturer, and

worldwide distributor of performance optics products.

Through its retail operations, as of December 31, 2008, the Company owned and operated 5,696 retail

locations worldwide (5,885 locations at December 31, 2007) and franchised an additional 559 locations (522

locations at December 31, 2007) principally through LensCrafters, Inc., Sunglass Hut International Inc.,

OPSM Group Limited, Cole National Corporation (“Cole”) and Oakley. The retail division of Oakley (“O”

retail) consists of owned retail locations operating under various names including “O” stores which sell

apparel and other Oakley branded merchandise in addition to performance sunglasses.

Luxottica Group’s net sales consist of direct sales of finished products manufactured under its own brand

names or licensed brands to opticians and other independent retailers through its wholesale distribution

channels and direct sales to consumers through its retail segment.

Demand for the Company’s products, particularly the higher-end designer lines, is largely dependent on

the discretionary spending power of the consumers in the markets in which the Company operates.

The North America retail division’s fiscal year is a 52- or 53-week period ending on the Saturday nearest

December 31. The accompanying consolidated financial statements include the operations of the North

America retail division for the 53-week period ended January 3, 2009 and for the 52-week periods ended

December 29, 2007 and December 30, 2006.

Principles of consolidation and basis of presentation. The consolidated financial statements of

Luxottica Group include the financial statements of the parent company and all wholly or majority-owned

subsidiaries. The principles of the Financial Accounting Standards Board (“FASB”) Interpretation (“FIN”)

No. 46 (revised December 2003),

Consolidation of Variable Interest Entities

and Accounting Research

Bulletin (“ARB”) No. 51,

Consolidated Financial Statements

are considered when determining whether an

entity is subject to consolidation. During 2007 a subsidiary of the Company located in the United States

acquired an additional 26 percent interest in an affiliated manufacturing and wholesale distributor, located

and publicly traded in India, in which it previously held an approximate 44 percent interest. Until the time

that the Company became the majority shareholder, this investment was accounted for under the equity

method. During 2008, the Company acquired through one of its subsidiaries an additional 16 percent

interest in an affiliated company in which it previously held a 50 percent interest. Until the time that the

Company became the majority shareholder, this investment was accounted for under the equity method.

Investments in other companies in which the Company has less than a 20 percent interest with no ability

to exercise significant influence are carried at cost. All intercompany accounts and transactions are

eliminated in consolidation. Luxottica Group prepares its consolidated financial statements in accordance

with accounting principles generally accepted in the United States of America (“US GAAP”).

In accordance with FASB Statement of Financial Accounting Standard (“SFAS”) No. 141,

Business

Combinations

, the Company accounts for all business combinations under the purchase method (see

“Recent Accounting Pronouncements” for a discussion on the revised standard). Furthermore, the

Company recognizes intangible assets apart from goodwill if they arise from contractual or legal rights or

if they are separable from goodwill.

Use of estimates. The preparation of financial statements in conformity with US GAAP requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities

and disclosure of contingent assets and liabilities at the date of the financial statements and the reported

NOTES TO

CONSOLIDATED

FINANCIAL

STATEMENTS