LensCrafters 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

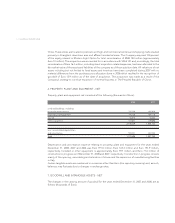

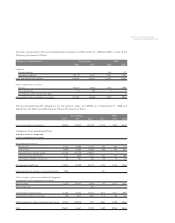

(a) Goodwill acquired in 2007 mainly consists of the acquisition of Oakley, the acquisition of the additional 26% of the net equity of the Indian subsidiary and minor

acquisitions in the Retail segment. Goodwill acquired in 2008 in the Retail segment mainly consists of the acquisition of OHL. Goodwill acquired in 2008 in the

Wholesale segment mainly consists of the acquisition of the additional 17.7% of the net equity of the Indian subsidiary. The adjustments on previous acquisitions

mainly refer to the finalization of the Oakley fair value analysis. Oakley goodwill has been allocated to the wholesale and retail segments in 2008.

(b) Certain goodwill balances are denominated in currencies other than Euro (the reporting currency) and, as such, balances may fluctuate due to changes in

exchange rates.

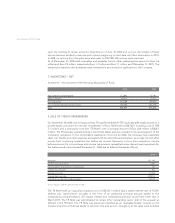

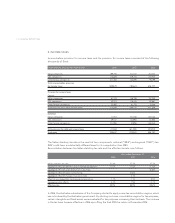

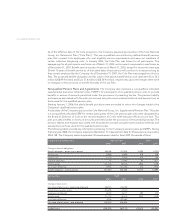

Intangible assets-net consist of the following (thousands of Euro):

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |73<

Retail Segment Wholesale Segment Oakley Total

Balance as of January 1, 2007 1,353,999 340,615 - 1,694,614

Acquisitions(a) 86,021 9,611 904,148 999,780

Adjustments on previous acquisitions(a) (15,678) (15,678)

Change in exchange rates(b) (84,323) 4,393 3,054 (76,876)

Balance as of December 31, 2007 1,355,697 338,941 907,202 2,601,840

Acquisitions(a) 24,192 6,914 31,106

Adjustments on previous acquisitions(a) 241,238 695,787 (907,202) 29,823

Change in exchange rates(b) 6,629 25,376 32,005

Balance as of December 31, 2008 1,627,756 1,067,018 - 2,694,774

2008 2007

Gross Accumulated Total Gross Accumulated Total

carrying amount depreciation carrying amount depreciation

Trade names and trademarks(a) 1,318,737 (394,612) 924,125 1,288,620 (325,912) 962,708

Customer relation, contracts and list(b) 215,868 (20,206) 195,662 210,258 (9,153) 201,105

Distributor network(b) 81,086 (15,179) 65,907 79,359 (12,410) 66,949

Franchise agreements(b) 20,619 (3,870) 16,749 20,749 (2,757) 17,992

Other(c) 51,490 (19,903) 31,587 77,847 (20,484) 57,363

Total 1,687,800 (453,770) 1,234,030 1,676,833 (370,716) 1,306,117

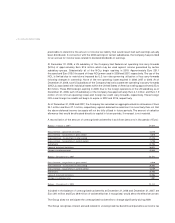

(a) Trade names includes various trade names and trademarks acquired with the acquisitions of LensCrafters, Sunglass Hut International, OPSM, Cole and Oakley.

Trade names are amortized on a straight-line basis over a period of 25 years (except for the Ray-Ban trade names, which are amortized over a period of 20 years),

as the Company believes these trade names to be finite-lived assets. The weighted average amortization period is 24 years.

(b) Distributor network, customer contracts and lists, and franchise agreements wereidentifiable intangibles recorded in connection with the acquisition of Cole in

2004 and of Oakley in 2007. These assets have finite lives and are amortized on a straight-line basis or on an accelerated basis (projected diminishing cash flows)

over periods ranging between 3 and 25 years. The weighted average amortization period is 20.6 years.

(c) Other identifiable intangibles have finite lives ranging between 3 and 17 years and are amortized on a straight line basis. The weighted average amortization

period is 11.3 years. Most of these useful lives were determined based on the terms of the license agreements and non-compete agreements. During 2007,

approximately Euro5.8 million of intangibles became fully amortized and werewritten off. The reduction in the gross carrying amount in 2008 of the Other

Intangible assets was primarily due to (i) the finalization of the Oakley fair value analysis, and (ii) the reclassification of some intangible assets as a result of the

change in the contractual agreement based on which the above mentioned assets were originally recorded.

Certain intangible assets are maintained in currencies other than Euro (the reporting currency) and, as

such, balances may fluctuate due to changes in exchange rates.

Amortization expense for 2008, 2007 and 2006 was Euro73.9 million, Euro69.6 million and Euro 68.8 million,

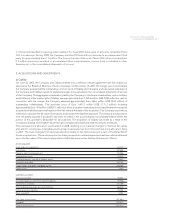

respectively. Estimated annual amortization expense relating to identifiable assets is shown below (Euro 000):

Years ending December 31,

2009 77,376

2010 75,877

2011 74,350

2012 73,388

2013 72,610