LensCrafters 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

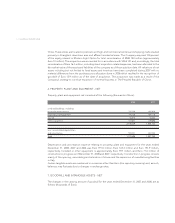

>76 |ANNUAL REPORT 2008

practicable to determine the amount of income tax liability that would result had such earnings actually

been distributed. In connection with the 2008 earnings of certain subsidiaries, the Company has provided

for an accrual for income taxes related to declared dividends of earnings.

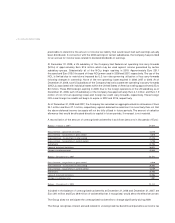

At December 31, 2008, a US subsidiary of the Company had Federal net operating loss carry-forwards

(NOLs) of approximately Euro 97.6 million which may be used against income generated by certain

subsidiary groups. Substantially all of the NOLs begin expiring in 2019. Approximately Euro 231.1

thousand and Euro 513.0 thousand of these NOLs were used in 2008 and 2007, respectively. The use of the

NOL is limited due to restrictions imposed by U.S. tax rules governing utilization of loss carry-forwards

following changes in ownership. None of the net operating losses expired in 2008, 2007 or 2006. As of

December 31, 2008, such US subsidiary of the Company had various state net operating loss carry-forwards

(SNOLs), associated with individual states within the United States of America totaling approximately Euro

8.0 million. These SNOLs begin expiring in 2009. Due to the foreign operations of the US subsidiary, as of

December 31, 2008, such US subsidiary of the Company has approximately Euro 4.1 million and Euro 1.9

million of non US net operating losses and foreign tax credit carry-forwards, respectively. These foreign

NOLs and foreign tax credits will begin to expirein 2012 and 2016, respectively.

As of December 31, 2008 and 2007, the Company has recorded an aggregate valuation allowance of Euro

24.1 million and Euro27.1 million, respectively, against deferred tax assets as it is more likely than not that

the above deferred income tax assets will not be fully utilized in future periods. The amount of valuation

allowance that would be allocated directly to capital in future periods, if reversed, is not material.

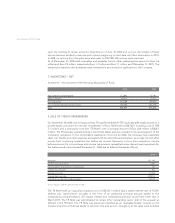

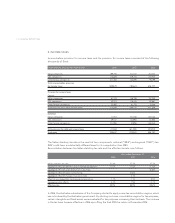

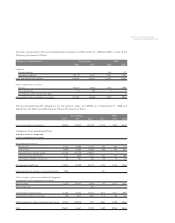

Areconciliation of the amount of unrecognized tax benefits is as follows (amounts in thousands of Euro):

Balance - January1, 2007 54,089

Gross increase - acquisition of Oakley 14,176

Gross increase - tax positions in prior period 5,018

Gross decrease - tax positions in prior period (7,473)

Gross increase - tax positions in current period 5,796

Settlements (2,799)

Lapse of statute of limitations (8,851)

Change in exchange rates (3,365)

Balance - December 31, 2007 56,591

Gross increase - tax positions in prior period 4,910

Gross decrease - tax positions in prior period (9,356)

Gross increase - tax positions in current period 13,139

Settlements (6,756)

Lapse of statute of limitations (2,296)

Change in exchange rates 1,901

Balance - December 31, 2008 58,133

Included in the balance of unrecognized tax benefits at December 31, 2008 and December 31, 2007, are

Euro39.1 million and Euro39.9 million of tax benefits that, if recognized, would affect the effective tax rate.

The Group does not anticipate the unrecognized tax benefits to change significantly during 2009.

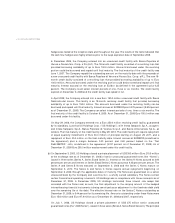

The Group recognizes interest accrued related to unrecognized tax benefits and penalties as income tax