LensCrafters 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 64 |ANNUAL REPORT 2008

advertising costs are expected to result in future economic benefit and the primary purpose of the

advertising is to elicit sales to customers who could be shown to have responded specifically to the

advertising. Such costs related to the direct response advertising are amortized over the period during

which the revenues are recognized, not to exceed 90 days. Generally, other direct response program costs

that do not meet the capitalization criteria are expensed the first time the advertising occurs. Advertising

expenses incurred during fiscal years 2008, 2007 and 2006 were Euro 339.3 million, Euro 348.2 million and

Euro 318.1 million, respectively, and no significant amounts have been reported as assets.

The Company receives a reimbursement from its acquired franchisees for certain marketing costs.

Operating expenses in the consolidated statements of income are net of amounts reimbursed by the

franchisees calculated based on a percentage of their sales. The amounts received in fiscal years 2008,

2007 and 2006 for such reimbursement were Euro 15.1 million, Euro 16.8 million and Euro 19.2 million,

respectively.

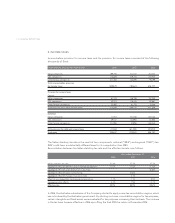

Earnings per share. Luxottica Group calculates basic and diluted earnings per share in accordance with

SFAS No. 128,

Earnings per Share

. Net income available to shareholders is the same for the basic and

diluted earnings per share calculations for the years ended December 31, 2008, 2007 and 2006. Basic

earnings per share are based on the weighted average number of shares of common stock outstanding

during the period. Diluted earnings per share are based on the weighted average number of shares of

common stock and common stock equivalents (options) outstanding during the period, except when the

common stock equivalents are anti-dilutive. The following is a reconciliation from basic to diluted shares

outstanding used in the calculation of earnings per share:

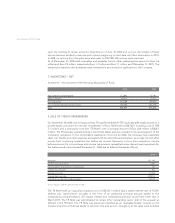

2008 2007 2006

Weighted average shares outstanding - basic 456,563,502 455,184,797 452,897,854

Effect of dilutive stock options 1,153,542 3,345,812 3,287,796

Weighted average shares outstanding - dilutive 457,717,044 458,530,609 456,185,650

Options not included in calculation of dilutive

shares as the exercise price was greater than the

average price during the respective period 18,529,635 4,947,775 6,885,893

Stock-based compensation. Stock-based compensation represents the cost related to stock-based

awards granted to employees. Stock-based compensation cost is measured at grant date based on the

estimated fair value of the award and recognizes the cost on a straight-line basis (net of estimated

forfeitures) over the employee requisite service period. The fair value of stock options is estimated using

a binomial lattice valuation technique. Deferred tax assets are recorded for awards that result in

deductions on income tax returns, based on the amount of compensation cost recognized and the

statutory tax rate in the jurisdiction in which the deduction will be received. Differences between the

deferred tax assets recognized for financial reporting purposes and the actual tax deduction reported on

the income tax return are recorded in Additional Paid-In Capital (if the tax deduction exceeds the deferred

tax asset) or in the consolidated statements of income (if the deferred tax asset exceeds the tax deduction

and no additional paid-in capital exists from previous awards).

Derivative financial instruments. Derivative financial instruments are accounted for in accordance with

SFAS No. 133,

Accounting for Derivative Instruments and Hedging Activities

(“SFAS 133”), as amended

and interpreted.

SFAS 133 requires that all derivatives, whether or not designed in hedging relationships, be recorded on

the balance sheet at fair value regardless of the purpose or intent for holding them. If a derivative is

designated as a fair-value hedge, changes in the fair value of the derivative and the related change in the

hedge item are recognized in operations. If a derivative is designated as a cash-flow hedge, changes in