LensCrafters 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 72 |ANNUAL REPORT 2008

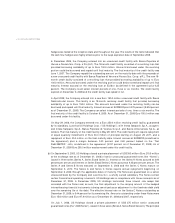

China. These stores are located in premium and high-end commercial centers and shopping malls situated

primarily in Shanghai’s downtown area and affluent residential areas. The Company acquired 100 percent

of the equity interest in Modern Sight Optics for total consideration of RMB 140 million (approximately

Euro 14 million). The acquisition was accounted for in accordance with SFAS 141 and, accordingly, the total

consideration of Euro 16.3 million, including direct acquisition-related expenses, has been allocated to the

fair market value of the assets and liabilities of the company as of the acquisition date. All valuations of net

assets including but not limited to fixed assets and inventory have been completed during 2007 with no

material differences from the purchase price allocation done in 2006 which resulted in the recognition of

goodwill of Euro 15.9 million as of the date of acquisition. The acquisition was made as a result of the

Company’s strategy to continue expansion of its retail business in The People’s Republic of China.

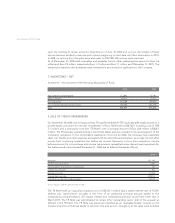

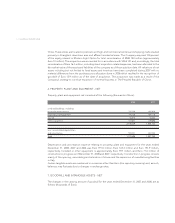

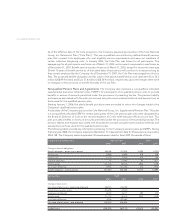

6. PROPERTY, PLANT AND EQUIPMENT - NET

Property, plant and equipment-net consisted of the following (thousands of Euro):

2008 2007

Land and buildings, including

leasehold improvements 755,254 687,428

Machinery and equipment 795,126 697,776

Aircraft 40,018 40,222

Other equipment 513,631 439,696

2,104,029 1,865,122

Less: accumulated depreciation

and amortization 933,331 807,340

Total 1,170,698 1,057,782

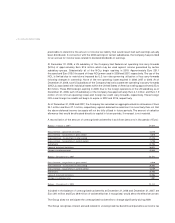

Depreciation and amortization expense relating to property, plant and equipment for the years ended

December 31, 2008, 2007 and 2006 was Euro 191.0 million, Euro 163.3 million and Euro 151.9 million,

respectively. Included in other equipment is approximately Euro 79.7 million and Euro 71.6 million of

construction in progress as of December 31, 2008 and 2007, respectively. Construction in progress consists

mainly of the opening, remodeling and relocation of stores and the expansion of manufacturing facilities

in Italy.

Certain tangible assets are maintained in currencies other than Euro (the reporting currency) and, as such,

balances may fluctuate due to changes in exchange rates.

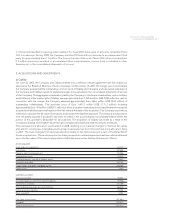

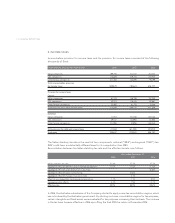

7. GOODWILL AND INTANGIBLE ASSETS - NET

The changes in the carrying amount of goodwill for the years ended December 31, 2007 and 2008, are as

follows (thousands of Euro):