LensCrafters 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Amounts recognized in accumulated OCI are immaterial.

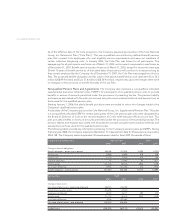

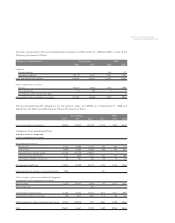

Benefit payments. The following estimated future benefit payments for the health benefit plans, which

reflect expected future service, are estimated to be paid in the years indicated (thousands of Euro):

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |87 <

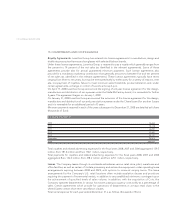

2008 2007

Liabilities:

Current liabilities 157 173

Noncurrent liabilities 2,773 3,260

Total accrued postretirement liabilities 2,930 3,433

Years ending December 31,

2009 157

2010 171

2011 192

2012 206

2013 215

2014-2018 1,275

Contributions. The expected contributions for 2009 are expected to be immaterial for both the

Company and aggregate employee participants.

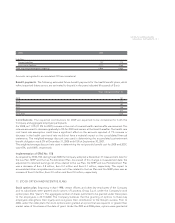

For 2008, an 11.0% (11.5% for 2007) increase in the cost of covered health care benefits was assumed. This

rate was assumed to decrease gradually to 5% for 2020 and remain at that level thereafter. The health care

cost trend rate assumption could have a significant effect on the amounts reported. A 1% increase or

decrease in the health care trend rate would not have a material impact on the consolidated financial

statements. The weighted-average discount rate used in determining the accumulated postretirement

benefit obligation was 6.3% at December 31, 2008 and 6.5% at September 30, 2007.

The weighted-average discount rate used in determining the net periodic benefit cost for 2008 and 2007,

was 6.5%, and 6.00%, respectively.

Implementation of SFAS No. 158

As required by SFAS 158, during fiscal 2008 the Company adopted a December 31 measurement date for

the Lux Plan, SERP and the Lux Postretirement Plan. As a result of this change in measurement date, the

adjustment to retained earnings net of tax related to the Lux Plan, the SERP and Lux Postretirement Plan

was a decrease of Euro 2.8 million, Euro 0.2 million and Euro 0.1 million, respectively. The impact to

accumulated other comprehensive Income net of tax related to the Lux Plan and the SERP plans was an

increase of Euro 0.2million, Euro 0.0 million and Euro 0.0 million, respectively

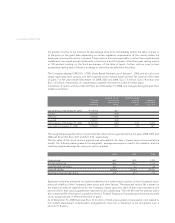

11. STOCK OPTION AND INCENTIVE PLANS

Stock option plan. Beginning in April 1998, certain officers and other key employees of the Company

and its subsidiaries were granted stock options of Luxottica Group S.p.A. under the Company’s stock

option plans (the “plans”). The aggregate number of shares permitted to be granted under these plans

to the employees is 24,714,600. The Company believes that the granting of options to these key

employees strengthens their loyalty and recognizes their contribution to the Group’s success. Prior to

2006, under the older plans the stock options were granted at a price that was equal to or greater than

market value of the shares at the date of grant. Under the 2005 and 2006 plans, options were granted at