LensCrafters 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

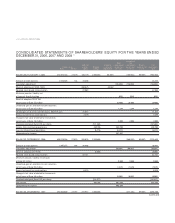

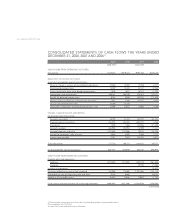

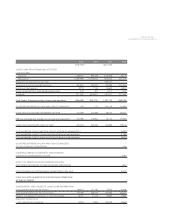

CONSOLIDATED

STATEMENTS OF

SHAREHOLDERS’ EQUITY |55 <

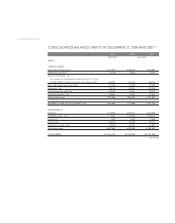

(1) Translated for convenience at the New York City Noon Buying Rate as determined in Note 1

(*) In accordance with US GAAP

See notes to the consolidated financial statements

BALANCES, DECEMBER 31, 2007 462,623,620 27,757 277,947 2,636,868 (377,428) (69,987) 2,495,158

Exercise of stock options 744,613 45 7,081 7,126

Translation adjustment (73,682) (73,682) (73,682)

Realized stock based compensation 10,424 10,424

Adjustment to pension liability,

net of taxes of Euro 29.2 million (50,658) (50,658) (50,658)

Adoption of SFAS No. 158 measurement date

provisions, net of taxes of Euro 1.9 million (3,079) (3,079)

Unrealized gain on available-for-sale securities,

net of taxes of Euro 0.2 million 409 409 409

Excess tax benefit on stock options 631 631

Change in fair value of derivative instruments,

net of taxes of Euro 20.7 million (41,287) (41,287) (41,287)

Diluted gain on business combinations 5,446 5,446

Dividends declared (Euro 0.49 per share) (223,617) (223,617)

Net income 379,722 379,722

Comprehensive income (165,218)

BALANCES, DECEMBER 31, 2008 463,368,233 27,802 301,529 2,789,894 (542,646) (69,987) 2,506,593

Comprehensive income (1) (US$ 000) (229,967)

BALANCES, DECEMBER 31, 2008 (1) 463,368,233 38,698 419,699 3,883,253 (755,308) (97,415) 3,488,927

(US$ 000) (1)

Accumulated

Other other

Additional Unearned comprehensive comprehensive Treasury Total

Common stock paid-in Retained stock-based income (loss) income (loss) shares amount, shareholders’

Shares Amount capital earnings compensation net of tax net of tax at cost equity