LensCrafters 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNEXES |113 <

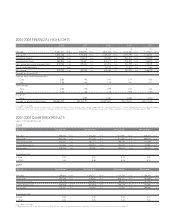

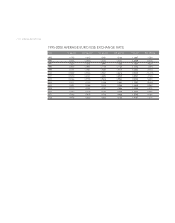

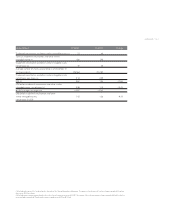

(Euro millions) FY 2008(1) FY 2007(2) Change

Trademark amortization and other similar intangible assets (+) 72 64

Taxes on trademark amortization and other similar

intangible assets (-) (26) (24)

Trademark amortization and other similar intangible assets,

net of taxes (=) 45 40

Average number of shares outstanding as of December 31

(in thousands) (/) 456,564 455,185

Trademark amortization and other similar intangible assets,

net of taxes, per share (=) 0.10 0.09

EPS (+) 0.87 1.05 -17.8%

EPS before trademark amortization and other similar

intangible assets, net of taxes (=) 0.96 1.14 -15.4%

/US$ average exchange rate 1.4707 1.3705

EPS before trademark amortization and other

similar intangible assets, 1.42 1.56 -9.2%

net of taxes (in US$)

(1) Excluding the write-off of credit related to the sale of the Things Remembered business. The impact of such write-off is a loss of approximately 15 million

after tax or 0.03 per share.

(2) Excluding non-recurring gain related to the sale of a real estate property in 2Q 2007. The impact of the sale was a gain of approximately 20 million before

taxes and approximately 13 million after taxes, equivalent to 0.03 at EPS level.