LensCrafters 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 56 |ANNUAL REPORT 2008

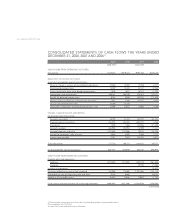

CONSOLIDATED STATEMENTS OF CASH FLOWS THE YEARS ENDED

DECEMBER 31, 2008, 2007 AND 2006 (*)

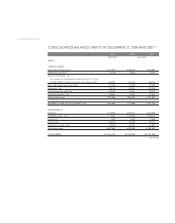

2008 2008 2007 2006

(US$ 000) (1) (Euro 000)

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $528,535 379,722 492,204 430,705

Adjustments to reconcile net income

to net cash provided by operating activitities:

Minority interest in income of consolidated subsidiaries 21,563 15,492 14,976 8,715

Stock-based compensation 14,509 10,424 42,121 47,969

Excess tax benefits from stock-based compensation (878) (631) (6,313) (7,279)

Depreciation and amortization 368,767 264,938 232,813 220,797

Benefit for deferred income taxes 6,762 4,858 (45,037) (72,509)

Net loss (Gain) on disposals of fixed assets and other 2,851 2,048 (19,337) 4,930

Loss on sale of promissory note 32,298 23,204

Termination indemnities matured during the year - net (2,049) (1,472) (3,595) 4,369

Changes in operating assets and liabilities,

net of acquisition of businesses:

Accounts receivable 38,799 27,875 (55,707) (83,107)

Prepaid expenses and other (36,391) (26,145) (220,727) 8,568

Inventories 1,904 1,368 (41,916) (27,658)

Accounts payable (26,993) (19,393) 32,989 71,723

Accrued expenses and other (153,646) (110,386) (9,433) (25,243)

Accrual for customers’ right of return 5,692 4,090 9,855 11,121

Income taxes payable 4,041 2,903 (92,142) 5,875

Total adjustments 277,228 199,173 (161,453) 168,271

Cash provided by operating activities 805,763 578,895 330,751 598,976

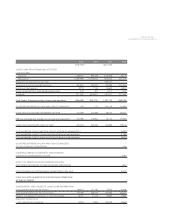

CASH FLOWS FROM INVESTING ACTIVITIES:

Property, plant and equipment:

Additions (433,632) (311,540) (322,770) (267,882)

Disposals 29,700 21,563

Increase in investments (5,872)

Purchases of businesses net of cash acquired (18,496) (13,288) (1,491,086) (134,114)

Proceeds from sale of Promissory note and other 9,576 6,880 128,007

Additions of intangible assets (6,452) (4,636) (3,883) (1,140)

Cash used in investing activities of continuing operations (449,004) (322,584) (1,788,039) (259,439)

(Continued)

(1) Translated for convenience at the New York City Noon Buying Rate as determined in Note 1

(*) In accordance with US GAAP

See notes to the consolidated financial statements