LensCrafters 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 82 |ANNUAL REPORT 2008

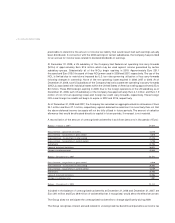

As of the effective date of the Cole acquisition, the Company assumed sponsorship of the Cole National

Group, Inc. Retirement Plan (“Cole Plan”). This was a qualified noncontributory defined benefit pension

plan that covered Cole employees who met eligibility service requirements and were not members of

certain collective bargaining units. In January 2002, the Cole Plan was frozen for all participants. The

average pay for all participants was frozen as of March 31, 2002, and covered compensation was frozen as

of December 31, 2001. Benefit service was also frozen as of March 31, 2002, except for those who were age

50 with 10 years of benefit service as of that same date, whose service will continue to increase as long as

they remain employed by the Company. As of December 31, 2007, the Cole Plan was merged into the Lux

Plan. The projected benefit obligation and fair value of net assets transferred on such date were Euro 34.2

million (US$ 49.9 million) and Euro 37.6 million (US$ 54.9 million), respectively. Upon the merger, there were

no changes to the provisions or benefit formulas of the Lux Plan.

Nonqualified Pension Plans and Agreements. The Company also maintains a nonqualified, unfunded

supplemental executive retirement plan (“SERP”) for participants of its qualified pension plan to provide

benefits in excess of amounts permitted under the provisions of prevailing tax law. The pension liability

and expense associated with this plan are accrued using the same actuarial methods and assumptions as

those used for the qualified pension plan.

Starting January 1, 2006, this plan’s benefit provisions were amended to mirror the changes made to the

Company’s qualified pension plan.

A subsidiary of the Company sponsors the Cole National Group, Inc. Supplemental Pension Plan. This plan

is a nonqualified unfunded SERP for certain participants of the Cole pension plan who were designated by

the Board of Directors of Cole on the recommendation of Cole’s chief executive officer at such time. This

plan provides benefits in excess of amounts permitted under the provisions of the prevailing tax law. The

pension liability and expense associated with this plan are accrued using the same actuarial methods and

assumptions as those used for the qualified pension plan.

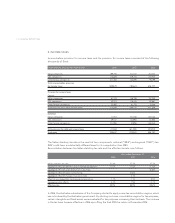

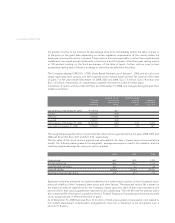

The following tables provide key information pertaining to the Company’s pension plans and SERPs. During

the fiscal year 2008, the Company adopted a December 31 measurement date for these plans as required by

SFAS 158. The Company used a September 30 measurement date for fiscal 2007 (thousands of Euro).

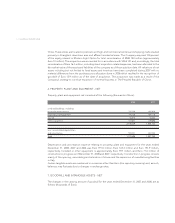

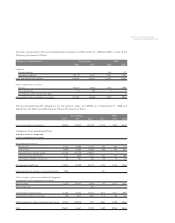

Obligation and funded status Pension Plans SERP

2008 2007 2008 2007

Change in benefit obligations:

Benefit obligation - beginning of period 266,786 272,248 10,095 8,320

Service cost 21,666 16,449 679 504

Interest cost 21,210 15,606 870 589

Actuarial (gain)/loss 55 (1,690) 92 1,871

Benefits paid (11,111) (8,573) (294) (219)

Translation difference 14,914 (27,254) 573 (970)

Benefit obligation - end of period 313,520 266,786 12,015 10,095

Pension Plans SERP

2008 2007 2008 2007

Change in plan assets:

Fair value of plan assets - beginning of period 226,575 216,792

Actual return on plan assets (55,679) 24,203

Employer contribution 16,318 16,717 294 219

Benefits paid (11,111) (8,573) (294) (219)

Translation difference 8,276 (22,564)

Fair value of plan assets - end of period 184,379 226,575

Funded status (129,141) (40,211) (12,015) (10,095)