LensCrafters 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 74 |ANNUAL REPORT 2008

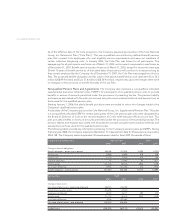

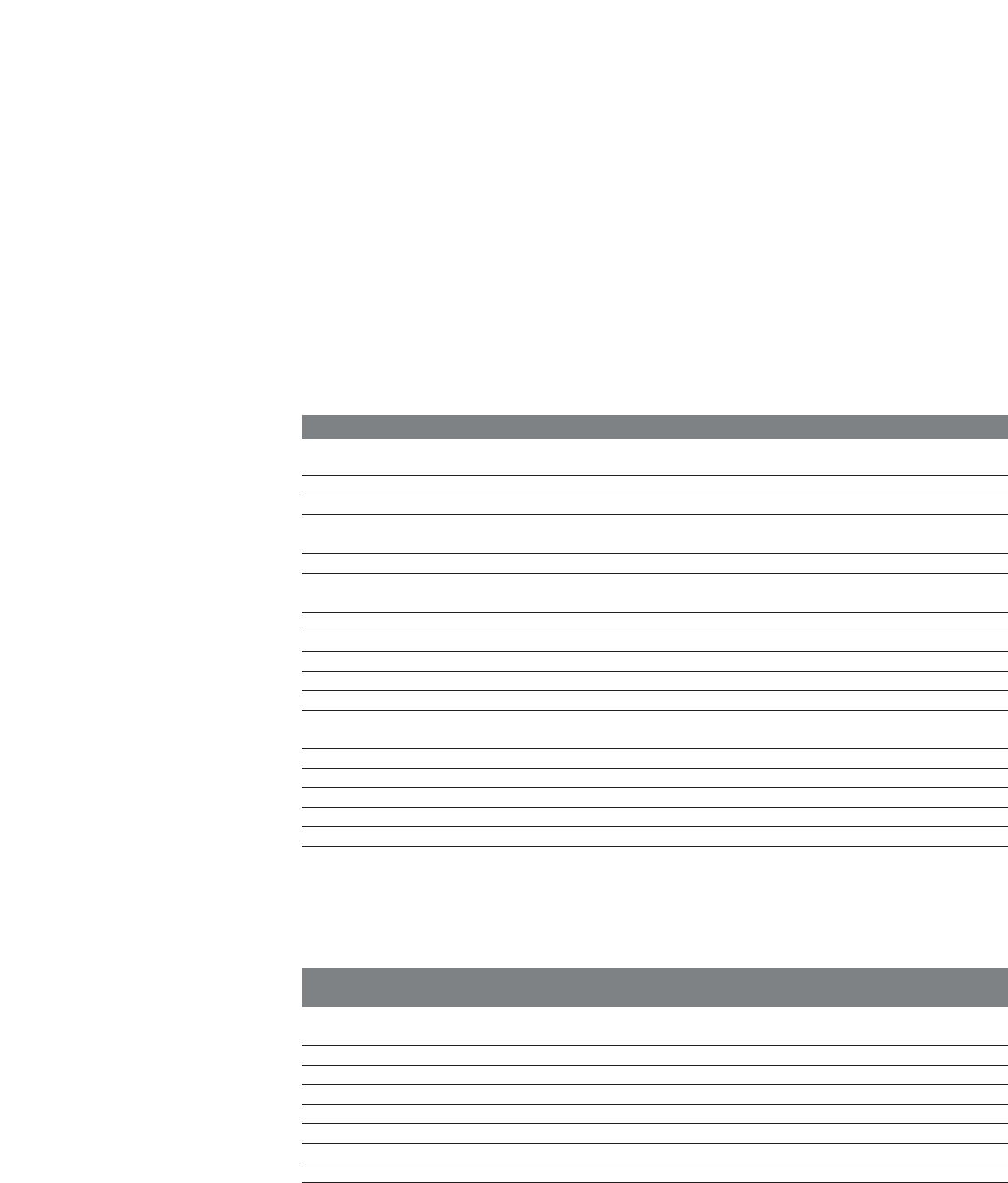

8. INCOME TAXES

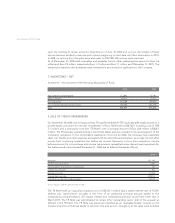

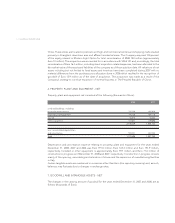

Income before provision for income taxes and the provision for income taxes consisted of the following

(thousands of Euro):

Income before provision for income taxes 2008 2007 2006

Italian companies 199,793 317,637 251,343

USA companies 172,609 319,154 331,035

Other foreign companies 217,468 143,890 95,799

Total income before provision

for income taxes 589,870 780,681 678,177

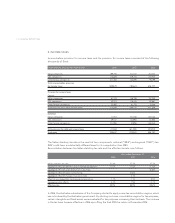

Provision for income taxes

Current

Italian companies 87,333 156,198 157,342

USA companies 29,975 116,785 120,681

Other foreign companies 55,985 61,742 33,206

Total provision for current income taxes 173,293 334,725 311,229

Deferred

Italian companies (7,757) (47,736) (23,016)

USA companies 39,517 (10,592) (3,392)

Other foreign companies (10,396) (2,896) (46,064)

Total provision for deferred income taxes 21,364 (61,224) (72,472)

Total taxes 194,657 273,501 238,757

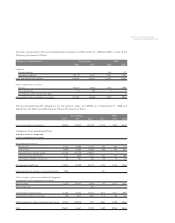

The Italian statutory tax rate is the result of two components: national (“IRES”) and regional (“IRAP”) tax.

IRAP could have a substantially different base for its computation than IRES.

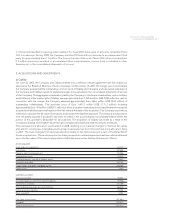

Reconciliation between the Italian statutory tax rate and the effective tax rate is as follows:

Year ended December 31,

2008 2007 2006

Italian statutory tax rate 31.4% 37.3% 37.3%

Aggregate effect of different rates in foreign jurisdictions (1.7)% (1.7)% (1.5)%

Aggregate effect of asset revaluation in Australia (6.8)%

Aggregate effect of Italian restructuring (5.3)%

Aggregate effect of change in tax law in Italy 2.1%

Effect of non-deductible stock-based compensation 1.1% 1.1% 5.5%

Aggregate other effects 2.2% 1.5% 0.7%

Effective rate 33.0% 35.0% 35.2%

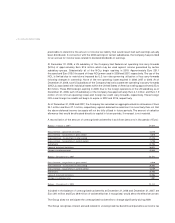

In 2006, the Australian subsidiaries of the Company elected to apply a new tax consolidation regime, which

was introduced by the Australian government. By electing such new consolidation regime for tax purposes,

certain intangible and fixed assets were revaluated for tax purposes increasing their tax basis. The increase

in the tax basis became effective in 2006 upon filing the final 2005 tax return in December 2006.