LensCrafters 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 68 |ANNUAL REPORT 2008

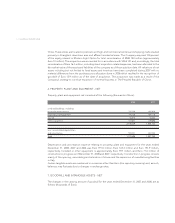

2008 2007

Raw materials and packaging 112,693 117,191

Work in process 48,013 52,132

Finished goods 464,289 492,839

Less: Inventory obsolescence reserves (54,008) (87,146)

Total 570,987 575,016

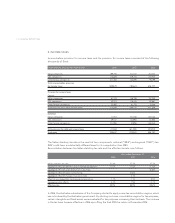

4. SALE OF THINGS REMEMBERED

On September 29, 2006, the Company sold its Things Remembered (“TR”) specialty gifts retail business to a

private equity consortium for net cash consideration of Euro 128.0 million (US$ 162.1 including costs of US$

5.3 million) and a promissory note (the “TR Note”) with a principal amount of Euro 20.6 million (US$26.1

million). The TR business operated solely in the United States and was included in the retail segment of the

Company’s operations. In the consolidated statements of income for 2006, the Company has reclassified

sales, cost of sales and other expenses associated with the discontinued operations as a single line item after

income from continuing operations but before net income. Revenues, income from operations, income

before provision for income taxes and income tax provision reclassified under discontinued operations for

the twelve-month period ended December 31, 2006, are as follows (thousands of Euro):

2006 (1)

Revenues 157,110

Income from operations 3,250

Income before provision for income taxes 761

Income tax provision (45)

Gain/loss on sale 13,278

Income taxes on sale (20,413)

(Loss)/Gain on discontinued operations (6,419)

(1) From January 1, 2006 through September 29, 2006

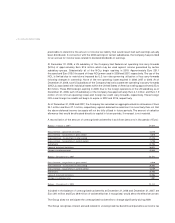

The TR Note (with an original principal amount of US$ 26.1 million) had a stated interest rate of 15.0%.

Interest was “paid-in-kind” annually in the form of an additional principal amount added to the

outstanding principal balance. All unpaid interest and outstanding principal would have been due in

March 2013. The TR Note was subordinated to certain other outstanding senior debt of the acquirer as

defined in the TR Note. The TR Note was previously classified as an “available-forsale” security as the

Company had the contractual ability to sell such note and as such, changes in its fair value were included

upon the meeting of certain economic objectives as of June 30, 2006 and, as such, the holders of these

options became entitled to exercise such options beginning on that date until their termination in 2014.

In 2008, no options from this grant were exercised. In 2007 400,000 options were exercised.

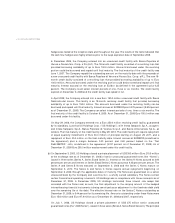

As of December 31, 2008 total receivables and payables from/to other related parties amount to Euro 3.6

million and Euro 0.9 million, respectively (Euro 1.3 million and Euro 1.1 million as of December 31, 2007). The

transactions related to the receivables were immaterial in amount and/or significance to the Company.

3. INVENTORIES - NET

Inventories - net consisted of the following (thousands of Euro):