LensCrafters 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>54 |ANNUAL REPORT 2008

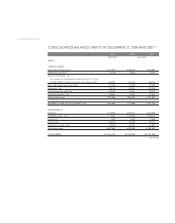

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY FOR THE YEARS ENDED

DECEMBER 31, 2006, 2007 AND 2008 (*)

Accumulated

Other other

Additional Unearned comprehensive comprehensive Treasury Total

Common stock paid-in Retained stock-based income (loss) income (loss) shares amount, shareholders’

Shares Amount capital earnings compensation net of tax net of tax at cost equity

BALANCES AT JANUARY 1, 2006 457,975,723 27,479 150,179 2,050,883 (48,567) (155,954) (69,987) 1,954,033

Exercise of stock options 2,240,525 134 24,308 24,443

Translation adjustment (126,853) (126,853) (126,853)

Effect of adoption of SFAS 123 R (48,567) 48,567

Realized stock based compensation 47,969 47,969

Minimum pension, liability,net

of taxes of Euro 0.4 million (624) (624) (624)

Effect of adoption SFAS 158,

net of taxes of Euro 5.5 million (8,409) (8,409) (8,409)

Unrealized gain on available-for-sale securities,

net of taxes of Euro0.5 million 1,244 1,244 1,244

Diluted gain on business combinations, SAB 5-H gain 21,847 21,847

Excess tax benefit on stock options 7,279 7,279

Change in fair value of derivative instruments,

net of taxes of Euro1.8 million 2,003 2,003 2,003

Dividends declared (Euro 0.29 per share) (131,369) (131,369)

Income from continuing operations 430,705 430,705 430,705

(Loss) on discontinued operations (6,419) (6,419) (6,419)

Comprehensive income 291,647

BALANCES, DECEMBER 31, 2006 460,216,248 27,613 203,016 2,343,800 (288,593) (69,987) 2,215,849

Exercise of stock options 2,407,372 144 26,498 26,642

Translation adjustment (90,881) (90,881) (90,881)

Effect of adoption of FIN 48 (8,060) (8,060)

Realized stock based compensation 42,121 42,121

Minimum pension, liability, net of taxes

of Euro 3.9 million 9,688 9,688 9,688

Unrealized gain on available-for-sale securities,

net of taxes of Euro 0.9 million (1,579) (1,579) (1,579)

Excess tax benefit on stock options 6,313 6,313

Change in fair value of derivative instruments,

net of taxes of Euro4.6 million (6,062) (6,062) (6,062)

Dividends declared (Euro0.42 per share) (191,077) (191,077)

Net income 492,204 492,204 492,204

Comprehensive income 403,369

BALANCES, DECEMBER 31, 2007 462,623,620 27,757 277,947 2,636,868 (377,428) (69,987) 2,495,158

(Continued)