LensCrafters 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

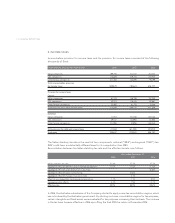

The 2007 tax benefit of 5.3%, relates to the business reorganization of certain Italian companies which results

in the release of deferred tax liabilities and is partially offset by the increase by 2.1% in the 2007 tax charge

due to the change in the Italian statutory tax rates which results in the reduction of deferred tax assets.

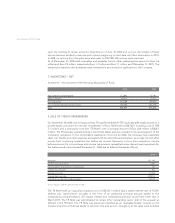

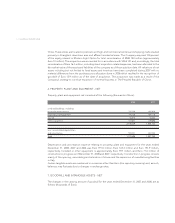

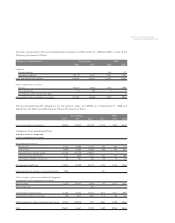

The deferred tax assets and liabilities as of December 31, 2008 and 2007, respectively, were comprised of

(Euro 000):

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |75 <

Amounts in thousands of Euro 2008 2007

Deferred income tax assets

Inventory 71,660 73,062

Insurance and other reserves 8,580 10,238

Right of return reserve 14,471 13,464

Net operating loss carryforwards 50,565 45,224

Occupancy reserves 19,630 14,681

Employee-related reserves (including pension liability) 72,974 48,977

Trade name 76,525 72,686

Deferred tax on derivatives 21,685 549

Other 54,819 28,349

Fixed assets 29,684 24,472

Total deferred income tax assets 420,593 331,702

Valuation allowance (24,048) (27,088)

Net deferred tax assets 396,545 304,614

Deferred income tax liabilities

Trade name (241,409) (216,997)

Fixed assets (32,919)

Other intangibles (115,031) (117,975)

Dividends (13,316) (11,933)

Other (12,067) (20,342)

Total deferred income tax liabilites (414,742) (367,247)

Net deferred income tax liabilities (18,197) (62,633)

Deferred income tax assets and liabilities have been classified in the consolidated financial statements as

follows:

Deferred income tax assets - current 131,907 117,853

Deferred income tax assets - non current 83,447 67,891

Deferred income tax liabilities - non current (233,551) (248,377)

Net deferred income tax liabilities (18,197) (62,633)

On December 24, 2007, the Italian Government issued the Italian Finance Bill of 2008 (the “2008 Bill”). The

2008 Bill decreases the national tax rate (referred to as “IRES”) from 33% to 27.5%, and the regional tax

rate (referred to as “IRAP”) from 4.25% to 3.9%. The effect of this change created an additional Euro 8

million of deferred tax expense in 2007.

The Company does not provide for an accrual for income taxes on undistributed earnings of its non Italian

operations to the related Italian parent company that are intended to be permanently invested. It is not