LensCrafters 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 88 |ANNUAL REPORT 2008

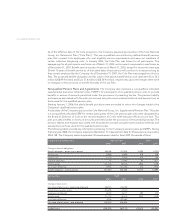

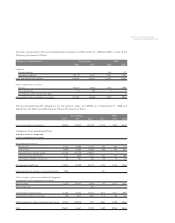

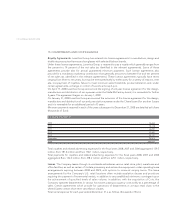

Weighted average Weighted average

Number exercise price remaining Aggregate

of options (denominated contractual intrinsic value

outstanding in Euro) terms (Euro 000)

Outstanding as of December 31, 2007 9,113,913 16.61

Granted 2,020,500 18.08

Forfeitures (248,800) 10.89

Exercised (724,613) 8.65

Outstanding as of December 31, 2008 10,161,000 13.89 5.51 3,611

Exercisable at December 31, 2008 5,708,000 14.57 3.75 3,611

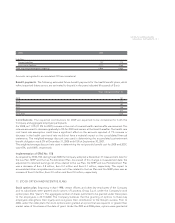

The weighted-average fair value of grant-date fair value options granted during the years 2008, 2007 and

2006 was Euro 5.02, Euro 6.03 and Euro 5.72, respectively.

The fair value of the stock options granted was estimated at the date of grant using a binomial lattice

model. The following table presents the weighted - average assumptions used in the valuation and the

resulting weighted average fair value per option granted:

2008 2007 2006

Dividend yield 1.65% 1.43% 1.33%

Risk-free interest rate 3.63% 3.91% 3.11%

Expected option life (years) 6.27 5.7 5.8

Expected volatility 26.93% 23.70% 25.91%

Weighted average fair value (Euro) 5.02 6.03 5.72

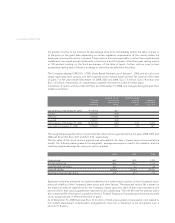

Expected volatilities are based on implied volatilities from traded share options on the Company’s stock,

historical volatility of the Company’s share price, and other factors. The expected option life is based on

the historical exercise experience for the Company based upon the date of grant and represents the

period of time that options granted are expected to be outstanding. The risk-free rate for periods within

the contractual life of the option is based on the U.S. Federal Treasury or European government bond yield

curve, as appropriate, in effect at the time of grant.

As of December 31, 2008 there was Euro 10.2 million of total unrecognized compensation cost related to

non-vested share-based compensation arrangements; that cost is expected to be recognized over a

period of 1.8 years.

the greater of either (i) the previous 30 day average stock price immediately before the date of grant or

(ii) the price on the grant date depending on certain regulatory requirements of the country where the

employee receiving the option is located. These options become exercisable in either three equal annual

installments, two equal annual installments in the second and third years of the three-year vesting period

or 100 percent vesting on the third anniversary of the date of grant. Certain options may contain

accelerated vesting terms if there is a change in ownership (as defined in the plans).

The Company adopted SFAS No. 123(R), Share-Based Payment, as of January 1, 2006, and at such point

began expensing stock options over their requisite service period based on their fair value as of the date

of grant. For the years ended December 31, 2008, 2007 and 2006, Euro 7.5 million, Euro 7.8 million and

Euro 7.0 million, respectively, of compensation expense has been recorded for these plans.

A summary of option activity under the Plans as of December 31, 2008, and changes during the year then

ended is as follows: