LensCrafters 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A N N U A L R E P O R T 2 0 0 8

Table of contents

-

Page 1

ANNUAL REPORT 2008 -

Page 2

-

Page 3

ANNUAL REPORT 2008 FISCAL YEAR ENDED DECEMBER 31, 2008 -

Page 4

All pictures in this Annual Report are from OneSight and are portraits of some of the thousands of people worldwide who received free eyecare from this Luxottica Group Foundation in 2008. Further information on the OneSight Foundation can be found in the section dedicated to it on page 31 and on www... -

Page 5

... Profile History Mission and strategy Operations Brand portfolio Wholesale distribution Retail distribution Structure of the Group OneSight, Luxottica Group Foundation Annual review 2008 Key events Financial overview Outlook Risk management Human resources Consolidated financial statements under US... -

Page 6

-

Page 7

... all, the prescription eyewear business, in which we are a world leader, did not show evident signs of slowing down. Over the year, Luxottica managed to react effectively and rapidly. As macro-economic conditions changed, the Group promptly took measures designed on one hand to boost sales and on... -

Page 8

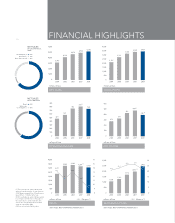

...2008 2,127 2,761 3,188 3,390 3,457 North America Asia-Pacific Rest of the world 64% 10% 26% NET SALES GROSS PROFIT NET SALES BY DISTRIBUTION Retail...tax due to the write-off of a credit related to the sale of the Things Remembered retail chain in September 2006. (3) Does not include Oakley sales.... -

Page 9

LUXOTTICA GROUP -

Page 10

-

Page 11

... Hut brand. In North America, the world's largest prescription eyewear market in terms of sales, Luxottica also operates licensed brand points of sale, with over 1,200 stores under the Target Optical and Sears Optical brands. In addition, Luxottica is one of the primary managed vision care operators... -

Page 12

... house brands, the Company slowly expanded in the sun business by buying Vogue (1990) and the famous Persol (1995), a brand with a glorious tradition and a mid- to high-end positioning. FINANCIAL MARKETS In 1990, Luxottica listed its ADS (American Depositary Shares) on the New York Stock Exchange... -

Page 13

...) a leading global retailer of premium sunglasses, OPSM Group (2003), a leading optical player in the Asia-Pacific region, and finally Cole National (2004), bringing with it one of North America's other leading optical retail chains, Pearle Vision, and an extensive licensed brand store business. In... -

Page 14

... the quality of products and processes, introduce innovations, discover synergies and new operating methods, and optimize times and costs at the same time. The Group also has a centralized warehouse management and orders system that processes data from the wholesale and retail structures to make... -

Page 15

... Technological supremacy in sunglass lenses One of the strongest and most balanced brand portfolios in the industry Leadership in the prescription eyewear business and sport channel Wholesale distribution spanning 130 countries Over 6,250 retail locations worldwide In-house control of lens... -

Page 16

... MANUFACTURING Luxottica Group's manufacturing system has two main platforms: in Italy and China. Alongside these, the Foothill Ranch facility in California manufactures and assembles most of Oakley's eyewear products, while Oakley's second manufacturing center in Dayton, Nevada, produces the frames... -

Page 17

... centers worldwide. There are three main distribution centers (hubs) in strategic locations serving the major markets: Sedico in Europe, Atlanta in the Americas and Dongguan in the Asia-Pacific region. They operate as centralized facilities, offering customers a highly automated order management... -

Page 18

> 16 | ANNUAL REPORT 2008 QUALITY Product quality is the critical factor in the premium and luxury markets for both opticians and end consumers. It has always been Luxottica's main focus and was the reason for undertaking full integration of every phase of production. Quality and process control ... -

Page 19

...capillary distribution and direct retail operations supported by well-calibrated advertising and deep understanding of international markets, Luxottica is the ideal partner for fashion houses and stylists seeking to translate their style and values into successful premium quality eyewear collections... -

Page 20

...| ANNUAL REPORT 2008 HOUSE BRANDS Style, tradition and freedom of expression are the key values underpinning the philosophy of Ray-Ban, for generations the undisputed world leader in sun and prescription eyewear. Debuting in 1937 with the Aviator model created for American Air Force pilots, Ray-Ban... -

Page 21

...flexi-hinge, Sferoflex prescription frames enjoy wide consensus in the optical sector and are designed for people demanding reliability and top quality. Launched in 1973 under the same name as the famous fashion magazine, the Vogue brand was acquired by Luxottica in 1990. Vogue models speak through... -

Page 22

> 20 | ANNUAL REPORT 2008 In 1999, Luxottica was the first company licensed to produce Chanel eyewear products. The Chanel product line, targeting luxury-oriented consumers, reflects the essential characteristics of the brand: style, elegance and class. Chaps features easy-to-wear designs in the ... -

Page 23

BRAND PORTFOLIO | 21 < for men who appreciate quality and tradition and are seeking classic styles with a fresh design. The Prada license agreement was signed in 2003. Prada collections offer a range of optical frames and sunglass collections, as well as a series of models created for leisure time... -

Page 24

... Australia China India Japan Korea Singapore RETAIL 6,255 stores managed in the world (of which 559 in franchising and 10 in joint venture) NORTH AMERICA Prescrition LensCrafters Pearl Vision Sears Optical Target Optical The Optical Shop of Aspen Prescrition/Sun Oliver Peoples Sun Sunglass Hut... -

Page 25

...venture) 82 22 15 (of which 5 in franchising) CHINA Prescription LensCrafters Other retail brands Sun Sunglass Hut ASIA-PACIFIC Prescription OPSM Laubman&Pank Budget Eyewear Prescription/Sun Oliver Peoples Sun Sunglass Hut Bright Eyes Sun/Clothing Oakley Stores & Vaults 244 170 68 6 907 319 131 89... -

Page 26

... duty-free shops. In North America and other areas, the main customers also include independent optometrists and ophthalmologists and premium department stores. Direct distribution in the key markets gives the Group a considerable competitive edge, making it possible to maintain close contact with... -

Page 27

...North America in terms of sales. LensCrafters stores offer a wide selection of prescription frames and sunglasses, mostly made by Luxottica, but also a wide range of lenses and optical products made by other suppliers. Points of sale are normally in high-traffic commercial malls and shopping centers... -

Page 28

... offering brands such as Ray-Ban and Vogue. As of December 31, 2008, Luxottica operated 879 Sears Optical and 325 Target Optical locations throughout North America. In Australia and New Zealand, Luxottica operates three chains specializing in the optical business: OPSM, Australia's top eyewear brand... -

Page 29

... emerging markets, Thailand and India, where the Group has major plans for medium- to long-term growth. Founded in the United States in 1971 to operate in department stores, Sunglass Hut gradually expanded its base of stores and kiosks in shopping malls to new retail locations on city shopping... -

Page 30

... having a nominal value of Euro 0.06. The Company does not hold treasury shares directly. However, a US subsidiary, Arnette Optics Illusions Inc., owns 6,434,786 Luxottica Group shares. The shareholders' meeting on May 13, 2008 authorised, for a period of 18 months after such date, the purchase and... -

Page 31

... the Shareholders' Meeting. Auditing Company in office until the approval of the Financial Statements as of December 31, 2011 Deloitte & Touche More information on Luxottica Group's Corporate Governance are available in the Annual Report on Corporate Governance 2008, available on the website www... -

Page 32

> 30 | ANNUAL REPORT 2008 ORGANIZATION STRUCTURE As of February 28, 2009, Luxottica Group's management is based on three organizational areas reporting directly to CEO Andrea Guerra. Functions The organizational units termed Group Functions - Information Technology, Business Development, ... -

Page 33

...Luxottica employees share the same objective everyday: to offer the best eyewear and best service to every customer. OneSight takes the Group's passion for eyewear and eye care to a new level, giving additional meaning to employee's everyday work. OneSight operates four programs: • Global Eye Care... -

Page 34

...people; their operations were backed up in 2008 by Vision Vans which worked for 81 days. OneSight volunteers for the first time reached Tianjing in China, where 1,001 people benefited from our services. Initiatives in communities in North America and Australia helped 240,084 people in optical stores... -

Page 35

ANNUAL REVIEW 2008 -

Page 36

-

Page 37

... Hut to begin operations in Thailand's promising sun eyewear market. The partnership will open 15 new stores to add to the existing 216 Sunglass Hut retail locations in the Asia-Pacific region. June Luxottica US Holdings, a subsidiary, made a private placement of three series of bonds, totaling... -

Page 38

... constant exchange rates in 2008). The consolidation of Oakley, which is a predominantly wholesale business, and the appreciation of the Euro, which had a bigger impact on the retail distribution segment, significantly changed the Group's revenue breakdown. Sales for the retail distribution segment... -

Page 39

... organizational restructuring in Europe and the emerging markets for the wholesale distribution segment as well as the integration of the American and Australian retail chains, and the Group is starting to see the synergies it expected. Sharing of resources and cost savings in procurement, logistics... -

Page 40

... in eyewear. Ray-Ban has always stood for quality and function, yet 2008 marked a highly important new stage in its growth. In the sun business, polarized lens sales saw global growth thanks to an expansion of the crystal range, offering improved clarity and protection. In the optical business, the... -

Page 41

...by licensed brand chains fell 9.1% in 2008. The sun business, on the other hand, proved less cyclical. Comparable store sales by Sunglass Hut across the globe were down 4.9% year over year in 2008, with a marked difference between results in North America and other regions, such as Australia and New... -

Page 42

... is planning to have 100 retail locations, at full capacity to be operated under franchise by DLF, and these, like the new Sunglass Huts in Thailand, will be added to the 216 retail locations already operating in the Asia-Pacific region (which includes Australia, New Zealand, Hong Kong and Singapore... -

Page 43

... 28, 2009, the Company entered into a new licensing agreement to design, manufacture and globally distribute sun and prescription eyewear collections by Tory Burch and TT, two emerging American fashion and lifestyle brands. The agreement with Tory Burch LLC will run for six years - renewable for... -

Page 44

... 42 | ANNUAL REPORT 2008 On the premium and luxury front, numerous projects, collections and special editions are being developed to attract customers in this category. In the prescription eyewear business, which is less cyclical, Luxottica will carry forward the drive to improve market penetration... -

Page 45

...reporting and control. The principles and rules set out by this Policy shall be followed throughout the Group. This Policy supports the objective of effective and uniform risk management in the interest of the entire company belonging to Luxottica Group. Luxottica Group's financial risks are related... -

Page 46

... of net income, assets, equity, debt and equity in the various currencies differ. Competitive risk refers to the Group's foreign currency rate sensitivity in comparison to its competitors, i.e. to the long term effects of currency rate changes to the economic position of the Group in any affected... -

Page 47

...to recover organizational competitiveness was the radical review of central service structures in North America and the creation of marketing and sales structures serving the main retail chains (LensCrafters, Pearle Vision, Sunglass Hut and the licensed brands). No less significant were the measures... -

Page 48

.... 3. To select candidates whose profiles not only satisfy the required technical skills but also closely reflect the Company's values and the style of professional conduct the organization expects. 4. To favor positive and effective induction of new entries by creating the conditions for long-term... -

Page 49

HUMAN RESOURCES | 47 < professional positions by introducing a single corporate process for defining objectives and assessing results. • Long-term Incentive System: a 3-year senior management incentive system tied to generating value for shareholders (EPS) was introduced. Work safety: prevention... -

Page 50

-

Page 51

CONSOLIDATED FINANCIAL STATEMENTS UNDER US GAAP -

Page 52

-

Page 53

... (*) 2008 (US$ 000) (1) NET SALES COST OF SALES GROSS PROFIT OPERATING EXPENSES: Selling and advertising General and administrative Total INCOME FROM OPERATIONS OTHER INCOME (EXPENSE): Interest income Interest expense Other - net Other expense - net INCOME BEFORE PROVISION FOR INCOME TAXES PROVISION... -

Page 54

... cash equivalents Marketable securities Accounts receivable - net (Less allowance for doubtful accounts, Euro 29.1 million in 2008 (US$ 40.5 million) and Euro 25.5 million in 2007 Sales and income taxes receivable Inventories - net Prepaid expenses and other Deferred tax assets - net Total current... -

Page 55

... and related Customers' right of return Other Income taxes payable Total current liabilities LONG-TERM DEBT LIABILITY FOR TERMINATION INDEMNITIES DEFERRED TAX LIABILITIES - NET OTHER LONG-TERM LIABILITIES MINORITY INTERESTS IN CONSOLIDATED SUBSIDIARIES SHAREHOLDERS' EQUITY Capital stock par value... -

Page 56

...stock options Translation adjustment Effect of adoption of FIN 48 Realized stock based compensation Minimum pension, liability, net of taxes of Euro 3.9 million Unrealized gain on available-for-sale securities, net of taxes of Euro 0.9 million Excess tax benefit on stock options Change in fair value... -

Page 57

... Adjustment to pension liability, net of taxes of Euro 29.2 million Adoption of SFAS No. 158 measurement date provisions, net of taxes of Euro 1.9 million Unrealized gain on available-for-sale securities, net of taxes of Euro 0.2 million Excess tax benefit on stock options Change in fair value... -

Page 58

... during the year - net Changes in operating assets and liabilities, net of acquisition of businesses: Accounts receivable Prepaid expenses and other Inventories Accounts payable Accrued expenses and other Accrual for customers' right of return Income taxes payable Total adjustments Cash provided... -

Page 59

...overdraft balances Exercise of stock options Excess tax benefit from stock-based compensation Dividends Cash used in financing activities of continuing operations (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS CASH AND EQUIVALENTS, BEGINNING OF YEAR Effect of exchange rate changes on cash and cash... -

Page 60

-

Page 61

... Corporation ("Cole") and Oakley. The retail division of Oakley ("O" retail) consists of owned retail locations operating under various names including "O" stores which sell apparel and other Oakley branded merchandise in addition to performance sunglasses. Luxottica Group's net sales consist... -

Page 62

... 60 | ANNUAL REPORT 2008 amounts of revenues and expenses during the reporting period. Significant judgment and estimates are required in the determination of the valuation allowances against receivables, inventory and deferred tax assets, calculation of pension and other long-term employee benefit... -

Page 63

... an event has occurred that may impair goodwill. Such tests are performed at the reporting unit level which consists of four units, Wholesale, Retail North America, Retail Asia Pacific and Retail Other, as required by the provisions of SFAS 142. For the fiscal years 2008, 2007, and 2006 the Company... -

Page 64

... with local statutory requirements. Revenue recognition. Revenues include sales of merchandise (both wholesale and retail), insurance and administrative fees associated with the Company's managed vision care business, eye exams and related professional services, and sales of merchandise to... -

Page 65

... during the year. Free frames given to customers as part of a promotional offer are recorded in cost of sales at the time they are delivered to the customer. Discounts and coupons tendered by customers are recorded as a reduction of revenue at the date of sale. Managed vision care underwriting and... -

Page 66

... employee requisite service period. The fair value of stock options is estimated using a binomial lattice valuation technique. Deferred tax assets are recorded for awards that result in deductions on income tax returns, based on the amount of compensation cost recognized and the statutory tax rate... -

Page 67

...obligation ("PBO"), which represents the actuarial present value of benefits expected to be paid upon retirement based on estimated future compensation levels. The fair value of plan assets represents the current market value of cumulative company and participant contributions made to an irrevocable... -

Page 68

.... In December 2008, the FASB issued FASB Staff Position ("FSP") 132(R)-1, Employee Disclosures about Postretirement Benefit Plan Assets which requires enhanced disclosures on plan assets including fair value measurements and categories of assets, investment policies and strategies and disclosures on... -

Page 69

... effect on future operations. In September 2006, the FASB issued SFAS No. 158, Employer's Accounting for Defined Benefit Pension Other Post Retirement Plans ("SFAS 158"), which requires the Company to recognize an asset or liability for the funded status (difference between fair value of plan assets... -

Page 70

...). The TR business operated solely in the United States and was included in the retail segment of the Company's operations. In the consolidated statements of income for 2006, the Company has reclassified sales, cost of sales and other expenses associated with the discontinued operations as a single... -

Page 71

... for tax purposes. The acquisition of Oakley was made as a result of the Company's strategy to strengthen its performance sunglass wholesale and retail businesses worldwide. The purchase price allocation was finalized in 2008 resulting in no material changes to the final fair values allocated... -

Page 72

... of D.O.C Optics Corporation and its affiliates, an optical retail business with approximately 100 stores located primarily in the Midwest United States of America for approximately Euro 83.7 million (US$ 110.2 million) in cash. The purchase price, including direct acquisition-related expenses, was... -

Page 73

... strategy to continue expansion of its wholesale business in Turkey, in particular in the prescription frames market. In November 2006, the Company completed the acquisition, which was announced in June 2006, of Modern Sight Optics, a leading premium optical chain that operates a total of 28 stores... -

Page 74

...72 | ANNUAL REPORT 2008 China. These stores are located in premium and high-end commercial centers and shopping malls situated primarily in Shanghai's downtown area and affluent residential areas. The Company acquired 100 percent of the equity interest in Modern Sight Optics for total consideration... -

Page 75

... Company believes these trade names to be finite-lived assets. The weighted average amortization period is 24 years. (b) Distributor network, customer contracts and lists, and franchise agreements were identifiable intangibles recorded in connection with the acquisition of Cole in 2004 and of Oakley... -

Page 76

...: Year ended December 31, 2008 Italian statutory tax rate Aggregate effect of different rates in foreign jurisdictions Aggregate effect of asset revaluation in Australia Aggregate effect of Italian restructuring Aggregate effect of change in tax law in Italy Effect of non-deductible stock-based... -

Page 77

... TO CONSOLIDATED FINANCIAL STATEMENTS | 75 < The 2007 tax benefit of 5.3%, relates to the business reorganization of certain Italian companies which results in the release of deferred tax liabilities and is partially offset by the increase by 2.1% in the 2007 tax charge due to the change in the... -

Page 78

... following changes in ownership. None of the net operating losses expired in 2008, 2007 or 2006. As of December 31, 2008, such US subsidiary of the Company had various state net operating loss carry-forwards (SNOLs), associated with individual states within the United States of America totaling... -

Page 79

...to Italian law. As of December 31, 2008, tax years from 2003 through the most recent year were open for such review. At the date of December, 31 2008 no Italian companies are subjected to a tax inspection. The previous tax inspections open in 2007 were closed with no material liability for the Group... -

Page 80

> 78 | ANNUAL REPORT 2008 hedges was tested at the inception date and throughout the year. The results of the tests indicated that the cash flow hedges were highly effective prior to the swap expiration date of September 2008. In December 2005, the Company entered into an unsecured credit facility ... -

Page 81

... cash flow hedge on Tranche A of the credit facility discussed above. The Club Deal Swaps exchange the floating rate of Euribor for an average fixed rate of 2.565. percent per annum. The ineffectiveness of cash flow hedges was tested at the inception date and at least every three months. The results... -

Page 82

... as of December 31, 2008. Based on current interest rates and market conditions, the estimated aggregate amount to be recognized in earnings from other comprehensive income for these hedges in fiscal 2009 is approximately US$ (4.7) million, net of taxes. The short term bridge loan facility was for... -

Page 83

...the Company upon retirement. Pension benefits are accrued based on length of service and annual compensation under a cash balance formula. The Lux Plan was amended effective January 1, 2006, granting eligibility to associates who work in the Cole Vision stores, field management, and the related labs... -

Page 84

...ANNUAL REPORT 2008 As of the effective date of the Cole acquisition, the Company assumed sponsorship of the Cole National Group, Inc. Retirement Plan ("Cole Plan"). This was a qualified noncontributory defined benefit pension plan that covered Cole employees who met eligibility service requirements... -

Page 85

... income Net periodic benefit cost: Service cost Interest cost Expected return on plan assets Amortization of actuarial loss Amortization of prior service cost Net periodic benefit cost Adjustment due to change in measurement date Other changes in plan assets and benefit obligations recognized... -

Page 86

... 2008 Weighted-average assumption used to determine benefit obligations: Discount rate Rate of compensation increase Weighted-average assumption used to determine net periodic benefit cost for years ended December 31, 2008 and 2007: Discount rate Expected long-term return on plan assets Rate... -

Page 87

...pension plan trusts. Beginning in September 2008, the global capital markets took a downward turn and have since become extremely volatile. This volatility is evident in the year-end market values of plan assets. Upon direction from the plan's administrator, the Luxottica Group's Employee Retirement... -

Page 88

> 86 | ANNUAL REPORT 2008 Upon the acquisition of Oakley, effective November 14, 2007, the Company also sponsors a tax incentive savings plan for all United States Oakley associates with at least six months of service. This plan is funded by employee contributions with the Company matching a ... -

Page 89

.... The weighted-average discount rate used in determining the net periodic benefit cost for 2008 and 2007, was 6.5%, and 6.00%, respectively. Implementation of SFAS No. 158 As required by SFAS 158, during fiscal 2008 the Company adopted a December 31 measurement date for the Lux Plan, SERP and the... -

Page 90

... terms if there is a change in ownership (as defined in the plans). The Company adopted SFAS No. 123(R), Share-Based Payment, as of January 1, 2006, and at such point began expensing stock options over their requisite service period based on their fair value as of the date of grant. For the years... -

Page 91

... performance plan, the Company granted options to acquire an aggregate of 1,000,000 shares of the Company to certain employees of the North American Luxottica Retail Division which vested and became exercisable on January 31, 2007 as certain financial performance measures were met over the period... -

Page 92

... Risk-free interest rate Expected option life (years) Expected volatility Weighted average fair value (Euro) 1.65% 3.96% 2.10 30.41% 17.67 - 1.33% 3.88% 5.36 26.63% 6.15 1.33% 3.89% 5.53 26.63% 5.8 (a) Stock Performance Plan issued in July 2006 for a total of 9,500,000 options granted (b) Stock... -

Page 93

...marketing of house brand and designer lines of mid- to premium-priced prescription frames and sunglasses. The Company operates in the retail segment through its Retail Division, consisting of LensCrafters, Sunglass Hut International, OPSM Group Limited and Cole National Corporation. For 2007, Oakley... -

Page 94

...trade names of acquired retail businesses. The geographic segments include Italy, the main manufacturing and distribution base, United States and Canada (which includes the United States of America, Canada and Caribbean islands), Asia Pacific (which includes Australia, New Zealand, China, Hong Kong... -

Page 95

... both fiscal years, due from the host stores of our license brands retail division. These receivables represent cash proceeds from sales deposited into the host stores bank accounts, which are subsequently forwarded to the Company on a weekly or monthly basis depending on the Company's contract with... -

Page 96

...94 | ANNUAL REPORT 2008 15. COMMITMENTS AND CONTINGENCIES Royalty Agreements. Luxottica Group has entered into license agreements to manufacture, design and distribute prescription frames and sunglasses with selected fashion brands. Under these license agreements, Luxottica Group is required to pay... -

Page 97

.... The Company is committed to pay amounts in future periods for endorsement contracts, supplier purchase and other long term commitments. Endorsement contracts are entered into with selected athletes and others who endorse Oakley products. Oakley is often required to pay specified minimal annual... -

Page 98

...'s business, financial position or operating results. California Vision Health Care Service Plan lawsuit. In March 2002, an individual commenced an action in the California Superior Court for the County of San Francisco against the Company and certain of its subsidiaries, including LensCrafters... -

Page 99

... the United States District Court for the Central District of California, alleging willful violations of the Fair and Accurate Credit Transactions Act related to the inclusion of credit card expiration dates on sales receipts. Plaintiff brought suit on behalf of a class of Oakley's customers. Oakley... -

Page 100

.... Further, LensCrafters and Luxottica Group might be required to pay statutory damages, the amount of which might have a material adverse effect on the Company's operating results, financial condition and cash flow. Costs associated with this litigation for the year ended December 31, 2008 were not... -

Page 101

...to be accounted for under SFAS 159. 17. SUBSEQUENT EVENTS On January 28, 2009, the Company entered a new licensing agreement to design, manufacture and globally distribute sun and prescription eyewear collection by Tory Burch and TT, two emerging American fashion and lifestyle brands. The agreement... -

Page 102

> 100 | ANNUAL REPORT 2008 INDEPENDENT AUDITOR'S REPORT -

Page 103

INDEPENDENT AUDITORS REPORT | 101 -

Page 104

-

Page 105

ANNEXES -

Page 106

... 8.3% Net sales Gross profit Operating income Income before taxes Net income from continuing operations Discontinued operations Net income Per ordinary share/(ADS)(1) Earnings from continuing operations: Euro US$ Total earnings Euro US$ Dividend (2) Euro Average no. of outstanding shares 4,966,054... -

Page 107

...of business net of cash acquired Sale of Things Remembered Other Free cash flow Dividends Exercise of stock options Effect of exchange adjustments to net financial position Decrease/(Increase) in net financial position Cash Bank overdraft and notes payable Current portion of long-term debt Long-term... -

Page 108

> 106 | ANNUAL REPORT 2008 SHARE CAPITAL AND DIVIDEND PER ORDINARY SHARE (ADS) ORDINARY SHARES AND ADS EVOLUTION (1) Number of shares authorized and issued as of December 31 1990 1991 1992 1993 1994 1995 1996 1997 1998 (1) 1999 2000 (1) 2001 2002 2003 2004 2005 2006 2007 2008 45,050,000 45,050,000 ... -

Page 109

... - Budget Eyewear - Oliver Peoples Sunglass Hut Asia-Pacific Bright Eyes Oakley Stores & Vaults ASIA-PACIFIC David Clulow Sunglass Hut Europe Oakley Stores & Vaults EUROPE Optical China Sunglass Hut Hong Kong CHINA Sunglass Hut Oakley Stores & Vaults SOUTH AFRICA Sunglass Hut Oakley Stores & Vaults... -

Page 110

> 108 | ANNUAL REPORT 2008 1990-2008 LUXOTTICA ADS AND ORDINARY SHARE PERFORMANCES 1990-2008 LUXOTTICA ADS AT NYSE (US$) Year 1990 (1) 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Low 0.794 0.988 2.250 2.025 2.787 3.175 5.212 5.125 3.875 5.000 7.969 12.... -

Page 111

... 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2008 ADS NYSE (US$) Dow Jones (rebased) S&P 500 (rebased) Nine-years high Euro 28.79 on July 9, 2007 30 25 20 15 10 Nine-years low Euro 9.248 on March 12, 2003 5 0 2000 2001 2002 2003 2004 2005 2006... -

Page 112

...ANNUAL REPORT 2008 1995-2008 AVERAGE EURO/US$ EXCHANGE RATE Year 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008...1886 1.2889 1.4486 1.3180 Full-year 1.1887 1.2549 1.1367 1.1152 1.0642 0.9209 0.8957 0.9450 1.1307 1.2435 1.2444 1.2553 1.3705 1.4707 Year change -1.05% 5.57% -9.42%... -

Page 113

... working capital over the prior period, less capital expenditures, plus or minus interest income/(expense) and net charges for extraordinary items, minus taxes paid. The Company believes that free cash flow is useful to both management and investors in evaluating the Company's operating performance... -

Page 114

...is not a measure of performance under accounting principles generally accepted in the United States (US GAAP). We include it in this presentation in order to: • improve transparency for investors; • assist investors in their assessment of the Company's operating performance; • ensure that this... -

Page 115

... exchange rate EPS before trademark amortization and other similar intangible assets, net of taxes (in US$) FY 2008(1) 72 (26) 45 456,564 0.10 0.87 0.96 1.4707 1.42 FY 2007(2) 64 (24) 40 455,185 0.09 1.05 1.14 1.3705 1.56 Change -17.8% -15.4% -9.2% (1) Excluding the write-off of credit related... -

Page 116

... THE YEAR ENDED 31, 2008 (Euro 000) US GAAP 2008 IFRS 2 option IAS 2 IFRS 3 Business IAS 12 taxes IAS 19 benefit IAS 36 IAS 38 IAS 39 Total adj. Stock Inventories Income Employee Impairment Intangible Derivatives cost Net sales Cost of sales Gross profit Operating expenses: Selling and advertising... -

Page 117

-

Page 118

[email protected] USA Deutsche Bank Shareholder Services c/o American Stock Transfer & Trust Company (ADR Depositary Bank) Peck Slip Station - P.O. Box 2050 - New York, NY 10272-2050 - USA Telephone Toll free number: 800 7491873 (from USA only) International callers: +1 718 9218137 INDEPENDENT AUDITOR... -

Page 119

-

Page 120

> 118 | ANNUAL REPORT 2008