Kraft 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

kraft foods inc. notes to consolidated financial statements

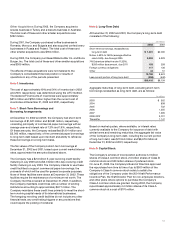

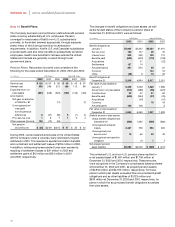

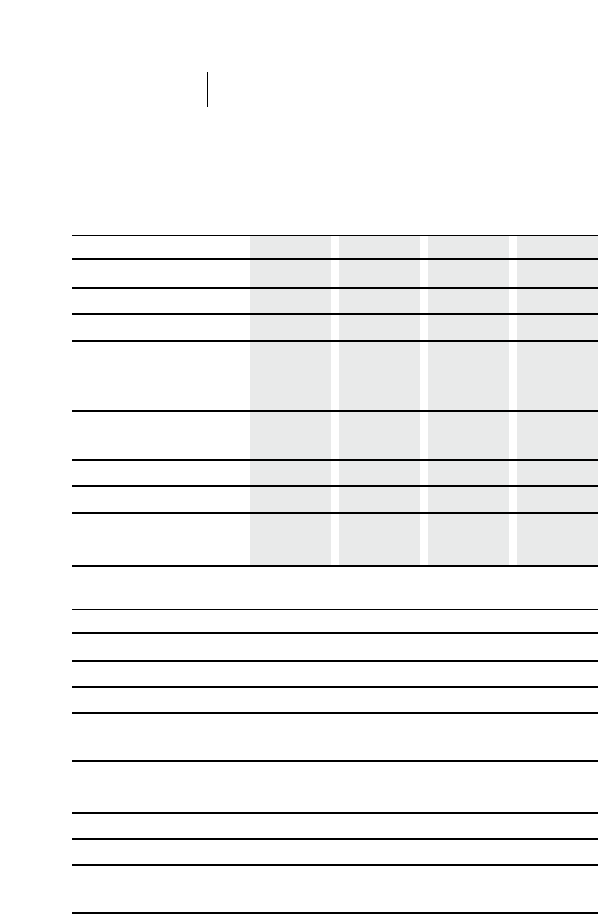

Note 18. Quarterly Financial Data (Unaudited):

(in millions, except per share data) 2002 Quarters

First Second Third Fourth

Net revenues $7,147 $7,513 $7,216 $7,847

Gross profit $2,864 $3,127 $2,971 $3,041

Net earnings $ 693 $ 901 $ 869 $ 931

Weighted average

shares for

diluted EPS 1,737 1,738 1,737 1,734

Per share data:

Basic EPS $ 0.40 $ 0.52 $ 0.50 $ 0.54

Diluted EPS $ 0.40 $ 0.52 $ 0.50 $ 0.54

Dividends declared $ 0.13 $ 0.13 $ 0.15 $ 0.15

Market price—high $39.70 $43.95 $41.70 $41.30

—low $32.50 $38.32 $33.87 $36.12

(in millions, except per share data) 2001 Quarters

First Second Third Fourth

Net revenues $7,197 $7,473 $7,018 $7,546

Gross profit $2,922 $3,071 $2,785 $2,890

Net earnings $ 326 $ 505 $ 503 $ 548

Weighted average shares

for diluted EPS 1,455 1,510 1,735 1,736

Per share data:

Basic EPS $ 0.22 $ 0.33 $ 0.29 $ 0.32

Diluted EPS $ 0.22 $ 0.33 $ 0.29 $ 0.32

Dividends declared $ 0.13 $ 0.13

Market price—high $32.00 $34.81 $35.57

—low $29.50 $30.00 $31.50

Basic and diluted EPS are computed independently for each of the periods presented.

Accordingly, the sum of the quarterly EPS amounts may not agree to the total year.

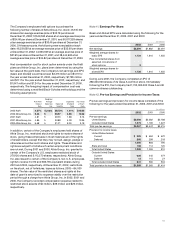

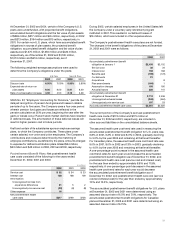

During the first quarter of 2002, the Company recorded a

pre-tax charge of $142 million related to employee acceptances

of a voluntary retirement program and a pre-tax integration

related charge of $27 million to consolidate production lines

in North America.

During the second quarter of 2002, the Company recorded a pre-

tax integration related charge of $92 million to close a facility and

for other consolidation programs. Also, during the second quarter

of 2002, the Company sold a small business at a pre-tax gain of

$3 million.

During the fourth quarter of 2002, the Company sold two small

businesses at an aggregate pre-tax gain of $77 million. Also,

during the fourth quarter of 2002, the Company reversed

$4 million of previously recorded integration related liabilities

and $4 million related to the loss on sale of a food factory to the

consolidated statement of earnings.

During the first quarter of 2001, the Company recorded a pre-tax

loss of $29 million for the sale of a North American food factory.

On June 13, 2001, the Company completed an IPO by issuing

280 million shares of its Class A common stock. Also, during the

second quarter of 2001, the Company sold a small business at a

pre-tax gain of $8 million.

During the third quarter of 2001, the Company recorded a pre-tax

integration related charge of $37 million to consolidate production

lines in the United States.

During the fourth quarter of 2001, the Company recorded a pre-tax

integration related charge of $16 million for site reconfigurations

and other consolidation programs in the United States.