Kraft 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 31, 2002, for the U.S. pension and postretirement

plans, the Company reduced its discount rate assumption

from 7.0% to 6.5%, maintained its expected return on asset

assumption at 9.0%, and increased its medical trend rate

assumption. The Company presently anticipates that these

assumption changes, coupled with lower returns on pension fund

assets in prior years, will result in an increase in 2003 pre-tax

benefit expense of approximately $180 million, or approximately

$0.07 per share, exclusive of the impact of the voluntary early

retirement and integration programs in 2002. The Company’s

long-term rate of return assumption remains at 9.0% based on

the investment of its pension assets primarily in U.S. equity

securities. While the Company does not presently anticipate a

change in its 2003 assumptions, a fifty basis point decline in

the Company’s discount rate would increase the Company’s

pension and postretirement expense by approximately

$50 million, while a fifty basis point increase in the discount

rate would decrease pension and postretirement expense by

approximately $35 million. Similarly, a fifty basis point decline

(increase) in the expected return on plan assets would increase

(decrease) the Company’s pension expense for the U.S. pension

plans by approximately $35 million. See Note 14 to the

consolidated financial statements, for a sensitivity discussion of

the assumed health care cost trend rates.

Revenue Recognition: As required by U.S. GAAP, the Company

recognizes revenues, net of sales incentives, and including

shipping and handling charges billed to customers, upon

shipment of goods when title and risk of loss pass to customers.

Shipping and handling costs are classified as part of cost of

sales. Provisions and allowances for sales returns and bad debts

are also recorded in the Company’s consolidated financial

statements. The amounts recorded for these provisions and

related allowances are not significant to the Company’s

consolidated financial position or results of operations. As

discussed in Note 2 to the consolidated financial statements,

effective January 1, 2002, the Company adopted newly required

accounting standards mandating that certain costs reported as

marketing, administration and research costs be shown as a

reduction of operating revenues or an increase in cost of sales.

As a result, previously reported revenues were reduced by

approximately $4.6 billion and $3.6 billion for 2001 and 2000,

respectively. The adoption of the new accounting standards had

no impact on operating income, net earnings or basic or diluted

earnings per share (“EPS”).

Depreciation and Amortization: The Company depreciates

property, plant and equipment and amortizes definite life

intangibles using straight-line methods over the estimated useful

lives of the assets. As discussed in Note 2 to the consolidated

financial statements, the Company adopted Statement of

Financial Accounting Standards (“SFAS”) No. 141, “Business

Combinations” and SFAS No. 142, “Goodwill and Other Intangible

Assets,” on January 1, 2002. The Company has determined that

substantially all of its goodwill and other intangible assets have

indefinite lives due to the long history of its brands. As a result,

the Company stopped recording the amortization of goodwill

and substantially all of its intangible assets as a charge to

earnings. Net earnings and diluted EPS would have been as

follows had the provisions of the new standards been applied

as of January 1, 2000:

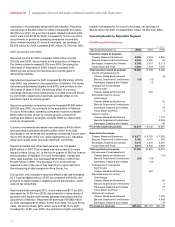

(in millions, except per share amounts)

Year Ended December 31, 2001 2000

Net earnings, as previously reported $1,882 $2,001

Adjustment for amortization

of goodwill and indefinite

life intangibles 955 530

Net earnings, as adjusted $2,837 $2,531

Diluted EPS, as previously reported $ 1.17 $ 1.38

Adjustment for amortization

of goodwill and indefinite

life intangibles 0.59 0.36

Diluted EPS, as adjusted $ 1.76 $ 1.74

Average diluted shares outstanding 1,610 1,455

Marketing and Advertising Costs: As required by U.S. GAAP,

the Company records marketing costs as an expense in the year

to which such costs relate. The Company does not defer any

amounts on its consolidated balance sheet with respect to

marketing costs. The Company expenses advertising costs in the

year in which the related advertisement initially appears. The

Company records consumer incentive and trade promotion costs

as a reduction of revenues in the year in which these programs

are offered, based on estimates of utilization and redemption

rates that are developed from historical information.

Related Party Transactions: As discussed in Note 3 to

the consolidated financial statements, Altria Group, Inc.’s

subsidiary, Altria Corporate Services, Inc. (formerly Philip Morris

Management Corp.), provides the Company with various

services, including planning, legal, treasury, accounting, auditing,

insurance, human resources, office of the secretary, corporate

affairs, information technology and tax services. Billings for these

services, which were based on the cost to Altria Corporate

Services, Inc. to provide such services plus a management fee,

were $327 million, $339 million and $248 million for the years

ended December 31, 2002, 2001 and 2000, respectively. Although

the value of services provided by Altria Corporate Services, Inc.

cannot be quantified on a stand-alone basis, management

believes that the billings are reasonable based on the level of

support provided by Altria Corporate Services, Inc., and that the

charges reflect all services provided. The cost and nature of the

services are reviewed annually by the Company’s Audit

Committee, which is comprised of independent directors.

The Company also has long-term notes payable to Altria Group,

Inc. and its affiliates of $2.6 billion at December 31, 2002 and

$5.0 billion at December 31, 2001. The decrease from 2001 to

2002 reflects the repayment of borrowings with proceeds from

public global bond offerings, floating rate notes and short-term

borrowings. The interest rates on the debt with Altria Group, Inc.

were established at market rates available to Altria Group, Inc. at

the time of issuance for similar debt with matching maturities. The

remaining amount due under the 7.0% long-term note payable to

Altria Group, Inc. and affiliates has no prepayment penalty, and

27