Kraft 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

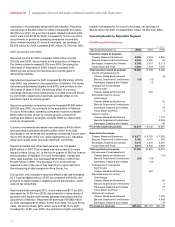

Kraft Foods North America (continued)

(in millions)

Year Ended December 31, 2002 2001 2000

Reported operating

companies income:

Cheese, Meals and Enhancers $2,168 $2,099 $1,845

Biscuits, Snacks and Confectionery 1,093 966 100

Beverages, Desserts and Cereals 1,136 1,192 1,090

Oscar Mayer and Pizza 556 539 512

Total reported operating

companies income 4,953 4,796 3,547

Gains on sales of businesses:

Cheese, Meals and Enhancers (33)

Biscuits, Snacks and Confectionery (8)

Operating companies income of

businesses sold:

Cheese, Meals and Enhancers (4)

Biscuits, Snacks and Confectionery (5) (4)

Beverages, Desserts and Cereals (2)

Integration costs and a loss on

sale of a food factory:

Cheese, Meals and Enhancers 30 63

Biscuits, Snacks and Confectionery 12

Beverages, Desserts and Cereals 56 12

Oscar Mayer and Pizza 75

Separation programs:

Cheese, Meals and Enhancers 60

Biscuits, Snacks and Confectionery 3

Beverages, Desserts and Cereals 47

Oscar Mayer and Pizza 25

Changes due to businesses

held for sale:

Cheese, Meals and Enhancers 23

Estimated impact of century

date change:

Cheese, Meals and Enhancers 15

Biscuits, Snacks and Confectionery 1

Beverages, Desserts and Cereals 7

Oscar Mayer and Pizza 4

Nabisco operating

companies income:

Cheese, Meals and Enhancers 230

Biscuits, Snacks and Confectionery 671

Beverages, Desserts and Cereals 28

Pro forma operating

companies income $5,169 $4,895 $4,466

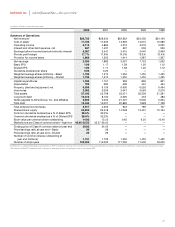

2002 compared with 2001

KFNA’s reported volume for 2002 increased 8.2% over 2001, due

primarily to the inclusion in 2002 of a business that was previously

held for sale and contributions from new products. On a pro

forma basis, volume for 2002 increased 2.8%, due primarily to

higher shipments across all segments, which benefited from

contributions by new products.

Reported net revenues increased $515 million (2.5%) over 2001,

due primarily to higher volume/mix ($437 million) and the

inclusion in 2002 of a business that was previously held for sale

($252 million), partially offset by lower selling prices in response

to lower commodity costs ($154 million). On a pro forma basis,

net revenues increased 1.3%.

Reported operating companies income for 2002 increased

$157 million (3.3%) over 2001, due primarily to higher volume/mix

($174 million), favorable margins ($176 million, driven by lower

commodity-related costs and productivity) and Nabisco synergy

savings, partially offset by higher benefit expense, including the

2002 charge for voluntary retirement programs ($135 million). On

a pro forma basis, operating companies income increased 5.6%.

The following discusses operating results within each of KFNA’s

reportable segments.

Cheese, Meals and Enhancers: Reported volume in 2002

increased 13.0% over 2001, due primarily to the inclusion in 2002

of a business that was previously held for sale. On a pro forma

basis, volume in 2002 increased 0.5%, driven by volume gains in

enhancers, meals and food service, partially offset by a decline in

cheese. Volume gains in enhancers and meals were led by Kraft

pourable dressings, barbecue sauce, macaroni & cheese dinners

and the 2001 acquisition of It’s Pasta Anytime. In cheese, volume

declined as lower dairy costs resulted in aggressive competitive

activity by private label manufacturers as they reduced prices and

increased merchandising levels.

During 2002, reported net revenues increased $145 million (1.7%)

over 2001, due primarily to the inclusion in 2002 of a business that

was previously held for sale ($252 million) and higher volume/mix

($36 million), partially offset by lower net pricing ($135 million,

primarily related to lower dairy commodity costs). On a pro forma

basis, net revenues decreased 1.2% from the comparable period

of 2001, as lower net pricing was partially offset by higher

volume/mix.

Reported operating companies income for 2002 increased

$69 million (3.3%) over 2001, due primarily to favorable margins

($48 million, due primarily to lower cheese commodity costs and

productivity savings), higher volume/mix ($30 million), lower

integration related costs in 2002 ($33 million) and the inclusion in

2002 of a business that was previously held for sale ($23 million),

partially offset by higher benefit expenses, including the 2002

charge for voluntary retirement programs ($60 million). On a pro

forma basis, operating companies income also increased 3.3%,

driven by favorable margins and higher volume/mix, partially

offset by higher benefit expenses.

Biscuits, Snacks and Confectionery: Reported volume in 2002

increased 0.8% over 2001. On a pro forma basis, volume in 2002

increased 0.7% over 2001, as volume gains in biscuits and snacks

were partially offset by a decline in confectionery shipments. In

biscuits, volume increased, driven by new product initiatives in

both cookies and crackers. In snacks, volume also increased,

due primarily to promotional initiatives. Confectionery volume

declined, resulting primarily from competitive activity in the breath

freshening category, partially offset by new product introductions

in the non-chocolate confectionery business.

33