Kraft 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

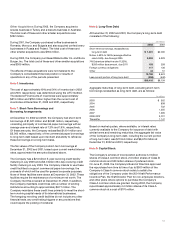

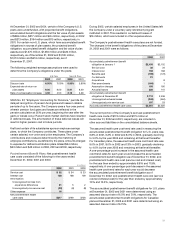

Other Acquisitions: During 2002, the Company acquired a

snacks business in Turkey and a biscuits business in Australia.

The total cost of these and other smaller acquisitions was

$122 million.

During 2001, the Company purchased coffee businesses in

Romania, Morocco and Bulgaria and also acquired confectionery

businesses in Russia and Poland. The total cost of these and

other smaller acquisitions was $194 million.

During 2000, the Company purchased Balance Bar Co. and Boca

Burger, Inc. The total cost of these and other smaller acquisitions

was $365 million.

The effects of these acquisitions were not material to the

Company’s consolidated financial position or results of

operations in any of the periods presented.

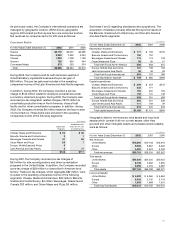

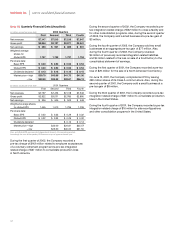

Note 6. Inventories:

The cost of approximately 49% and 54% of inventories in 2002

and 2001, respectively, was determined using the LIFO method.

The stated LIFO amounts of inventories were approximately

$215 million and $150 million higher than the current cost of

inventories at December 31, 2002 and 2001, respectively.

Note 7. Short-Term Borrowings and

Borrowing Arrangements:

At December 31, 2002 and 2001, the Company had short-term

borrowings of $1,621 million and $2,681 million, respectively,

consisting principally of commercial paper borrowings with an

average year-end interest rate of 1.3% and 1.9%, respectively.

Of these amounts, the Company reclassified $1,401 million and

$2,000 million, respectively, of the commercial paper borrowings

to long-term debt based upon its intent and ability to refinance

these borrowings on a long-term basis.

The fair values of the Company’s short-term borrowings at

December 31, 2002 and 2001, based upon current market interest

rates, approximate the amounts disclosed above.

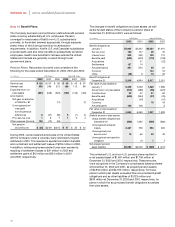

The Company has a $2.0 billion 5-year revolving credit facility

maturing in July 2006 and a $3.0 billion 364-day revolving credit

facility maturing in July 2003. The Company intends to use these

credit facilities to support commercial paper borrowings, the

proceeds of which will be used for general corporate purposes.

None of these facilities were drawn at December 31, 2002. These

facilities require the maintenance of a minimum net worth. The

Company met this covenant at December 31, 2002. In addition,

the Company maintains credit lines with a number of lending

institutions amounting to approximately $577 million. The

Company maintains these credit lines primarily to meet the short-

term working capital needs of its international businesses.

The foregoing revolving credit facilities do not include any other

financial tests, any credit rating triggers or any provisions that

could require the posting of collateral.

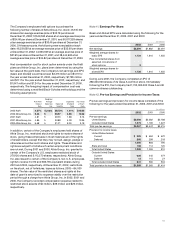

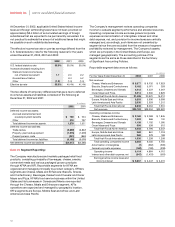

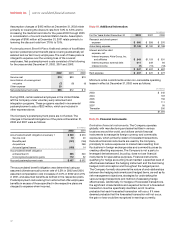

Note 8. Long-Term Debt:

At December 31, 2002 and 2001, the Company’s long-term debt

consisted of the following:

(in millions)

2002 2001

Short-term borrowings, reclassified as

long-term debt $ 1,401 $2,000

Notes, 4.63% to 7.55% (average effective

rate 5.53%), due through 2035 9,053 6,229

7% Debenture (effective rate 11.32%),

$200 million face amount, due 2011 153 258

Foreign currency obligations 117 136

Other 44 51

10,768 8,674

Less current portion of long-term debt (352) (540)

$10,416 $8,134

Aggregate maturities of long-term debt, excluding short-term

borrowings reclassified as long-term debt, are as follows:

(in millions)

2003 $ 352

2004 838

2005 732

2006 1,255

2007 1,395

2008-2012 3,701

Thereafter 1,141

Based on market quotes, where available, or interest rates

currently available to the Company for issuance of debt with

similar terms and remaining maturities, the aggregate fair value

of the Company’s long-term debt, including the current portion

of long-term debt, was $11,544 million and $8,679 million at

December 31, 2002 and 2001, respectively.

Note 9. Capital Stock:

The Company’s articles of incorporation authorize 3.0 billion

shares of Class A common stock, 2.0 billion shares of Class B

common stock and 500 million shares of preferred stock.

On June 21, 2002, the Company’s Board of Directors approved

the repurchase from time to time of up to $500 million of the

Company’s Class A common stock solely to satisfy the

obligations of the Company under the 2001 Kraft Performance

Incentive Plan, the Kraft Director Plan for non-employee directors,

and other plans where options to purchase the Company’s

Class A common stock are granted. During 2002, the Company

repurchased approximately 4.4 million shares of its Class A

common stock at a cost of $170 million.

53