Kraft 2002 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

deliverables contains more than one unit of accounting.

EITF Issue No. 00-21 is effective for the Company for revenue

arrangements entered into beginning July 1, 2003. The Company

does not expect the adoption of EITF Issue No. 00-21 to have a

material impact on its 2003 consolidated financial statements.

In January 2003, the FASB issued Interpretation No. 46,

“Consolidation of Variable Interest Entities.” Interpretation No. 46

requires that the assets, liabilities and results of the activity of

variable interest entities be consolidated into the financial

statements of the company that has the controlling financial

interest. Interpretation No. 46 also provides the framework for

determining whether a variable interest entity should be

consolidated based on voting interests or significant financial

support provided to it. Interpretation No. 46 will be effective for

the Company on February 1, 2003 for variable interest entities

created after January 31, 2003, and on July 1, 2003 for variable

interest entities created prior to February 1, 2003. The Company

does not expect the adoption of Interpretation No. 46 to have a

material impact on its 2003 consolidated financial statements.

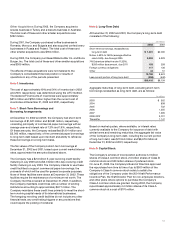

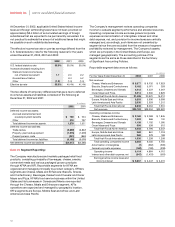

Note 3. Related Party Transactions:

Altria Group, Inc.’s subsidiary, Altria Corporate Services, Inc.,

provides the Company with various services, including planning,

legal, treasury, accounting, auditing, insurance, human resources,

office of the secretary, corporate affairs, information technology

and tax services. In 2001, the Company entered into a formal

agreement with Altria Corporate Services, Inc., providing for a

continuation of these services, the cost of which increased

$91 million during 2001 as Altria Corporate Services, Inc., provided

information technology and financial services, all of which were

previously performed by the Company at approximately the same

cost. Billings for these services, which were based on the cost to

Altria Corporate Services, Inc. to provide such services and a

management fee, were $327 million, $339 million and $248 million

for the years ended December 31, 2002, 2001 and 2000,

respectively. These costs were paid to Altria Corporate Services,

Inc. monthly. Although the cost of these services cannot be

quantified on a stand-alone basis, management believes that the

billings are reasonable based on the level of support provided by

Altria Corporate Services, Inc., and that they reflect all services

provided. The cost and nature of the services are reviewed

annually by the Company’s audit committee, which is comprised

of independent directors. The effects of these transactions are

included in operating cash flows in the Company’s consolidated

statements of cash flows.

In addition, the Company’s daily net cash or overdraft position

is transferred to Altria Group, Inc., or its European subsidiary.

The Company pays or receives interest based upon the applicable

London Interbank Offered Rate, on the amounts payable to, or

receivable from, Altria Group, Inc., or its European subsidiary.

The Company also has long-term notes payable to Altria Group,

Inc. and its affiliates as follows:

(in millions)

At December 31, 2002 2001

Notes payable in 2009, interest at 7.0% $1,150 $5,000

Short-term due to Altria Group, Inc. and

affiliates reclassified as long-term 1,410

$2,560 $5,000

The 7.0% notes have no prepayment penalty. During 2002, the

Company prepaid $3,850 million of the 7.0% long-term notes

payable. In addition, at December 31, 2002, the Company has

short-term debt totaling $2,305 million to Altria Group, Inc.

Interest on these borrowings is based on the average one-month

London Interbank Offered Rate. A portion of the debt, totaling

$1,410 million, was reclassified on the consolidated balance sheet

as long-term notes due to Altria Group, Inc. and affiliates based

upon the Company’s ability and intention to refinance on a long-

term basis.

Based on interest rates available to the Company for issuances of

debt with similar terms and remaining maturities, the aggregate

fair value of the Company’s long-term notes payable to Altria

Group, Inc. and affiliates, at December 31, 2002 and 2001, were

$2,764 million and $5,325 million, respectively. The fair values of

the Company’s current amounts due to Altria Group, Inc. and

affiliates approximate carrying amounts.

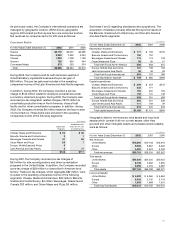

Note 4. Divestitures:

During 2002, the Company sold several small North American

food businesses, some of which were previously classified as

businesses held for sale. The net revenues and operating

results of the businesses held for sale, which were not significant,

were excluded from the Company’s consolidated statements

of earnings, and no gain or loss was recognized on these sales.

In addition, the Company sold its Latin American yeast and

industrial bakery ingredients business for approximately

$110 million and recorded a pre-tax gain of $69 million. The

aggregate proceeds received from sales of businesses were

$219 million, on which the Company recorded pre-tax gains of

$80 million.

During 2001, the Company sold several small food businesses.

The aggregate proceeds received in these transactions were

$21 million, on which the Company recorded pre-tax gains of

$8 million.

During 2000, the Company sold a French confectionery business

for proceeds of $251 million, on which a pre-tax gain of

$139 million was recorded. Several small international and North

American food businesses were also sold in 2000. The aggregate

proceeds received from sales of businesses were $300 million,

on which the Company recorded pre-tax gains of $172 million.

The operating results of the businesses sold were not material to

the Company’s consolidated operating results in any of the

periods presented.

51