Kraft 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

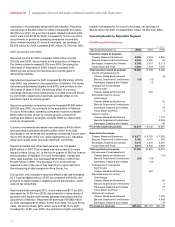

kraft foods inc. management’s discussion and analysis of financial condition and results of operations

During 2001, reported net revenues increased $1,116 million

(92.1%) over 2000, due primarily to the acquisition of Nabisco,

partially offset by unfavorable currency movements. On a pro

forma basis, net revenues increased 0.3%.

Reported operating companies income for 2001 increased

$189 million (100.0%) over 2000, due primarily to the acquisition

of Nabisco ($128 million), lower marketing, administration and

research costs ($89 million) and the shift in CDC income, partially

offset by unfavorable currency movements ($32 million). On a pro

forma basis, operating companies income increased 34.9%, due

primarily to productivity savings and Nabisco synergies.

Financial Review

Net Cash Provided by Operating Activities

Net cash provided by operating activities was $3.7 billion in 2002

and $3.3 billion in 2001 and 2000. The increase in 2002 operating

cash flows over 2001 primarily reflected cash flow from increased

net earnings.

Net Cash Used in Investing Activities

One element of the growth strategy of the Company is to

strengthen its brand portfolios through disciplined programs

of selective acquisitions and divestitures. The Company is

constantly investigating potential acquisition candidates and from

time to time sells businesses that are outside its core categories

or that do not meet its growth or profitability targets.

During 2002, 2001 and 2000, net cash used in investing

activities was $1.1 billion, $1.2 billion and $16.1 billion,

respectively. The decrease in 2002 primarily reflected lower

purchases of businesses and higher cash received from the

sales of businesses, partially offset by higher capital expenditures

related to the integration of Nabisco. The cash used in 2000

primarily reflected cash used for the acquisition of Nabisco.

Capital expenditures, which were funded by operating activities,

were $1.2 billion, $1.1 billion and $906 million in 2002, 2001 and

2000, respectively. The capital expenditures were primarily to

modernize the manufacturing facilities, lower cost of production

and expand production capacity for growing product lines. In

2003, capital expenditures are expected to be at or slightly

below 2002 expenditures and are expected to be funded

from operations.

Net Cash Used in Financing Activities

During 2002, net cash of $2.6 billion was used in financing

activities, compared with $2.1 billion during 2001. The increase

in cash used was due primarily to dividends paid during 2002

and repurchases of the Company’s Class A common stock.

During 2002, the Company issued $2.5 billion of global bonds

and $750 million of floating rate notes, the proceeds of which

were used to repay outstanding indebtedness. Financing

activities included net debt repayments of approximately

$1.5 billion in 2002.

During 2001, net cash of $2.1 billion was used in financing

activities, compared with $13.0 billion provided by financing

activities during 2000. During 2001, financing activities included

net debt repayments of $2.0 billion, excluding debt repayments

made with IPO proceeds. The net proceeds from the IPO were

used to repay debt to Altria Group, Inc. and affiliates, and, as

a result, had no impact on financing cash flows. In 2000, the

Company’s financing activities provided cash, as additional

borrowings to finance the acquisition of Nabisco exceeded the

cash used to pay dividends.

Debt and Liquidity

The SEC issued Financial Reporting Release No. 61, which

sets forth the views of the SEC regarding enhanced disclosures

relating to liquidity and capital resources. The information

provided below about the Company’s debt, credit facilities,

guarantees and future commitments is included here to facilitate

a review of the Company’s liquidity.

Debt: The Company’s total debt, including amounts due to Altria

Group, Inc. and affiliates, was $14.4 billion at December 31, 2002

and $16.0 billion at December 31, 2001. Aggregate prepayments

of $3.9 billion on the 7.0% note payable to Altria Group, Inc. and

affiliates and repayments of short-term borrowings were partially

offset by an increase in long-term debt.

In April 2002, the Company filed a Form S-3 shelf registration

statement with the Securities and Exchange Commission, under

which the Company may sell debt securities and/or warrants to

purchase debt securities in one or more offerings up to a total

amount of $5.0 billion. In May 2002, the Company issued

$2.5 billion of global bonds under the shelf registration. The bond

offering included $1.0 billion of five-year notes bearing interest at

a rate of 5.25% and $1.5 billion of ten-year notes bearing interest

at a rate of 6.25%. The net proceeds from the offering were used

to retire maturing long-term debt in the amount of $400 million

and to prepay a portion (approximately $2.1 billion) of the

Company’s 7.0% long-term note payable to Altria Group, Inc. and

affiliates. In November 2002, the Company issued $750 million of

floating rate notes due in 2004 under the shelf registration. The

interest rate on the notes is based on the three-month London

Interbank Offered Rate plus 0.20% and will be reset quarterly. The

net proceeds from the offering were used to prepay a portion of

the Company’s 7.0% long-term note payable to Altria Group, Inc.

and affiliates. At December 31, 2002, the Company had $1,750

million of capacity remaining under its existing $5.0 billion shelf

registration statement.

During 2002, the Company prepaid $3,850 million of the 7.0%

long-term notes payable to Altria Group, Inc. and affiliates. In

addition, at December 31, 2002, the Company had short-term

debt totaling $2,305 million to Altria Group, Inc. and affiliates.

Interest on these borrowings is based on the average one-month

London Interbank Offered Rate. A portion of the short-term debt,

totaling $1,410 million, was reclassified on the consolidated

balance sheet as long-term notes due to Altria Group, Inc. and

affiliates based upon the Company’s ability and intention to

refinance such amounts on a long-term basis.

38