Kraft 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

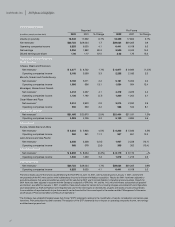

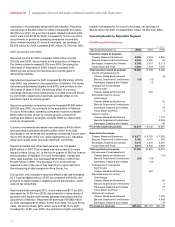

Kraft Foods International

Europe, Middle East and Africa—Volume grew 4.8%, as gains from acquisitions along

with growth in many markets more than offset lower volume in Germany. Operating

companies income increased 12.3%.

Latin America and Asia Pacific—Volume was up 2.1%, led by gains in beverages,

snacks and convenient meals. However, operating companies income declined

13.4%, due primarily to currency devaluations and difficult economic conditions in

Brazil, Argentina and Venezuela.

Looking ahead to 2003, our business fundamentals are strong. However, two factors

will restrain the growth of our earnings.

First, higher benefit costs, primarily related to pension and post-retirement medical

expenses, are expected to reduce our earnings per share by 7 cents, or three

percentage points of growth. The higher pension costs are primarily the result of

lower returns on our U.S. pension-fund assets. Despite these lower returns, our U.S.

pension plan is well funded, and we will not need to make a cash contribution in the

near future.

Second, a new stock-based compensation plan using a three-year restricted stock

grant in place of stock options will reduce earnings per share by 2 cents, or more than

one percentage point of growth. The restricted stock will further align the long-term

interest of employees with those of Kraft’s shareholders, and it enables us to expense

stock-based compensation in a transparent manner.

Importantly, both the pension and stock-compensation expenses are primarily

non-cash charges. We look forward to continued strong cash generation, with an

expected increase in discretionary cash flow of more than 10% in 2003.

Diluted earnings per share for the year are targeted to increase 4%-6% to $2.10-

$2.15. Other challenges, some anticipated and some we cannot foresee, also remain

risks to these results.

If our focus were strictly short term, we might choose to roll back marketing support

or cut our investment in product development to offset the combined impact on

earnings of these issues. But in the long-term interests of our brands—and our

shareholders—we will increase our investment in future growth. The health of our

business is strong, and as we manage through these challenges, we are committed to

keeping it that way.

The five enduring strategies we’ve used to build our business will guide our

growth in the future.

Accelerate growth of core brands by:

•Focusing new-product innovation on four high-growth consumer needs—snacking,

beverages, convenient meals and health & wellness.

•Capturing a greater share of the fastest-growing distribution channels.

•Expanding our products and marketing programs to connect with the rapidly growing

U.S. Hispanic population.

•Supporting all our brands with world-class marketing.

Drive global category leadership by:

•Using worldwide category councils to share best practices, fast-adapt product ideas,

and optimize productivity and sourcing.

•Stepping up our expansion in developing markets.

•Building distribution in all markets.

22

our strategies

accelerate growth of core brands

drive global category leadership

optimize our portfolio

drive world-class productivity,

quality and service

build employee and organizational

excellence