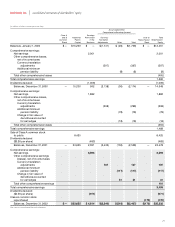

Kraft 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

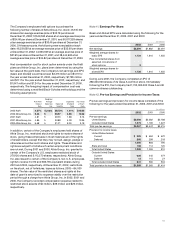

The Company’s employees held options to purchase the

following number of shares of Altria Group, Inc. stock: 46,615,162

shares at an average exercise price of $35.78 per share at

December 31, 2002; 57,349,595 shares at an average exercise price

of $34.66 per share at December 31, 2001; and 56,977,329 shares

at an average exercise price of $30.46 per share at December 31,

2000. Of these amounts, the following were exercisable at each

date: 46,231,629 at an average exercise price of $35.69 per share

at December 31, 2002; 44,930,609 at an average exercise price of

$31.95 per share at December 31, 2001; and 38,444,963 at an

average exercise price of $34.82 per share at December 31, 2000.

Had compensation cost for stock option awards under the Kraft

plans and Altria Group, Inc. plans been determined by using the

fair value at the grant date, the Company’s net earnings and EPS

(basic and diluted) would have been $3,316 million and $1.91 for

the year ended December 31, 2002, respectively; $1,785 million

and $1.11 for the year ended December 31, 2001, respectively; and

$1,947 million and $1.34 for the year ended December 31, 2000,

respectively. The foregoing impact of compensation cost was

determined using a modified Black-Scholes methodology and the

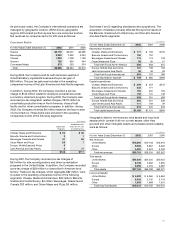

following assumptions:

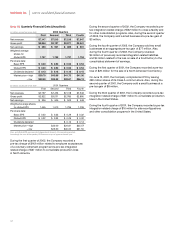

Weighted

Risk-Free Average Expected Fair Value

Interest Expected Expected Dividend at Grant

Rate Life Volatility Yield Date

2002 Kraft 4.27% 5 years 28.72% 1.41% $10.65

2002 Altria Group, Inc. 3.44 5 33.57 4.96 10.02

2001 Kraft 4.81 5 29.70 1.68 9.13

2001 Altria Group, Inc. 4.86 5 33.88 4.78 10.36

2000 Altria Group, Inc. 6.58 5 31.71 9.00 3.19

In addition, certain of the Company’s employees held shares of

Altria Group, Inc. restricted stock and rights to receive shares of

stock, giving these employees in most instances all of the rights

of shareholders, except that they may not sell, assign, pledge or

otherwise encumber such shares and rights. These shares and

rights are subject to forfeiture if certain employment conditions

are not met. During 2001 and 2000, Altria Group, Inc. granted to

certain of the Company’s U.S. employees restricted stock of

279,120 shares and 2,113,570 shares, respectively. Altria Group,

Inc. also issued to certain of the Company’s non-U.S. employees

rights to receive 31,310 and 683,790 equivalent shares during

2001 and 2000, respectively. At December 31, 2002, restrictions

on the stock, net of forfeitures, lapse as follows: 2003—84,000

shares. The fair value of the restricted shares and rights at the

date of grant is amortized to expense ratably over the restriction

period through a charge from Altria Group, Inc. In 2002, 2001 and

2000, the Company recorded compensation expense related to

restricted stock awards of $4 million, $39 million and $23 million,

respectively.

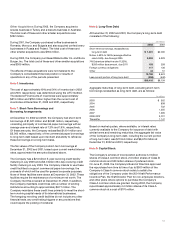

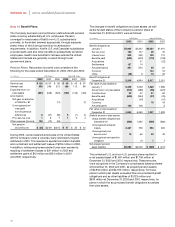

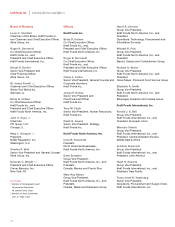

Note 11. Earnings Per Share:

Basic and diluted EPS were calculated using the following for the

years ended December 31, 2002, 2001 and 2000:

(in millions)

2002 2001 2000

Net earnings $3,394 $1,882 $2,001

Weighted average shares for

basic EPS 1,734 1,610 1,455

Plus: Incremental shares from

assumed conversions of

stock options 2

Weighted average shares for

diluted EPS 1,736 1,610 1,455

During June 2001, the Company completed an IPO of

280,000,000 shares of its Class A common stock. Immediately

following the IPO, the Company had 1,735,000,000 Class A and B

common shares outstanding.

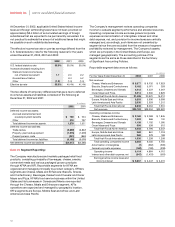

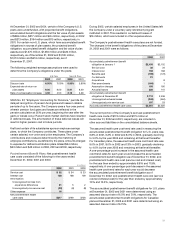

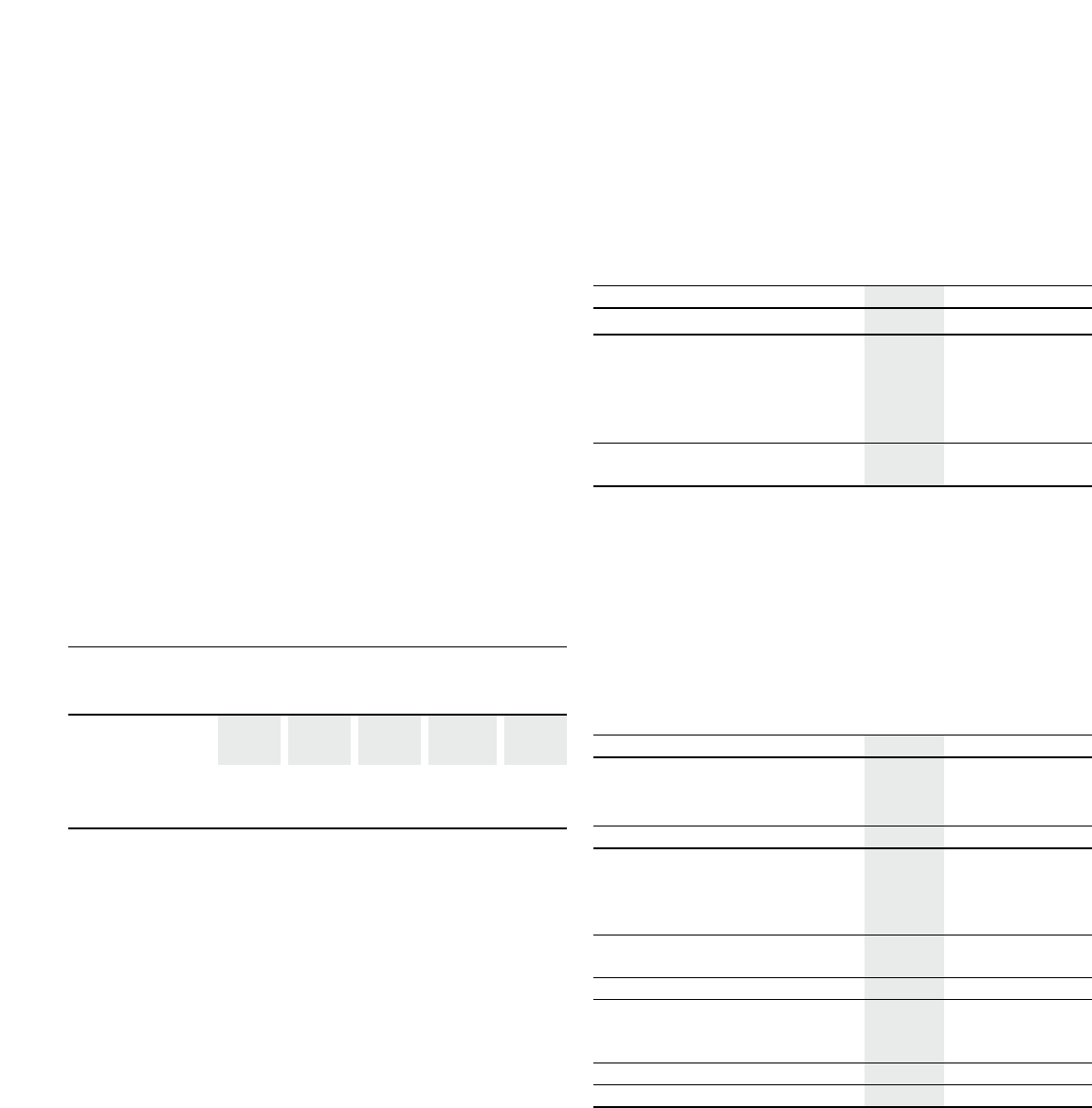

Note 12. Pre-tax Earnings and Provision for Income Taxes:

Pre-tax earnings and provision for income taxes consisted of the

following for the years ended December 31, 2002, 2001 and 2000:

(in millions)

2002 2001 2000

Pre-tax earnings:

United States $3,692 $2,282 $2,188

Outside United States 1,575 1,165 1,227

Total pre-tax earnings $5,267 $3,447 $3,415

Provision for income taxes:

United States federal:

Current $ 825 $ 594 $ 572

Deferred 265 299 218

1,090 893 790

State and local 138 112 120

Total United States 1,228 1,005 910

Outside United States:

Current 628 445 477

Deferred 13 115 27

Total outside United States 641 560 504

Total provision for income taxes $1,869 $1,565 $1,414

55