Kraft 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In Kraft Foods’ 100th year, we once again delivered on our commitments, relying on

the same enduring values that have inspired a century of growth.

Despite the marketplace challenges of 2002, including a weak global economy,

volatile commodity prices and significant economic uncertainty in Latin America, we

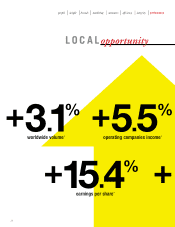

achieved strong results. Volume grew 3.1%, operating companies income increased

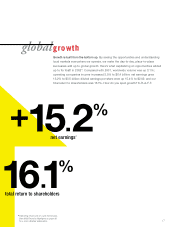

5.5% to $6.4 billion, net earnings increased 15.2% to $3.5 billion and diluted earnings

per share grew 15.4% to $2.02.

Around the world, our success is built on two key strengths

—

the best brands

and the best people.

And in 2002, this powerful combination of innovation and talent produced another

year of accomplishment:

•New products generated $1.1 billion in net revenues.

•We acquired two new growth businesses in Australia and Turkey.

•Our volume grew 7.1% in developing markets.

•More than 20 million people around the world visited our websites each month for

food ideas and information.

•In an independent survey of leading U.S. retailers, our customers selected Kraft as

“Best of the Best” among all consumer products companies.

•The integration of Nabisco created new growth opportunities and strong synergy

savings.

•We met our productivity target of at least 3.5% of cost of goods sold.

•We generated $2.5 billion in discretionary cash flow (operating cash flow minus

capital expenditures).

•We increased our dividend in the third quarter by 15% to 15 cents, bringing the annual

rate to 60 cents per share.

•And in a very challenging year for equities, we delivered to our investors a total return

of 16.1%.

Despite challenges in some key categories and geographies, our strong results

extended across the company.

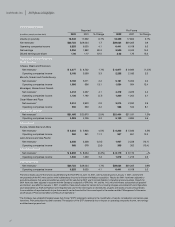

All six of our business segments increased volume, and five of the six grew operating

companies income for the year. We saw a negative impact on income in our Latin

America and Asia Pacific segment due to the economic issues we faced in several

Latin American markets.

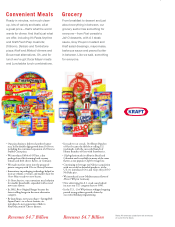

Kraft Foods North America

Beverages, Desserts and Cereals—Volume was up a strong 8.4%, once again led by

growth in ready-to-drink beverages, including Capri Sun and Kool-Aid Jammers.

Both Maxwell House coffee and Jell-O desserts gained volume as well. Operating

companies income for the segment increased 3.1%.

Biscuits, Snacks and Confectionery—Volume increased 0.7% on strong growth in

cookies and crackers from new products, including Double Delight Oreo, Chips Ahoy!

Cremewiches and Ritz Bits. Snacks volume also was up; however, confectionery

volume was off versus the prior year. Operating companies income was up 12.4%.

Cheese, Meals and Enhancers—Volume grew 0.5%, as gains in Kraft salad dressings,

barbecue sauce and macaroni & cheese dinners, and It’s Pasta Anytime more than

offset lower cheese volume. Operating companies income increased 3.3%.

Oscar Mayer and Pizza—Volume increased 2.3% on growth in Oscar Mayer hot dogs

and bacon, DiGiorno Stuffed Crust pizza and Boca meat alternatives. Operating

companies income was up 8.1%.

21

our mission

to be the undisputed global

food leader

consumers... first choice

customers... indispensable partner

alliances... most desired partner

employees... employer of choice

communities... responsible citizen

investors... top-tier performer

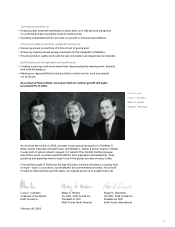

fellow shareholders:

Note: All operating results discussed in this letter are on a pro forma basis.