Kraft 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

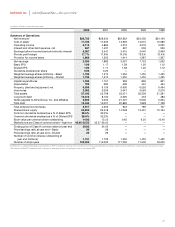

kraft foods inc. consolidated balance sheets

(in millions of dollars)

At December 31, 2002 2001

Assets

Cash and cash equivalents $ 215 $ 162

Receivables (less allowances of $119 and $151) 3,116 3,131

Inventories:

Raw materials 1,372 1,281

Finished product 2,010 1,745

3,382 3,026

Deferred income taxes 511 466

Other current assets 232 221

Total current assets 7,456 7,006

Property, plant and equipment, at cost:

Land and land improvements 387 387

Buildings and building equipment 3,153 2,915

Machinery and equipment 10,108 9,264

Construction in progress 802 706

14,450 13,272

Less accumulated depreciation 4,891 4,163

9,559 9,109

Goodwill and other intangible assets, net 36,420 35,957

Prepaid pension assets 2,814 2,675

Other assets 851 1,051

Total Assets $57,100 $55,798

Liabilities

Short-term borrowings $ 220 $ 681

Current portion of long-term debt 352 540

Due to Altria Group, Inc. and affiliates 895 1,652

Accounts payable 1,939 1,897

Accrued liabilities:

Marketing 1,474 1,398

Employment costs 610 658

Other 1,316 1,821

Income taxes 363 228

Total current liabilities 7,169 8,875

Long-term debt 10,416 8,134

Deferred income taxes 5,428 5,031

Accrued postretirement health care costs 1,889 1,850

Notes payable to Altria Group, Inc. and affiliates 2,560 5,000

Other liabilities 3,806 3,430

Total liabilities 31,268 32,320

Contingencies (Note 17)

Shareholders’ Equity

Class A common stock, no par value (555,000,000 shares issued in 2002 and 2001)

Class B common stock, no par value (1,180,000,000 shares issued and outstanding)

Additional paid-in capital 23,655 23,655

Earnings reinvested in the business 4,814 2,391

Accumulated other comprehensive losses (primarily currency translation adjustments) (2,467) (2,568)

26,002 23,478

Less cost of repurchased stock (4,381,150 Class A shares) (170)

Total shareholders’ equity 25,832 23,478

Total Liabilities and Shareholders’ Equity $57,100 $55,798

See notes to consolidated financial statements.