Kraft 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

kraft foods inc. notes to consolidated financial statements

Note 5. Acquisitions:

Nabisco: On December 11, 2000, the Company acquired all of

the outstanding shares of Nabisco for $55 per share in cash.

The purchase of the outstanding shares, retirement of employee

stock options and other payments totaled approximately

$15.2 billion. In addition, the acquisition included the assumption

of approximately $4.0 billion of existing Nabisco debt. The

Company financed the acquisition through the issuance

of two long-term notes payable to Altria Group, Inc., totaling

$15.0 billion, and short-term intercompany borrowings of

$255 million. The acquisition has been accounted for as a

purchase. Beginning January 1, 2001, Nabisco’s earnings have

been included in the consolidated operating results of the

Company. The Company’s interest cost associated with acquiring

Nabisco has been included in interest and other debt expense,

net, on the Company’s consolidated statements of earnings for

the years ended December 31, 2002, 2001 and 2000.

During 2001, the Company completed the allocation of excess

purchase price relating to Nabisco. As a result, the Company

recorded, among other things, the final valuations of property,

plant and equipment and intangible assets, primarily trade

names, amounts relating to the closure of Nabisco facilities and

related deferred income taxes. The final allocation of excess

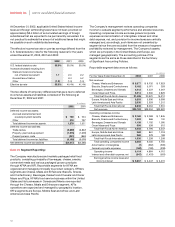

purchase price at December 31, 2001 was as follows:

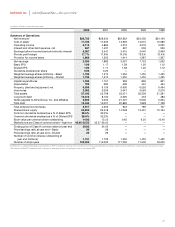

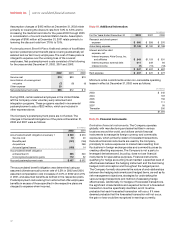

(in millions)

Purchase price $15,254

Historical value of tangible assets acquired and

liabilities assumed (1,271)

Excess of purchase price over assets acquired and

liabilities assumed at the date of acquisition 16,525

Increases for allocation of purchase price:

Property, plant and equipment 367

Other assets 347

Accrued postretirement health care costs 230

Pension liabilities 190

Debt 50

Legal, professional, lease and contract termination costs 129

Other liabilities, principally severance 602

Deferred income taxes 3,583

Goodwill and other intangible assets at December 31, 2001 $22,023

Goodwill and other intangible assets at December 31, 2001

included approximately $11.7 billion related to trade names.

The Company also recorded deferred federal income taxes of

$3.9 billion related to trade names. During 2002, the Company

decreased goodwill by $76 million due primarily to the favorable

completion of the severance and exit programs.

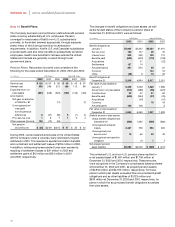

The closure of a number of Nabisco domestic and international

facilities resulted in severance and other exit costs of

$379 million, which are included in the above adjustments for

the allocation of the Nabisco purchase price. The closures

will result in the termination of approximately 7,500 employees

and will require total cash payments of $373 million, of

which approximately $190 million has been spent through

December 31, 2002. Substantially all of the closures were

completed as of December 31, 2002, and the remaining payments

relate to salary continuation payments for severed employees and

lease payments.

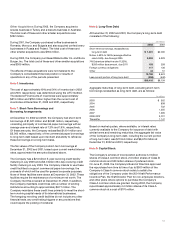

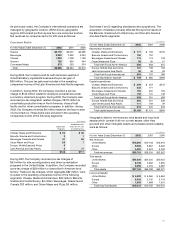

The integration of Nabisco into the operations of the Company

has also resulted in the closure or reconfiguration of several of

the Company’s existing facilities. The aggregate charges to the

Company’s consolidated statement of earnings to close or

reconfigure its facilities and integrate Nabisco were originally

estimated to be in the range of $200 million to $300 million.

During 2002, the Company recorded pre-tax integration related

charges of $115 million to consolidate production lines, close

facilities and for other consolidation programs. In addition, during

2001, the Company incurred pre-tax integration costs of

$53 million for site reconfigurations and other consolidation

programs in the United States. The integration related charges

of $168 million included $27 million relating to severance,

$117 million relating to asset write-offs and $24 million relating to

other cash exit costs. Cash payments relating to these charges

will approximate $51 million, of which $21 million has been

paid through December 31, 2002. In addition, during 2002,

approximately 700 salaried employees elected to retire or

terminate employment under voluntary retirement programs.

As a result, the Company recorded a pre-tax charge of

$142 million related to these programs. As of December 31, 2002,

the aggregate pre-tax charges to close or reconfigure the

Company’s facilities, including charges for early retirement

programs, were $310 million, slightly above the original estimate.

No additional pre-tax charges are expected to be recorded for

these programs.

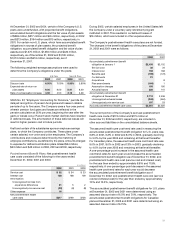

During 2001, certain small Nabisco businesses were reclassified

to businesses held for sale, including their estimated results of

operations through anticipated sale dates. These businesses

have subsequently been sold, with the exception of one business

that had been held for sale since the acquisition of Nabisco. This

business, which is no longer held for sale, has been included in

2002 consolidated operating results.

Assuming the acquisition of Nabisco occurred at the beginning

of 2000, pro forma net revenues would have been approximately

$30 billion and pro forma net earnings would have been

$1.4 billion in 2000; while 2000 basic and diluted EPS would have

been $0.96. These pro forma results, which are unaudited, do not

give effect to any synergies expected to result from the merger of

Nabisco’s operations with those of the Company, nor do they give

effect to the reduction of interest expense from the repayment of

borrowings with the proceeds from the IPO. The pro forma results

also do not reflect the effects of SFAS No. 141 and 142 on the

amortization of goodwill or other intangible assets. The pro forma

results are not necessarily indicative of what actually would have

occurred if the acquisition had been consummated and the IPO

completed at the beginning of 2000, nor are they necessarily

indicative of future consolidated operating results.