Kraft 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

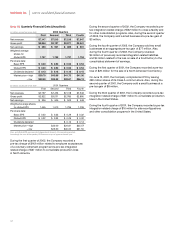

Substantially all of the Company’s derivative financial instruments

are effective as hedges under SFAS No. 133. The fair value of all

derivative financial instruments has been calculated based on

market quotes.

The Company uses forward foreign exchange contracts and

foreign currency options to mitigate its exposure to changes

in foreign currency exchange rates from third-party and

intercompany forecasted transactions. The primary currencies to

which the Company is exposed include the Euro, British pound

and Canadian dollar. At December 31, 2002 and 2001, the

Company had option and forward foreign exchange contracts

with aggregate notional amounts of $575 million and $431 million,

respectively, which are comprised of contracts for the purchase

and sale of foreign currencies. The effective portion of unrealized

gains and losses associated with forward contracts is deferred as

a component of accumulated other comprehensive earnings

(losses) until the underlying hedged transactions are reported on

the Company’s consolidated statement of earnings.

The Company is exposed to price risk related to forecasted

purchases of certain commodities used as raw materials by the

Company’s businesses. Accordingly, the Company uses

commodity forward contracts, as cash flow hedges, primarily for

coffee, cocoa, milk and cheese. Commodity futures and options

are also used to hedge the price of certain commodities,

including milk, coffee, cocoa, wheat, corn, sugar and soybean oil.

In general, commodity forward contracts qualify for the normal

purchase exception under SFAS No. 133 and are, therefore, not

subject to the provisions of SFAS No. 133. At December 31, 2002

and 2001, the Company had net long commodity positions of

$544 million and $589 million, respectively. Unrealized gains or

losses on net commodity positions were immaterial at December

31, 2002 and 2001. The effective portion of unrealized gains and

losses on commodity futures and option contracts is deferred as

a component of accumulated other comprehensive earnings

(losses) and is recognized as a component of cost of sales in the

Company’s consolidated statement of earnings when the related

inventory is sold.

Derivative gains or losses reported in accumulated other

comprehensive earnings (losses) are a result of qualifying

hedging activity. Transfers of these gains or losses from

accumulated other comprehensive earnings (losses) to earnings

are offset by corresponding gains or losses on the underlying

hedged items. During the years ended December 31, 2002

and 2001, ineffectiveness related to cash flow hedges was

not material. At December 31, 2002, the Company is hedging

forecasted transactions for periods not exceeding fifteen

months and expects substantially all amounts reported in

accumulated other comprehensive earnings (losses) to be

reclassified to the consolidated statement of earnings within

the next twelve months.

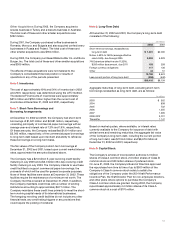

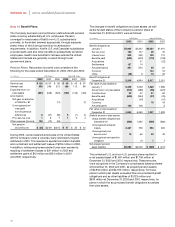

Hedging activity affected accumulated other comprehensive

earnings (losses), net of income taxes, during the years ended

December 31, 2002 and 2001, as follows:

(in millions)

Balance as of January 1, 2001 $

—

Derivative losses transferred to earnings 15

Change in fair value (33)

Balance as of December 31, 2001 (18)

Derivative losses transferred to earnings 21

Change in fair value 10

Balance as of December 31, 2002 $13

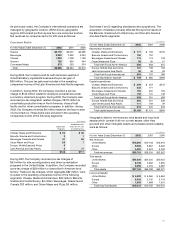

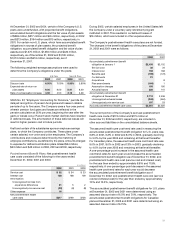

Credit exposure and credit risk: The Company is exposed to

credit loss in the event of nonperformance by counterparties.

However, the Company does not anticipate nonperformance,

and such exposure was not material at December 31, 2002.

Fair value: The aggregate fair value, based on market quotes,

of the Company’s third-party debt at December 31, 2002 was

$11,764 million as compared with its carrying value of

$10,988 million. The aggregate fair value of the Company’s third-

party debt at December 31, 2001 was $9,360 million as compared

with its carrying value of $9,355 million. Based on interest rates

available to the Company for issuances of debt with similar terms

and remaining maturities, the aggregate fair value and carrying

value of the Company’s long-term notes payable to Altria Group,

Inc. and its affiliates were $2,764 million and $2,560 million,

respectively, at December 31, 2002 and $5,325 million and

$5,000 million, respectively, at December 31, 2001.

See Notes 3, 7 and 8 for additional disclosures of fair value for

short-term borrowings and long-term debt.

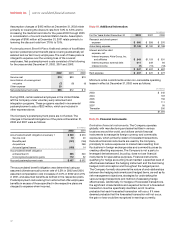

Note 17. Contingencies:

The Company and its subsidiaries are parties to a variety of legal

proceedings arising out of the normal course of business,

including a few cases in which substantial amounts of damages

are sought. While the results of litigation cannot be predicted with

certainty, management believes that the final outcome of these

proceedings will not have a material adverse effect on the

Company’s consolidated financial position or results of operations.

Guarantees: At December 31, 2002, the Company’s third-party

guarantees, which are primarily derived from acquisition and

divestiture activities, approximated $36 million. Substantially all

of these guarantees expire through 2012, with $12 million expiring

in 2003. The Company is required to perform under these

guarantees in the event that a third-party fails to make contractual

payments or achieve performance measures. The Company has

recorded a liability of $21 million at December 31, 2002 relating to

these guarantees.

61