Kraft 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

kraft foods inc. management’s discussion and analysis of financial condition and results of operations

elimination of substantially all goodwill amortization. Reported

net earnings of $3,394 million for 2002 increased $1,512 million

(80.3%) over 2001. On a pro forma basis, diluted and basic EPS,

which were both $2.02 for 2002, increased by 15.4% over 2001,

due primarily to growth in operating companies income and

lower interest expense. On a pro forma basis, net earnings of

$3,505 million for 2002 increased $463 million (15.2%) over 2001.

2001 compared with 2000

Reported volume for 2001 increased 4,262 million pounds

(32.5%) over 2000, due primarily to the acquisition of Nabisco.

Pro forma volume increased 2.2% over 2000. Excluding the

53rd week of shipments in 2000, volume increased 3.4%,

reflecting new product introductions and volume gains in

developing markets.

Reported net revenues for 2001 increased $6,312 million (27.5%)

over 2000, due primarily to the acquisition of Nabisco. Pro forma

net revenues decreased slightly from 2000, due primarily to the

53rd week of sales in 2000, the adverse effect of currency

exchange rates and lower sales prices on coffee products (driven

by commodity-related price declines), partially offset by the

favorable impact of volume growth.

Reported operating companies income increased $1,280 million

(26.9%) over 2000, due primarily to the acquisition of Nabisco.

On a pro forma basis, operating companies income increased

$524 million (9.4%), driven by volume growth, productivity

savings and Nabisco synergies, partially offset by unfavorable

currency movements.

Currency movements decreased net revenues by $493 million

and operating companies income by $60 million from 2000.

Decreases in net revenues and operating companies income were

due to the strength of the U.S. dollar against the euro, Canadian

dollar and certain Asian and Latin American currencies.

Reported interest and other debt expense, net, increased

$840 million in 2001. This increase was due primarily to notes

issued to Altria Group, Inc. in the fourth quarter of 2000 to finance

the acquisition of Nabisco. On a pro forma basis, interest and

other debt expense, net, decreased $213 million in 2001 from

$1,348 million in 2000. This decrease in pro forma interest

expense is due to the use of free cash flow to repay debt and

the refinancing of debt payable to Altria Group, Inc.

During 2001, the Company’s reported effective tax rate increased

by 4.0 percentage points to 45.4% as compared with 2000, due

primarily to higher Nabisco-related goodwill amortization, which

was not tax deductible.

Reported diluted and basic EPS, which were both $1.17 for 2001,

decreased by 15.2% from 2000, due primarily to higher levels of

goodwill amortization and interest expense associated with the

acquisition of Nabisco. Reported net earnings of $1,882 million

for 2001 decreased $119 million (5.9%) from 2000. On a pro forma

basis, diluted and basic EPS, which were both $1.75 for 2001,

increased by 12.9% over 2000, due primarily to higher operating

results in all segments. On a pro forma basis, net earnings of

$3,042 million for 2001 increased $361 million (13.5%) from 2000.

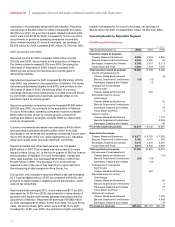

Operating Results by Reportable Segment

Kraft Foods North America

(in millions)

Year Ended December 31, 2002 2001 2000

Reported volume (in pounds):

Cheese, Meals and Enhancers 5,898 5,219 4,820

Biscuits, Snacks and Confectionery 2,369 2,350 54

Beverages, Desserts and Cereals 3,708 3,421 3,117

Oscar Mayer and Pizza 1,554 1,519 1,507

Total reported volume (in pounds) 13,529 12,509 9,498

Volume of businesses sold:

Cheese, Meals and Enhancers (5)

Biscuits, Snacks and Confectionery (15) (13)

Beverages, Desserts and Cereals (1)

Changes due to businesses

held for sale:

Cheese, Meals and Enhancers 647

Estimated impact of century

date change:

Cheese, Meals and Enhancers 16

Biscuits, Snacks and Confectionery 1

Beverages, Desserts and Cereals 19

Oscar Mayer and Pizza 5

Nabisco volume:

Cheese, Meals and Enhancers 1,101

Biscuits, Snacks and Confectionery 2,246

Beverages, Desserts and Cereals 40

Pro forma volume (in pounds) 13,514 13,142 12,921

Reported net revenues:

Cheese, Meals and Enhancers $ 8,877 $ 8,732 $ 7,923

Biscuits, Snacks and Confectionery 5,182 5,071 293

Beverages, Desserts and Cereals 4,412 4,237 4,267

Oscar Mayer and Pizza 3,014 2,930 2,829

Total reported net revenues 21,485 20,970 15,312

Net revenues of businesses sold:

Cheese, Meals and Enhancers (10)

Biscuits, Snacks and Confectionery (21) (19)

Beverages, Desserts and Cereals (12)

Changes due to businesses

held for sale:

Cheese, Meals and Enhancers 252

Estimated impact of century

date change:

Cheese, Meals and Enhancers 29

Biscuits, Snacks and Confectionery 3

Beverages, Desserts and Cereals 16

Oscar Mayer and Pizza 11

Nabisco net revenues:

Cheese, Meals and Enhancers 1,016

Biscuits, Snacks and Confectionery 4,653

Beverages, Desserts and Cereals 79

Pro forma net revenues $21,464 $21,191 $21,109

32