Kraft 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

kraft foods inc. management’s discussion and analysis of financial condition and results of operations

the Company may repay some or all of the note with the proceeds

from external debt offerings.

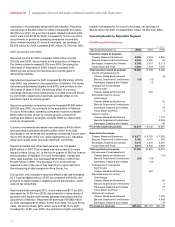

The Company accounts for income taxes in accordance with

SFAS No. 109, “Accounting for Income Taxes.” The accounts

of the Company are included in the consolidated federal income

tax return of Altria Group, Inc. Income taxes are generally

computed on a separate company basis. To the extent that

foreign tax credits, capital losses and other credits generated by

the Company, which cannot be utilized on a separate company

basis, are utilized in Altria Group, Inc.’s consolidated federal

income tax return, the benefit is recognized in the calculation of

the Company’s provision for income taxes. The Company utilized

tax benefits that it would otherwise not have been able to use of

$193 million, $185 million and $139 million for the years ended

December 31, 2002, 2001 and 2000, respectively.

Business Environment

The Company faces a number of challenges in 2003, including

among other things, higher benefit costs, increased stock

compensation costs and weak economies in certain parts of

Latin America. As previously discussed, higher benefit costs are

expected to impact 2003 EPS by approximately $0.07 per share.

The higher benefit costs are primarily the result of lower returns

on pension fund assets, a lower discount rate and higher retiree

medical costs. The additional stock compensation costs, which

are expected to impact 2003 earnings per share by approximately

$0.02 per share, relate to restricted stock awards to employees.

These awards have a three-year vesting period and will further

align the long-term interests of employees with those of the

Company’s shareholders. The award of restricted stock to

employees (rather than stock options) is more transparent to

shareholders as the cost of the program is based upon the

average market price of the stock on the date of grant, rather

than a fair value generated by an option-pricing model. In Latin

America, political unrest in Venezuela, as well as the devaluation

of certain currencies, are also expected to negatively impact

2003 EPS.

The Company is subject to fluctuating commodity costs, currency

movements and competitive challenges in various product

categories and markets, including a trend toward increasing

consolidation in the retail trade and consequent inventory

reductions and changing consumer preferences. In addition,

certain competitors may have different profit objectives, and

some competitors may be more or less susceptible to currency

exchange rates. To confront these challenges, the Company

continues to take steps to build the value of its brands and

improve its food business portfolio with new products and

marketing initiatives.

Fluctuations in commodity costs can lead to retail price volatility,

intensify price competition and influence consumer and trade

buying patterns. KFNA’s and KFI’s businesses are subject to

fluctuating commodity costs, including dairy, coffee bean and

cocoa costs. Dairy commodity costs on average were lower in

2002 than those seen in 2001. Coffee bean prices were also lower,

while cocoa bean prices were higher than in 2001.

On December 11, 2000, the Company acquired all of the

outstanding shares of Nabisco for $55 per share in cash. The

purchase of the outstanding shares, retirement of employee stock

options and other payments totaled approximately $15.2 billion.

In addition, the acquisition included the assumption of

approximately $4.0 billion of existing Nabisco debt. The Company

financed the acquisition through the issuance of two long-term

notes payable to Altria Group, Inc., totaling $15.0 billion, and

short-term intercompany borrowings of $255 million. The

acquisition has been accounted for as a purchase. Beginning

January 1, 2001, Nabisco’s earnings have been included in the

consolidated operating results of the Company.

The closure of a number of Nabisco domestic and international

facilities resulted in severance and other exit costs of

$379 million, which are included in the adjustments for the

allocation of the Nabisco purchase price. The closures will

result in the termination of approximately 7,500 employees

and will require total cash payments of $373 million, of which

approximately $190 million has been spent through December 31,

2002. Substantially all of the closures were completed as of

December 31, 2002, and the remaining payments relate to

salary continuation payments for severed employees and

lease payments.

The integration of Nabisco into the operations of the Company

has also resulted in the closure or reconfiguration of several of

the Company’s existing facilities. The aggregate charges to the

Company’s consolidated statement of earnings to close or

reconfigure its facilities and integrate Nabisco were originally

estimated to be in the range of $200 million to $300 million.

During 2002, the Company recorded pre-tax integration related

charges of $115 million to consolidate production lines, close

facilities and for other consolidation programs. In addition,

during 2001, the Company incurred pre-tax integration costs of

$53 million for site reconfigurations and other consolidation

programs in the United States. The integration related charges

of $168 million included $27 million relating to severance,

$117 million relating to asset write-offs and $24 million relating

to other cash exit costs. Cash payments relating to these

charges will approximate $51 million, of which $21 million has

been paid through December 31, 2002. In addition, during 2002,

approximately 700 salaried employees elected to retire or

terminate employment under voluntary retirement programs. As

a result, the Company recorded a pre-tax charge of $142 million

related to these programs. As of December 31, 2002, the

aggregate pre-tax charges to close or reconfigure the Company’s

facilities and integrate Nabisco, including charges for early

retirement programs, were $310 million, slightly above the original

estimate. No additional pre-tax charges are expected to be

recorded for these programs.

During 2001, certain small Nabisco businesses were reclassified

to businesses held for sale, including their estimated results of

operations through anticipated sale dates. These businesses

have subsequently been sold, with the exception of one business

that had been held for sale since the acquisition of Nabisco. This

business, which is no longer held for sale, has been included in

2002 consolidated operating results.

28