Kraft 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

kraft foods inc. management’s discussion and analysis of financial condition and results of operations

Overview

Kraft Foods Inc. (“Kraft”), together with its subsidiaries

(collectively referred to as the “Company”) is the largest branded

food and beverage company headquartered in the United States.

Prior to June 13, 2001, the Company was a wholly-owned

subsidiary of Altria Group, Inc. (formerly Philip Morris Companies

Inc.). On June 13, 2001, the Company completed an initial public

offering (“IPO”) of 280,000,000 shares of its Class A common

stock at a price of $31.00 per share. The IPO proceeds, net of the

underwriting discount and expenses, of $8.4 billion were used to

retire a portion of an $11.0 billion long-term note payable to Altria

Group, Inc., incurred in connection with the acquisition of

Nabisco Holdings Corp. (“Nabisco”). After the IPO, Altria Group,

Inc. owned approximately 83.9% of the outstanding shares of the

Company’s capital stock through its ownership of 49.5% of the

Company’s Class A common stock and 100% of the Company’s

Class B common stock. The Company’s Class A common stock

has one vote per share, while the Company’s Class B common

stock has ten votes per share. At December 31, 2002, Altria

Group, Inc. held 97.8% of the combined voting power of the

Company’s outstanding capital stock and owned approximately

84.2% of the outstanding shares of the Company’s capital stock.

The Company conducts its global business through two

subsidiaries: Kraft Foods North America, Inc. (“KFNA”) and Kraft

Foods International, Inc. (“KFI”). KFNA manages its operations

by product category, while KFI manages its operations by

geographic region. KFNA’s segments are Cheese, Meals and

Enhancers; Biscuits, Snacks and Confectionery; Beverages,

Desserts and Cereals; and Oscar Mayer and Pizza. KFNA’s food

service business within the United States and its businesses in

Canada and Mexico are reported through the Cheese, Meals and

Enhancers segment. KFI’s segments are Europe, Middle East and

Africa; and Latin America and Asia Pacific.

Critical Accounting Policies

Financial Reporting Release No. 60, which was issued by the

Securities and Exchange Commission (“SEC”), requires all

registrants to discuss critical accounting policies or methods

used in the preparation of financial statements. Note 2 to the

consolidated financial statements includes a summary of the

significant accounting policies and methods used in the

preparation of the Company’s consolidated financial statements.

In most instances, the Company must use an accounting policy

or method because it is the only policy or method permitted

under accounting principles generally accepted in the United

States of America (“U.S. GAAP”).

The preparation of all financial statements includes the use of

estimates and assumptions that affect a number of amounts

included in the Company’s financial statements, including, among

other things, employee benefit costs and income taxes. The

Company bases its estimates on historical experience and other

assumptions that it believes are reasonable. If actual amounts are

ultimately different from previous estimates, the revisions are

included in the Company’s results for the period in which the

actual amounts become known. Historically, the aggregate

differences, if any, between the Company’s estimates and actual

amounts in any year have not had a significant impact on the

Company’s consolidated financial statements.

The Company’s Audit Committee has reviewed the development,

selection and disclosure of the critical accounting policies

and estimates.

The following is a review of the more significant assumptions and

estimates, as well as the accounting policies and methods used

in the preparation of the Company’s consolidated financial

statements:

Employee Benefit Plans: As discussed in Note 14 to the

consolidated financial statements, the Company provides a

range of benefits to its employees and retired employees,

including pensions, postretirement health care benefits and

postemployment benefits (primarily severance). The Company

records amounts relating to these plans based on calculations

specified by U.S. GAAP, which include various actuarial

assumptions, such as discount rates, assumed rates of return on

plan assets, compensation increases, turnover rates and health

care cost trend rates. The Company reviews its actuarial

assumptions on an annual basis and makes modifications to the

assumptions based on current rates and trends when it is

deemed appropriate to do so. As required by U.S. GAAP, the

effect of the modifications is generally recorded or amortized over

future periods. The Company believes that the assumptions

utilized in recording its obligations under its plans, which are

presented in Note 14 to the consolidated financial statements, are

reasonable based on its experience and advice from its actuaries.

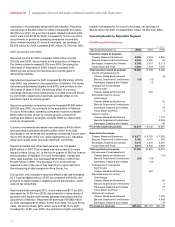

During the years ended December 31, 2002, 2001 and 2000, the

Company recorded the following amounts in the consolidated

statement of earnings for employee benefit plans:

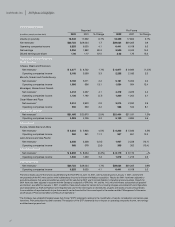

(in millions)

2002 2001 2000

U.S. pension plan income $ (33) $(227) $(315)

Non-U.S. pension plan cost 47 35 34

Postretirement healthcare cost 217 199 126

Postemployment benefit plan cost 35 12 9

Employee savings plan cost 64 63 43

Net expense (income) for employee

benefit plans $330 $ 82 $(103)

The 2002 net expense for employee benefit plans of $330 million

increased by $248 million over the 2001 amount. This increase

includes the costs associated with voluntary early retirement and

integration programs ($148 million), which were recorded during

2002. The remainder of the cost increase primarily relates to a

lowering of the Company’s discount rate assumption on its

pension and postretirement benefit plans, and lower than

expected returns on invested pension assets. The 2001 net

expense for employee benefit plans of $82 million increased by

$185 million over the 2000 amount. This increase was due

primarily to the Company’s acquisition of Nabisco, lower pension

asset returns and higher retiree medical costs.

26