Kraft 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

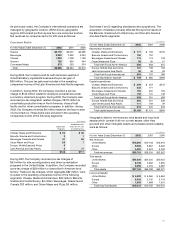

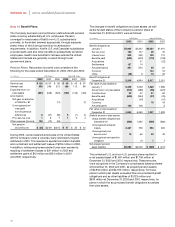

At December 31, 2002 and 2001, certain of the Company’s U.S.

plans were underfunded, with projected benefit obligations,

accumulated benefit obligations and the fair value of plan assets

of $269 million, $217 million and $45 million, respectively, in 2002

and $213 million, $164 million and $15 million, respectively, in

2001. For certain non-U.S. plans, which have accumulated benefit

obligations in excess of plan assets, the projected benefit

obligation, accumulated benefit obligation and fair value of plan

assets were $1,375 million, $1,250 million and $424 million,

respectively, as of December 31, 2002 and $1,165 million,

$1,073 million and $416 million, respectively, as of

December 31, 2001.

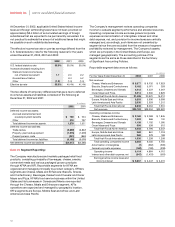

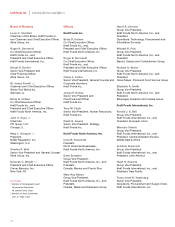

The following weighted-average assumptions were used to

determine the Company’s obligations under the plans:

U.S. Plans Non-U.S. Plans

2002 2001 2002 2001

Discount rate 6.50% 7.00% 5.56% 5.80%

Expected rate of return on

plan assets 9.00 9.00 8.41 8.49

Rate of compensation increase 4.00 4.50 3.12 3.36

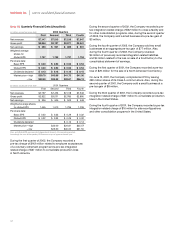

SFAS No. 87, “Employers’ Accounting for Pensions,” permits the

delayed recognition of pension fund gains and losses in ratable

periods of up to five years. The Company uses a four-year period

wherein pension fund gains and losses are reflected in the

pension calculation at 25% per year, beginning the year after the

gains or losses occur. Recent stock market declines have resulted

in deferred losses. The amortization of these deferred losses will

result in higher pension cost in future periods.

Kraft and certain of its subsidiaries sponsor employee savings

plans, to which the Company contributes. These plans cover

certain salaried, non-union and union employees. The Company’s

contributions and costs are determined by the matching of

employee contributions, as defined by the plans. Amounts charged

to expense for defined contribution plans totaled $64 million,

$63 million and $43 million in 2002, 2001 and 2000, respectively.

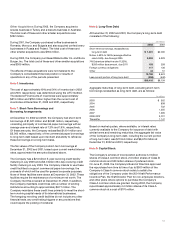

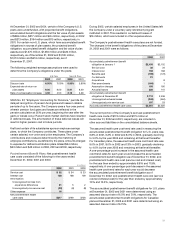

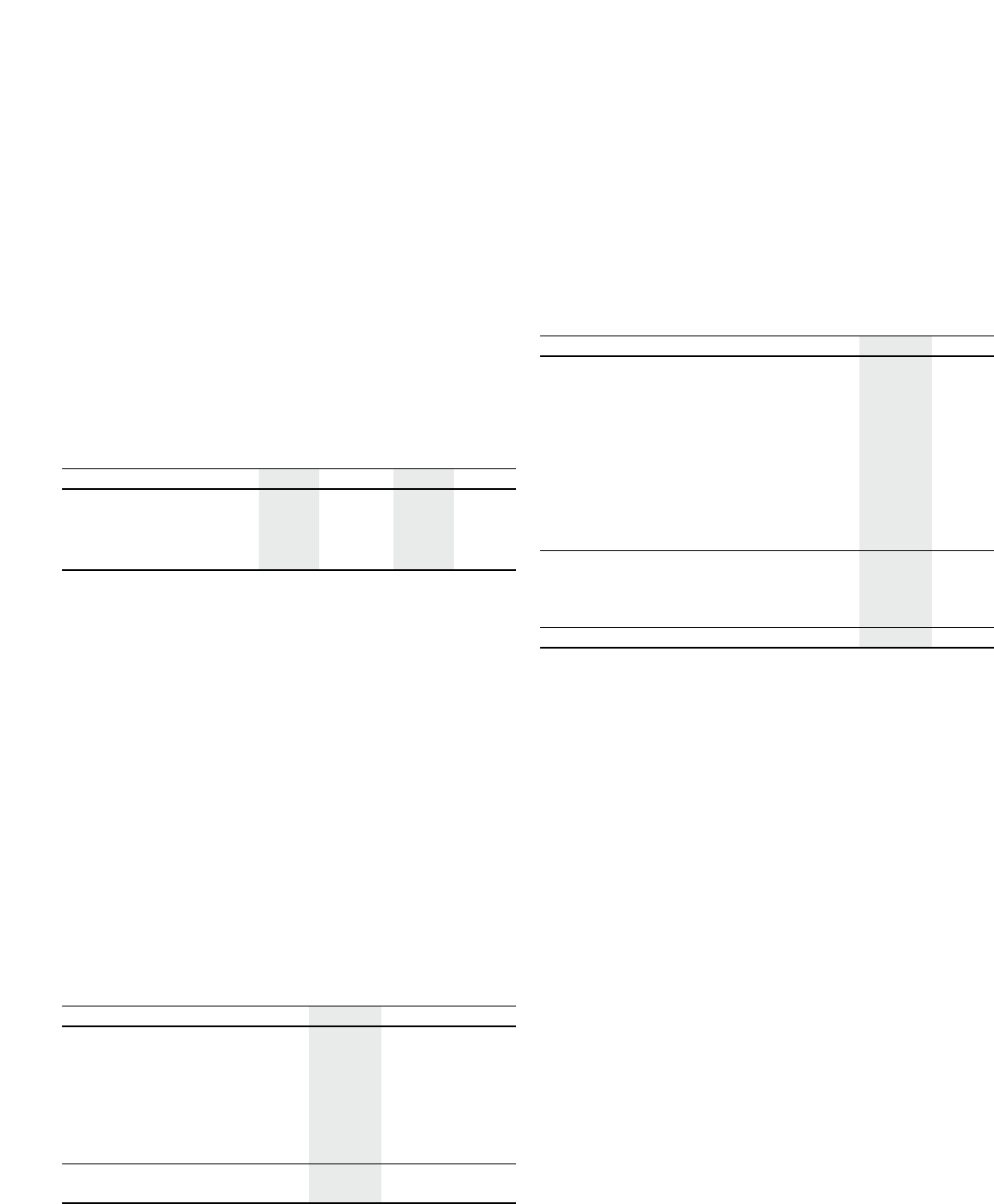

Postretirement Benefit Plans: Net postretirement health

care costs consisted of the following for the years ended

December 31, 2002, 2001 and 2000:

(in millions)

2002 2001 2000

Service cost $32 $34 $23

Interest cost 168 168 109

Amortization:

Unrecognized net loss from

experience differences 21 52

Unrecognized prior service cost (20) (8) (8)

Other expense 16

Net postretirement health

care costs $217 $199 $126

During 2002, certain salaried employees in the United States left

the Company under a voluntary early retirement program

instituted in 2001. This resulted in curtailment losses of

$16 million, which are included in other expense above.

The Company’s postretirement health care plans are not funded.

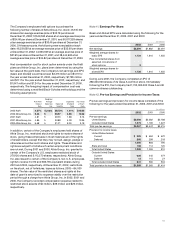

The changes in the benefit obligations of the plans at December

31, 2002 and 2001 were as follows:

(in millions)

2002 2001

Accumulated postretirement benefit

obligation at January 1 $2,436 $2,102

Service cost 32 34

Interest cost 168 168

Benefits paid (199) (172)

Curtailments 21

Acquisitions 8

Plan amendments (164) 1

Assumption changes 193 180

Actuarial losses 225 115

Accumulated postretirement benefit

obligation at December 31 2,712 2,436

Unrecognized actuarial losses (848) (464)

Unrecognized prior service cost 197 53

Accrued postretirement health care costs $2,061 $2,025

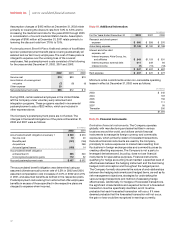

The current portion of the Company’s accrued postretirement

health care costs of $172 million and $175 million at

December 31, 2002 and 2001, respectively, are included in

other accrued liabilities on the consolidated balance sheets.

The assumed health care cost trend rate used in measuring the

accumulated postretirement benefit obligation for U.S. plans was

6.8% in 2001, 6.2% in 2002 and 8.0% in 2003, gradually declining

to 5.0% by the year 2006 and remaining at that level thereafter.

For Canadian plans, the assumed health care cost trend rate was

9.0% in 2001, 8.0% in 2002 and 7.0% in 2003, gradually declining

to 4.0% by the year 2006 and remaining at that level thereafter.

A one-percentage-point increase in the assumed health care

cost trend rates for each year would increase the accumulated

postretirement benefit obligation as of December 31, 2002, and

postretirement health care cost (service cost and interest cost)

for the year then ended by approximately 8.8% and 11.9%,

respectively. A one-percentage-point decrease in the assumed

health care cost trend rates for each year would decrease

the accumulated postretirement benefit obligation as of

December 31, 2002, and postretirement health care cost (service

cost and interest cost) for the year then ended by approximately

7.3% and 10.0%, respectively.

The accumulated postretirement benefit obligations for U.S. plans

at December 31, 2002 and 2001 were determined using an

assumed discount rate of 6.5% and 7.0%, respectively. The

accumulated postretirement benefit obligations for Canadian

plans at December 31, 2002 and 2001 were determined using an

assumed discount rate of 6.75%.

59