Kraft 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

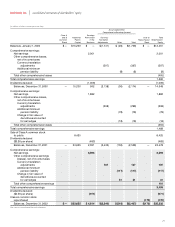

As previously noted, the Company’s international operations are

managed by geographic location. Within its two geographic

regions, KFI’s brand portfolio spans five core consumer sectors.

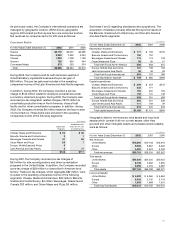

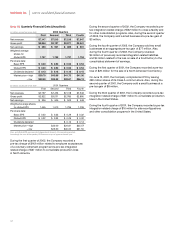

Net revenues by consumer sector for KFI were as follows:

Consumer Sector

(in millions)

For the Years Ended December 31, 2002 2001 2000

Snacks $3,179 $3,077 $2,565

Beverages 2,832 2,900 3,034

Cheese 1,202 1,208 1,193

Grocery 752 826 544

Convenient Meals 273 253 274

Total $8,238 $8,264 $7,610

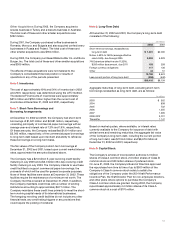

During 2002, the Company sold its Latin American yeast and

industrial bakery ingredients business at a pre-tax gain of

$69 million. This pre-tax gain was included in the operating

companies income of the Latin America and Asia Pacific segment.

In addition, during 2002, the Company recorded a pre-tax

charge of $142 million related to employee acceptances under

a voluntary retirement program. During 2002, the Company also

recorded pre-tax integration related charges of $115 million to

consolidate production lines in North America, close a Kraft

facility and for other consolidation programs. In addition, during

2002, the Company reversed $4 million related to the loss on sale

of a food factory. These items were included in the operating

companies income of the following segments:

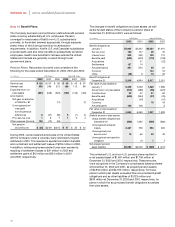

(in millions)

Integration costs

Separation and a loss on sale

Programs of a food factory

Cheese, Meals and Enhancers $60 $30

Biscuits, Snacks and Confectionery 31

Beverages, Desserts and Cereals 47 56

Oscar Mayer and Pizza 25 7

Europe, Middle East and Africa 5

Latin America and Asia Pacific 217

$142 $111

During 2001, the Company recorded pre-tax charges of

$53 million for site reconfigurations and other consolidation

programs in the United States. In addition, the Company recorded

a pre-tax charge of $29 million to close a North American food

factory. These pre-tax charges, which aggregate $82 million, were

included in the operating companies income of the following

segments: Cheese, Meals and Enhancers, $63 million; Biscuits,

Snacks and Confectionery, $2 million; Beverages, Desserts and

Cereals, $12 million; and Oscar Mayer and Pizza, $5 million.

See Notes 4 and 5 regarding divestitures and acquisitions. The

acquisition of Nabisco primarily affected the reported results of

the Biscuits, Snacks and Confectionery and the Latin America

and Asia Pacific segments.

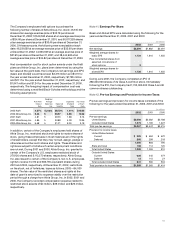

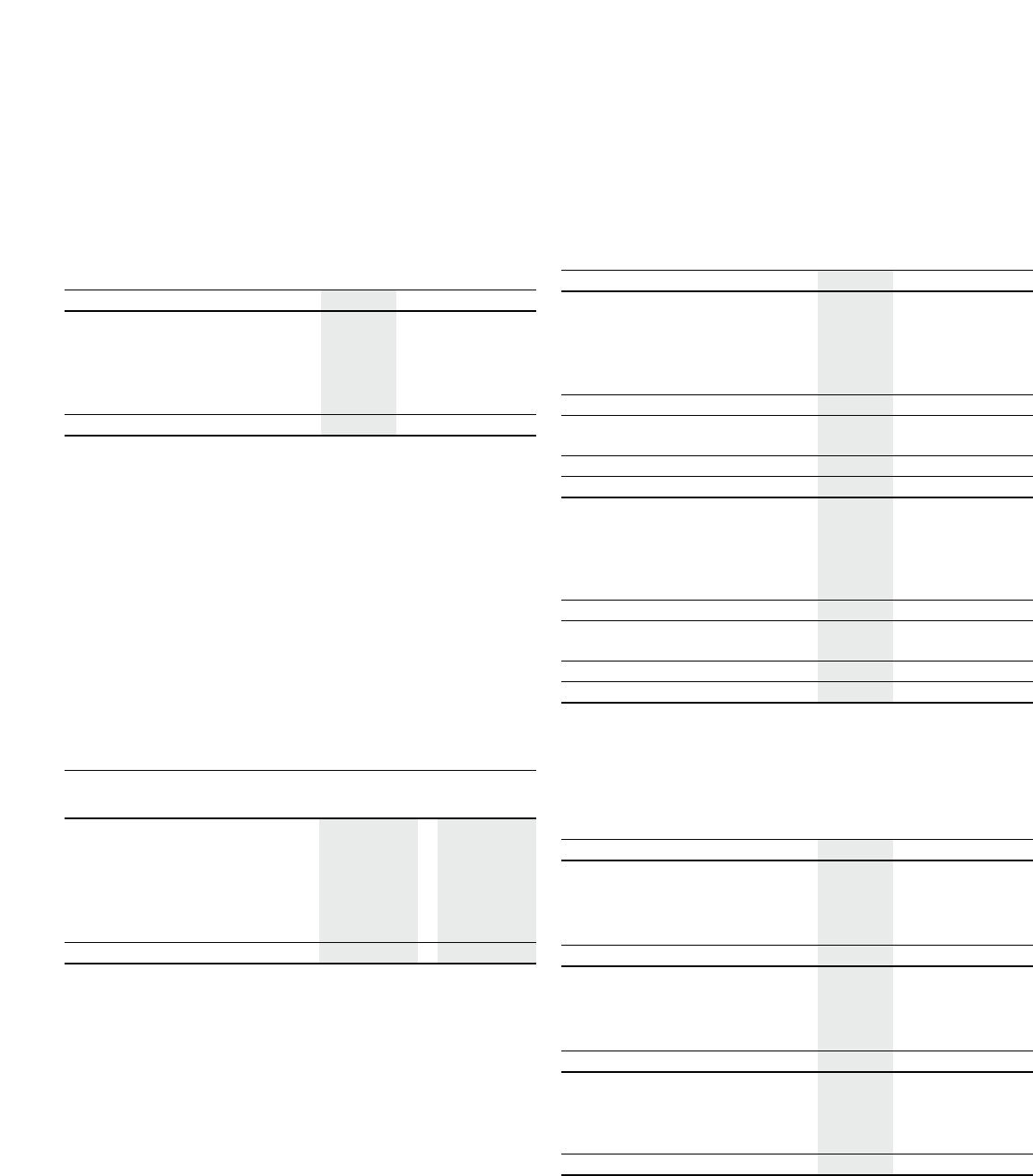

(in millions)

For the Years Ended December 31, 2002 2001 2000

Depreciation expense:

Cheese, Meals and Enhancers $ 177 $ 163 $150

Biscuits, Snacks and Confectionery 156 152

Beverages, Desserts and Cereals 115 113 109

Oscar Mayer and Pizza 58 55 51

Total Kraft Foods North America 506 483 310

Europe, Middle East and Africa 167 158 163

Latin America and Asia Pacific 36 39 26

Total Kraft Foods International 203 197 189

Total depreciation expense $ 709 $ 680 $499

Capital expenditures:

Cheese, Meals and Enhancers $ 249 $ 257 $247

Biscuits, Snacks and Confectionery 232 171

Beverages, Desserts and Cereals 194 202 193

Oscar Mayer and Pizza 133 131 148

Total Kraft Foods North America 808 761 588

Europe, Middle East and Africa 265 231 239

Latin America and Asia Pacific 111 109 79

Total Kraft Foods International 376 340 318

Total capital expenditures $1,184 $1,101 $906

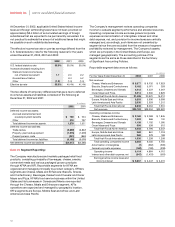

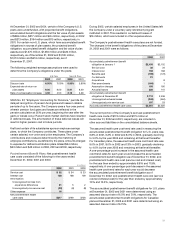

Geographic data for net revenues, total assets and long-lived

assets (which consist of all non-current assets, other than

goodwill and other intangible assets and prepaid pension assets)

were as follows:

(in millions)

For the Years Ended December 31, 2002 2001 2000

Net revenues:

United States $19,395 $19,193 $13,947

Europe 5,908 5,667 6,222

Other 4,420 4,374 2,753

Total net revenues $29,723 $29,234 $22,922

Total assets:

United States $44,406 $44,420 $40,454

Europe 8,738 7,362 7,630

Other 3,956 4,016 3,987

Total assets $57,100 $55,798 $52,071

Long-lived assets:

United States $ 6,382 $ 6,360 $ 6,684

Europe 2,432 2,132 2,116

Other 1,596 1,668 1,912

Total long-lived assets $10,410 $10,160 $10,712

57