Kraft 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During 2002, the Company acquired a snacks business in Turkey

and a biscuits business in Australia. The total cost of these and

other smaller acquisitions was $122 million. During 2001, the

Company purchased coffee businesses in Romania, Morocco

and Bulgaria and also acquired confectionery businesses in

Russia and Poland. The total cost of these and other smaller

acquisitions was $194 million. During 2000, the Company

purchased Balance Bar Co. and Boca Burger, Inc. The total cost

of these and other smaller acquisitions was $365 million. The

operating results of these businesses were not material to the

Company’s consolidated financial position or results of

operations in any of the periods presented.

During 2002, the Company sold several small North American

food businesses, some of which were previously classified as

businesses held for sale. The net revenues and operating results

of the businesses held for sale, which were not significant, were

excluded from the Company’s consolidated statements of

earnings, and no gain or loss was recognized on these sales.

In addition, the Company sold its Latin American yeast and

industrial bakery ingredients business for $110 million and

recorded a pre-tax gain of $69 million. The aggregate proceeds

received from sales of businesses during 2002 were $219 million,

on which the Company recorded pre-tax gains of $80 million.

During 2001, the Company sold several small food businesses.

The aggregate proceeds received in these transactions were

$21 million, on which the Company recorded pre-tax gains of

$8 million.

During 2000, the Company sold a French confectionery

business for proceeds of $251 million, on which a pre-tax gain of

$139 million was recorded. Several small international and North

American food businesses were also sold in 2000. The aggregate

proceeds received from sales of businesses during 2000 were

$300 million, on which the Company recorded pre-tax gains of

$172 million.

The operating results of the businesses sold were not material

to the Company’s consolidated operating results in any of the

periods presented.

Century Date Change: The Company did not experience any

material disruptions to its business as a result of the Century

Date Change (“CDC”). The Company’s increases in 1999 year-end

inventories and trade receivables caused by preemptive CDC

contingency plans resulted in incremental cash outflows during

1999 of approximately $155 million. The cash outflows reversed in

the first quarter of 2000. In addition, the Company had increased

shipments in the fourth quarter of 1999 because customers

purchased additional product in anticipation of potential CDC-

related disruptions. The increased shipments in 1999 resulted in

estimated incremental net revenues and operating companies

income in 1999 of approximately $85 million and $40 million,

respectively, and corresponding decreases in net revenues and

operating companies income in 2000.

53rd Week: The Company’s subsidiaries end their fiscal years

as of the Saturday closest to the end of each year. Accordingly,

most years contain 52 weeks of operating results while every fifth

or sixth year includes 53 weeks. The Company’s consolidated

statement of earnings for the year ended December 31, 2000

included a 53rd week. Volume comparisons contained in this

Management’s Discussion and Analysis for 2001 versus 2000

have been provided on a comparable 52-week basis to provide

a more meaningful comparison of operating results.

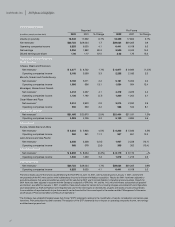

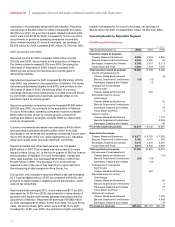

Consolidated Operating Results

The acquisition of Nabisco and subsequent IPO were significant

events that affect the comparability of earnings. In order to isolate

the financial effects of these events, and to provide a more

meaningful comparison of the Company’s results of operations,

the following tables and the subsequent discussion of the

Company’s consolidated operating results refer to results on a

reported and pro forma basis. Reported results include the

operating results of Nabisco in 2002 and 2001, but not in 2000.

Reported results also reflect average shares of common stock

outstanding during 2002 and 2001, and reflect an average of

1.455 billion shares outstanding during 2000. Pro forma results

assume the Company owned Nabisco for all of 2000. In addition,

pro forma results reflect common shares outstanding based on

the assumption that shares issued immediately following the IPO

were outstanding during 2001 and 2000, and that, effective

January 1, 2000, the net proceeds of the IPO were used to retire a

portion of a long-term note payable used to finance the Nabisco

acquisition. Pro forma results also adjust for other items, all of

which are detailed in reconciliations of reported to pro forma

results throughout this discussion. Management uses pro forma

results to manage and to evaluate the performance of the

Company. Management believes it is appropriate to disclose

pro forma results to assist investors with analyzing business

performance and trends. Pro forma measures should not be

considered in isolation or as a substitute for reported results,

which are prepared in accordance with accounting principles

generally accepted in the United States.

29