Kraft 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

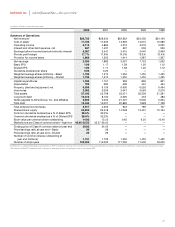

Reported operating companies income for 2001 increased

$254 million (13.8%) over 2000, due primarily to the acquisition

of Nabisco ($234 million), lower marketing, administration and

research costs ($140 million, primarily lower marketing expense)

and the shift in CDC income ($15 million), partially offset by

unfavorable margins ($48 million, due primarily to higher dairy

commodity costs) and the loss on the sale of a North American

food factory and integration costs ($63 million). On a pro forma

basis, operating companies income increased 6.4%.

Biscuits, Snacks and Confectionery: Reported volume in 2001

increased more than 100% over 2000, due primarily to the

acquisition of Nabisco. On a pro forma basis, volume in 2001

increased 1.6% over 2000. Excluding the 53rd week of shipments

in 2000, volume also increased 1.6%, due primarily to new

product introductions in biscuits, partially offset by lower

shipments of snack nuts.

During 2001, reported net revenues increased $4.8 billion, or more

than 100% over 2000, due primarily to the acquisition of Nabisco.

On a pro forma basis, net revenues increased 2.1%, due primarily

to higher volume driven by new biscuit products and higher

pricing of biscuit and confectionery products.

Reported operating companies income for 2001 increased

$866 million, or more than 100% over 2000, due primarily to the

acquisition of Nabisco ($925 million), partially offset by higher

marketing, administration and research costs ($27 million). On a

pro forma basis, operating companies income increased 24.9%,

due primarily to higher volume from new biscuit products, lower

commodity costs for snack nuts, and productivity and Nabisco

synergy savings.

Beverages, Desserts and Cereals: Reported volume in 2001

increased 9.8% over 2000, due primarily to growth in beverages.

On a pro forma basis, volume in 2001 increased 7.7% over 2000.

Excluding the 53rd week of shipments in 2000, volume increased

9.3%, due primarily to increased shipments of ready-to-drink

beverages, benefiting from the introduction of new products.

Desserts volume was below the prior year, due to lower shipments

of dry packaged desserts and frozen toppings. Cereal volume

declined, due primarily to weak category performance and

increased competition in the ready-to-eat cereal category.

During 2001, reported net revenues decreased $30 million (0.7%)

from 2000, due primarily to lower net pricing ($167 million, due

primarily to coffee commodity-related price reductions), partially

offset by the acquisition of Nabisco ($83 million), the acquisition

of Balance Bar Co. ($20 million), the shift in CDC revenues ($16

million) and higher volume/mix ($17 million). On a pro forma basis,

net revenues decreased 3.1%, reflecting commodity-related price

reductions on coffee products and lower shipments in desserts

and cereals.

Reported operating companies income for 2001 increased

$102 million (9.4%) over 2000, primarily reflecting lower marketing,

administration and research costs ($139 million), the acquisition

of Nabisco ($32 million), and the shift in CDC income ($7 million),

partially offset by unfavorable margins ($31 million) and

integration costs ($12 million). On a pro forma basis, operating

companies income increased 6.8%.

Oscar Mayer and Pizza: Reported volume in 2001 increased

0.8% over 2000. Excluding the 53rd week of shipments in 2000,

volume increased 2.3%, due to volume gains in processed meats

and pizza. The processed meats business recorded volume gains

in luncheon meats, hot dogs, bacon and soy-based meat

alternatives. Volume in the pizza business increased, driven by

new products.

During 2001, reported net revenues increased $101 million (3.6%)

over 2000, due primarily to higher volume/mix ($75 million), the

shift in CDC revenues ($11 million) and the acquisition of Boca

Burger, Inc.

Reported operating companies income for 2001 increased

$27 million (5.3%) over 2000, primarily reflecting higher

volume/mix ($45 million), lower marketing, administration and

research costs ($22 million) and the shift in CDC income, partially

offset by unfavorable margins ($36 million, due primarily to higher

meat and cheese commodity costs).

Kraft Foods International

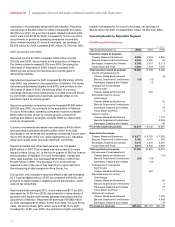

(in millions)

Year Ended December 31, 2002 2001 2000

Reported volume (in pounds):

Europe, Middle East and Africa 2,961 2,826 2,829

Latin America and Asia Pacific 2,059 2,057 803

Total reported volume (in pounds) 5,020 4,883 3,632

Volume of businesses sold:

Europe, Middle East and Africa (1) (40)

Latin America and Asia Pacific (135) (172) (37)

Estimated impact of century

date change:

Europe, Middle East and Africa 7

Latin America and Asia Pacific 7

Nabisco volume:

Europe, Middle East and Africa 44

Latin America and Asia Pacific 936

Pro forma volume (in pounds) 4,885 4,710 4,549

Reported net revenues:

Europe, Middle East and Africa $6,203 $5,936 $6,398

Latin America and Asia Pacific 2,035 2,328 1,212

Total reported net revenues 8,238 8,264 7,610

Net revenues of businesses sold:

Europe, Middle East and Africa (131)

Latin America and Asia Pacific (68) (90) (21)

Estimated impact of century

date change:

Europe, Middle East and Africa 14

Latin America and Asia Pacific 12

Nabisco net revenues:

Europe, Middle East and Africa 46

Latin America and Asia Pacific 1,028

Pro forma net revenues $8,170 $8,174 $8,558

35