Kraft 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

kraft foods inc. notes to consolidated financial statements

Note 14. Benefit Plans:

The Company sponsors noncontributory defined benefit pension

plans covering substantially all U.S. employees. Pension

coverage for employees of Kraft’s non-U.S. subsidiaries is

provided, to the extent deemed appropriate, through separate

plans, many of which are governed by local statutory

requirements. In addition, Kraft’s U.S. and Canadian subsidiaries

provide health care and other benefits to substantially all retired

employees. Health care benefits for retirees outside the United

States and Canada are generally covered through local

government plans.

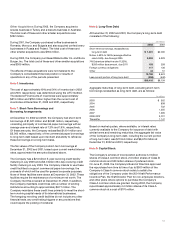

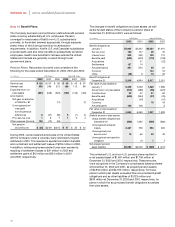

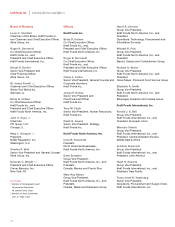

Pension Plans: Net pension (income) cost consisted of the

following for the years ended December 31, 2002, 2001 and 2000:

(in millions) U.S. Plans Non-U.S. Plans

2002 2001 2000 2002 2001 2000

Service cost $ 120 $ 107 $ 69 $49 $45 $37

Interest cost 339 339 213 120 112 98

Expected return on

plan assets (631) (648) (523) (134) (126) (103)

Amortization:

Net gain on adoption

of SFAS No. 87 (11) (1)

Unrecognized net

loss (gain)

from experience

differences 8(21) (36) 5(1) (1)

Prior service cost 187754

Other expense (income) 130 (12) (34)

Net pension

(income) cost $ (33) $(227) $(315) $47 $35 $34

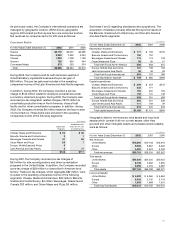

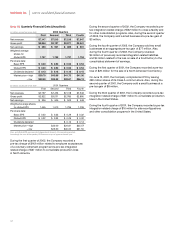

During 2002, certain salaried employees in the United States

left the Company under a voluntary early retirement program

instituted in 2001. This resulted in special termination benefits

and curtailment and settlement losses of $109 million in 2002.

In addition, retiring employees elected lump-sum payments,

resulting in settlement losses of $21 million in 2002 and

settlement gains of $12 million and $34 million in 2001

and 2000, respectively.

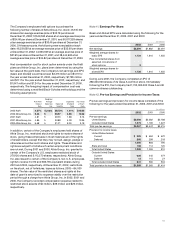

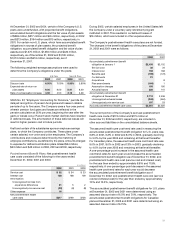

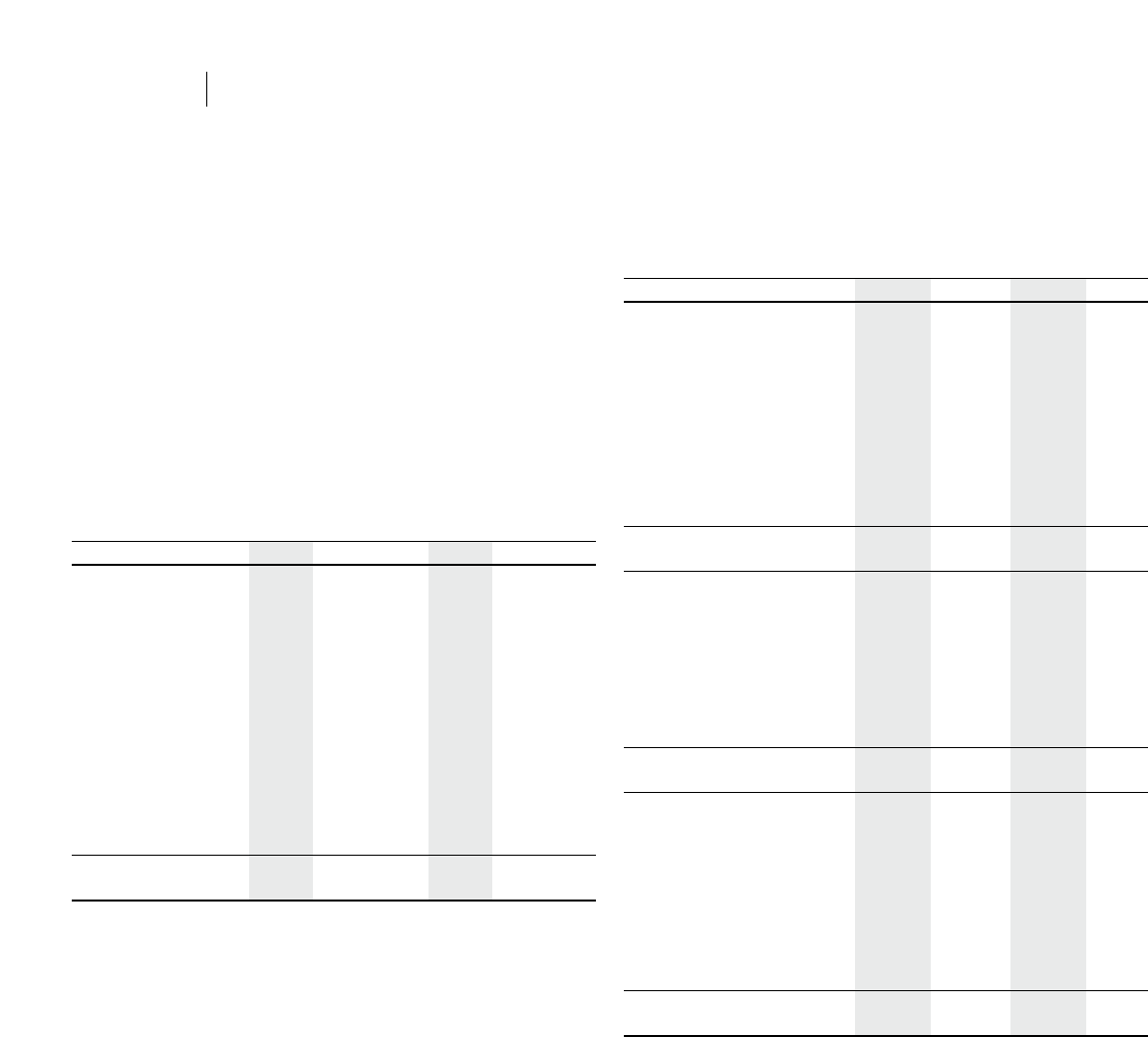

The changes in benefit obligations and plan assets, as well

as the funded status of the Company’s pension plans at

December 31, 2002 and 2001, were as follows:

(in millions) U.S. Plans Non-U.S. Plans

2002 2001 2002 2001

Benefit obligation at

January 1 $4,964 $4,327 $2,021 $1,915

Service cost 120 107 49 45

Interest cost 339 339 120 112

Benefits paid (624) (403) (115) (108)

Acquisitions 71 (22)

Settlements 127 14

Actuarial losses 367 500 85 22

Currency 144 18

Other (48) 913 39

Benefit obligation at

December 31 5,245 4,964 2,317 2,021

Fair value of plan assets at

January 1 6,359 7,039 1,329 1,589

Actual return on plan assets (914) (386) (56) (227)

Contributions 26 37 81 63

Benefits paid (636) (394) (87) (76)

Acquisitions (45) (41)

Currency 70 18

Actuarial gains 130 108 3

Fair value of plan assets at

December 31 4,965 6,359 1,337 1,329

(Deficit) excess of plan assets

versus benefit obligations at

December 31 (280) 1,395 (980) (692)

Unrecognized actuarial

losses 2,487 756 394 226

Unrecognized prior

service cost 13 56 50 49

Unrecognized net transition

obligation (1) 77

Net prepaid pension

asset (liability) $2,220 $2,206 $ (529) $ (410)

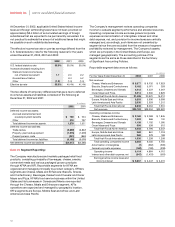

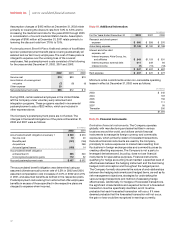

The combined U.S. and non-U.S. pension plans resulted in

a net prepaid asset of $1,691 million and $1,796 million at

December 31, 2002 and 2001, respectively. These amounts

were recognized in the Company’s consolidated balance sheets

at December 31, 2002 and 2001, as prepaid pension assets

of $2,814 million and $2,675 million, respectively, for those

plans in which plan assets exceeded their accumulated benefit

obligations and as other liabilities of $1,123 million and

$879 million at December 31, 2002 and 2001, respectively, for

plans in which the accumulated benefit obligations exceeded

their plan assets.