Kodak 2000 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

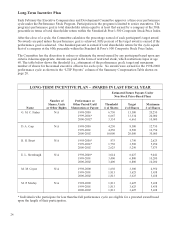

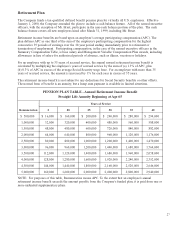

Retirement Plan

The Company funds a tax-qualified defined benefit pension plan for virtually all U.S. employees. Effective

January 1, 2000, the Company amended the plan to include a cash balance feature. All of the named executive

officers, with the exception of Mr. Brust, participate in the non-cash balance portion of the plan. The cash

balance feature covers all new employees hired after March 31, 1999, including Mr. Brust.

Retirement income benefits are based upon an employee’s average participating compensation (APC). The

plan defines APC as one third of the sum of the employee’s participating compensation for the highest

consecutive 39 periods of earnings over the 10-year period ending immediately prior to retirement or

termination of employment. Participating compensation, in the case of the named executive officers in the

Summary Compensation Table, is base salary and Management Variable Compensation Plan awards, including

allowances in lieu of salary for authorized periods of absence, such as illness, vacation or holidays.

For an employee with up to 35 years of accrued service, the annual normal retirement income benefit is

calculated by multiplying the employee’s years of accrued service by the sum of (a) 1.3% of APC, plus

(b) 0.3% of APC in excess of the average Social Security wage base. For an employee with more than 35

years of accrued service, the amount is increased by 1% for each year in excess of 35 years.

The retirement income benefit is not subject to any deductions for Social Security benefits or other offsets.

The normal form of benefit is an annuity, but a lump sum payment is available in limited situations.

PENSION PLAN TABLE - Annual Retirement Income Benefit

Straight Life Annuity Beginning at Age 65

Years of Service

Remuneration 2 20 25 30 35 40

$ 500,000 $ 16,000 $ 160,000 $ 200,000 $ 240,000 $ 280,000 $ 294,000

1,000,000 32,000 320,000 400,000 480,000 560,000 588,000

1,500,000 48,000 480,000 600,000 720,000 840,000 882,000

2,000,000 64,000 640,000 800,000 960,000 1,120,000 1,176,000

2,500,000 80,000 800,000 1,000,000 1,200,000 1,400,000 1,470,000

3,000,000 96,000 960,000 1,200,000 1,440,000 1,680,000 1,764,000

3,500,000 112,000 1,120,000 1,400,000 1,680,000 1,960,000 2,058,000

4,000,000 128,000 1,280,000 1,600,000 1,920,000 2,240,000 2,352,000

4,500,000 144,000 1,440,000 1,800,000 2,160,000 2,520,000 2,646,000

5,000,000 160,000 1,600,000 2,000,000 2,400,000 2,800,000 2,940,000

NOTE: For purposes of this table, Remuneration means APC. To the extent that an employee’s annual

retirement income benefit exceeds the amount payable from the Company’s funded plan, it is paid from one or

more unfunded supplementary plans.