Kodak 2000 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

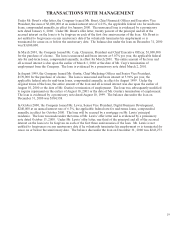

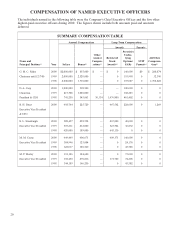

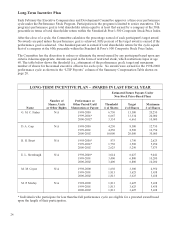

28

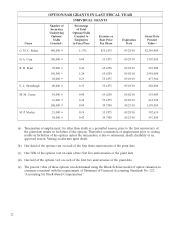

The following table shows the years of service credited as of December 31, 2000, to each of the named

executive officers. This table also shows the amount of each named executive officer’s APC at the end of

2000, except for Mr. Brust who participates in the cash balance feature.

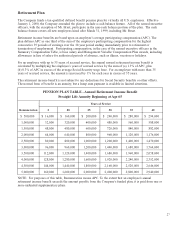

RETIREMENT PLAN

Name Years of Service Average Participating Compensation

G. M. C. Fisher 29(a) $3,794,998

D. A. Carp 30 1,372,617

E. L. Steenburgh 2(b) 700,440

M. M. Coyne 18 580,000

M. P. Morley 36 530,780

(a) Mr. Fisher was credited with 22 extra years of service for purposes of calculating his retirement benefit;

any pension benefit payable is offset by any pension paid by his previous employer.

(b) After Mr. Steenburgh has been employed for five years, he will be credited with 20 extra years of service

for purposes of calculating his retirement benefit.

Cash Balance Feature

Under the cash balance feature of the Company’s pension plan, the Company establishes an account for each

participating employee. Every month the employee works, the Company credits the employee’s account with

an amount equal to four percent of the employee’s monthly pay. In addition, the ongoing balance of the

employee’s account earns interest at the 30-year Treasury bond rate. To the extent federal laws place

limitations on the amount of pay that may be taken into account under the plan, four percent of the excess pay

is credited to an account established for the employee in an unfunded supplementary plan. If a participating

employee leaves the Company and is vested (five or more years of service), the employee’s account balance

will be distributed to the employee in the form of a lump sum or monthly annuity. If the participating

employee’s account balance exceeds $5,000, the employee also has the choice of leaving his or her account

balance in the plan to continue to earn interest.

In addition to the benefits described above, Mr. Brust is covered under a special supplemental pension

arrangement established under his December 20, 1999, offer letter. The supplemental pension arrangement

provides Mr. Brust a single life annuity of $12,500 per month upon his retirement if he remains employed with

the Company for at least five years. The $12,500 monthly annuity will be offset by Mr. Brust’s cash balance

benefit and by all other Company-paid retirement income benefits provided to Mr. Brust.