Kodak 2000 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

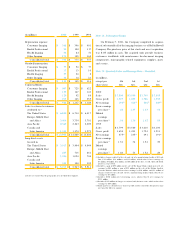

Note 15: Acquisitions and Joint Ve n t u re s

2 0 0 0 During the second quart e r, the Company acquired the

remaining ownership interest in Picture Vision, Inc. for cash and

assumed liabilities with a total transaction value of appro x i m a t e l y

$90 million. Picture Vision, the leading provider of digital imaging

network services and solutions at retail, now operates as a wholly-

owned subsidiary of the Company. Kodak has integrated the

p roducts and activities of its Picture Network, which pro v i d e s

consumers with an Internet-based digital imaging network serv-

ice, with Picture Vi s i o n ’s digital imaging service, PhotoNet. In re l a-

tion to this acquisition, the Company’s second quarter re s u l t s

included $10 million in charges for acquired in-process R&D and

a p p roximately $15 million for other acquisition-related charg e s .

Goodwill related to this acquisition is being amortized over 7 years.

1 9 9 9 In connection with the sale of the C ompany’s digital printer,

c o p i e r- d u p l i c a t o r , and roller assembly operations primarily asso-

ciated with the Office Imaging bus iness (See Note 16, Sales

of Assets and Divestitures), the Company and Heidelberg e r

D ruckmaschinen AG (Heidelberg) also announced an agre e m e n t

to expand their joint venture company, NexPress, to include the

black-and-white electrophotographic business. The C ompany

contributed R&D re s o u rces to NexPress, as well as its toner and

developer operations in Rochester and Kirkby, England. This

transaction did not have a material effect on the Company’s

results of operations or financial position in 1999. Kodak and

H e i d e l b e rg established the NexPress joint venture in September

1997 for the purpose of developing and marketing new digital

color printing solutions for the graphic arts industry. In connec-

tion with these arrangements, the Company serves as a supplier

both to Heidelberg and NexPress for consumables such as pho-

t o c o n d u c t o r s and raw materials for toner/developer manufacturing.

58

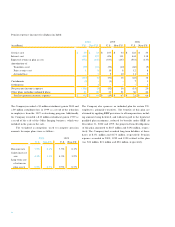

The following table summarizes information about stock options at December 31, 2000:

(Number of options in thousands) Options Outstanding Options Exerc i s a b l e

We i g h t e d -

Range of Exercise Prices Av e r a g e We i g h t e d - We i g h t e d -

R e m a i n i n g Av e r a g e Av e r a g e

A t L e s s C o n t r a c t u a l E x e rc i s e E x e rc i s e

L e a s t T h a n O p t i o n s L i f e P r i c e O p t i o n s P r i c e

$ 3 0 – $ 4 5 6 , 8 8 9 2 . 7 3 $ 4 0 . 0 4 6 , 3 4 8 $ 4 0 . 0 2

$ 4 5 – $ 6 0 1 3 , 4 3 3 7 . 9 4 $ 5 4 . 4 9 3 , 2 3 0 $ 5 4 . 1 8

$ 6 0 – $ 7 5 2 1 , 4 0 6 7 . 0 7 $ 6 7 . 7 7 1 6 , 7 3 8 $ 6 8 . 3 7

$ 7 5 – $ 9 0 9 9 6 6 . 7 7 $ 8 0 . 4 3 8 4 5 $ 8 0 . 9 6

Over $90 2 , 1 2 2 6 . 1 5 $ 9 0 . 1 9 1 , 6 2 2 $ 9 0 . 2 1

4 4 , 8 4 6 2 8 , 7 8 3

(Number of options in thousands)