Kodak 2000 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 31, 2000, the Company had outstanding letters

of credit totaling $54 million to ensure the completion of enviro n-

mental remediations and payment of poss ible casualty and

Workers’ Compensation claims.

Rental expense, net of minor sublease income, amounted to

$155 million in 2000, $142 million in 1999 and $149 million in

1998. The approximate amounts of noncancelable lease commit-

ments with terms of more than one year, principally for the re n t a l

of real pro p e rt y, reduced by minor sublease income, are $104 mil-

lion in 2001, $78 million in 2002, $65 million in 2003, $33 million

in 2004, $24 million in 2005, and $47 million in 2006 and there a f t e r.

The Company and its subs idiary companies are involved

in lawsuits, claims, investigations and proceedings, including

p roduct liability, commercial, environmental, and health and safety

matters, which are being handled and defended in the ord i n a ry

course of business. There are no such matters pending that the

Company and its General C ounsel expect to be material in

relation to the Company’s business, financial pos ition or re s u l t s

of operations.

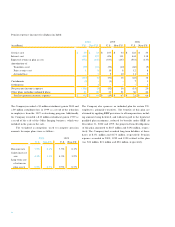

Note 9: Financial Instru m e n t s

The following table presents the carrying amounts and the esti-

mated fair values of financial instruments at December 31, 2000

and 1999; ( ) denotes liabilities:

2 0 0 0 1 9 9 9

C a rry i n g F a i r C a rry i n g F a i r

(in millions) A m o u n t Va l u e A m o u n t Va l u e

Marketable

s e c u r i t i e s :

C u rre n t $ 5 $ 5 $2 0 $ 2 0

L o n g - t e rm 4 8 5 3 9 3 9 3

Other

i n v e s t m e n t s 2 2 2 4 3 5

L o n g - t e rm

b o rro w i n g s ( 1 , 1 6 6 ) ( 1 , 1 8 4 ) ( 9 3 6 ) ( 9 4 8 )

F o reign

c u rrency

f o rw a rd s ( 4 4 ) ( 4 4 ) ( 6 ) ( 4 )

Silver forw a rd s ( 1 7 ) ( 1 7 ) – 3

Marketable securities and other investments are valued at quoted

market prices. The fair values of long-term borrowings were

d e t e rmined by re f e rence to quoted market prices or by obtaining

quotes from dealers. The fair values for the remaining financial

i n s t ruments in the above table are based on dealer quotes and

reflect the estimated amounts the Company would pay or re c e i v e

to terminate the contracts. The carrying values of cash and cash

equivalents, receivables, short - t e rm borrowings and payables

a p p roximate their fair values.

The Company, as a result of its global operating and

financing activities, is expos ed to changes in foreign curre n c y

exchange rates, commodity prices, and interest rates which may

adversely affect its results of operations and financial position.

The Company manages such exposures, in part, with derivative

financial instru m e n t s .

F o reign currency forw a rd contracts are used to hedge exist-

ing foreign currency denominated assets and liabilities, especially

those of the Company’s International Tre a s u ry Center, as well as

f o recasted foreign currency denominated intercompany sales.

Silver forw a rd contracts are used to mitigate the Company’s risk

to fluctuating silver prices. The Company’s exposure to changes

in interest rates results from its investing and borrowing activities

used to meet its liquidity needs. Long-term debt is generally

us ed to finance long-term investments, while short - t e rm debt

is used to meet working capital re q u i rements. Derivative instru-

ments are not presently used to adjust the Company’s intere s t

rate risk profile. The Company does not utilize financial instru-

ments for trading or other speculative purposes.

The Company’s financial instrument counterparties are high-

quality investment or commercial banks with significant experi-

ence with such instruments. The Company manages exposure to

c o u n t e r p a rty credit risk by requiring specific minimum credit stan-

d a rds and diversification of counterparties. The C ompany has

p ro c e d u res to monitor the credit exposure amounts. The maxi-

mum credit exposure at December 31, 2000 was not significant

to the Company.

50