Kodak 2000 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

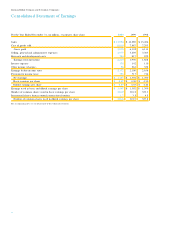

Note 10: Income Ta x e s

The components of earnings before income taxes and the re l a t e d

p rovis ion for U.S. and other income taxes were as follows:

(in millions) 2 0 0 0 1 9 9 9 1 9 9 8

E a rnings before

income taxes

U . S . $1 , 2 9 4 $1 , 3 9 8 $ 1 , 5 7 8

Outside the U.S. 8 3 8 7 1 1 5 2 8

To t a l $2 , 1 3 2 $2 , 1 0 9 $ 2 , 1 0 6

U.S. income taxes

C u rrent pro v i s i o n $1 4 5 $1 8 5 $ 3 5 1

D e f e rred pro v i s i o n 2 2 5 2 1 5 1 3 6

Income taxes outside

the U.S.

C u rrent pro v i s i o n 2 6 8 2 2 5 1 1 3

D e f e rred pro v i s i o n 3 7 2 3 6 1

State and other

income taxes

C u rrent pro v i s i o n 3 5 6 0 5 0

D e f e rred pro v i s i o n 1 5 9 5

To t a l $7 2 5 $7 1 7 $ 7 1 6

The diff e rences between the provision for income taxes and

income taxes computed using the U.S. federal income tax rate

w e re as follows:

(in millions) 2 0 0 0 1 9 9 9 1 9 9 8

Amount computed using

the statutory rate $7 4 6 $7 3 8 $ 7 3 7

I n c rease (reduction) in

taxes resulting fro m :

State and other

income taxes 3 3 4 5 3 8

Goodwill amort i z a t i o n 4 0 3 6 2 8

E x p o rt sales and

manufacturing

c re d i t s ( 4 8 ) ( 4 5 ) ( 3 9 )

Operations outside

the U.S. ( 7 9 ) ( 3 6 ) ( 1 5 )

O t h e r, net 3 3 ( 2 1 ) ( 3 3 )

P rovision for

income taxes $7 2 5 $7 1 7 $ 7 1 6

The significant components of deferred tax assets and liabilities

w e re as follows:

(in millions) 2 0 0 0 1 9 9 9

D e f e rred tax assets

Postemployment obligations $9 1 6 $9 9 2

R e s t ructuring pro g r a m s –7 4

I n v e n t o r i e s 1 3 9 1 5 3

Tax loss carry f o rw a rd s 1 0 3 9 4

O t h e r 8 8 4 9 0 5

2 , 0 4 2 2 , 2 1 8

Valuation allowance ( 1 0 3 ) ( 9 4 )

To t a l $1 , 9 3 9 $2 , 1 2 4

D e f e rred tax liabilities

D e p re c i a t i o n $5 5 5 $5 2 7

L e a s i n g 2 2 5 2 6 0

O t h e r 5 9 1 5 3 4

To t a l $1 , 3 7 1 $1 , 3 2 1

The valuation allowance is primarily attributable to certain net

operating loss carry f o rw a rds outside the U.S. A majority of the

net operating loss carry f o rw a rds are subject to a five-year expi-

ration period.

Retained earnings of subsidiary companies outs ide the

U.S. were approximately $1,574 million and $1,439 million at

December 31, 2000 and 1999, re s p e c t i v e l y. Retained earnings

at December 31, 2000 are considered to be reinvested indefi-

n i t e l y. If remitted, they would be substantially free of additional

tax. It is not practicable to determine the deferred tax liability for

t e m p o r a ry diff e rences related to these retained earn i n g s .

Note 11: Restructuring Programs and Cost Reduction

During the third quarter of 1999, the Company re c o rded a pre -

tax re s t ructuring charge of $350 million relating to worldwide

manufacturing and photofinishing consolidation and reductions in

selling, general and administrative positions worldwide. The

Company re c o rded $236 million of the $350 million provision as

cost of goods sold, primarily for employee severance costs, asset

write-downs, and shutdown costs related to these actions. The

remaining $114 million was re c o rded as SG &A for employee

severance payments.