Kodak 2000 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

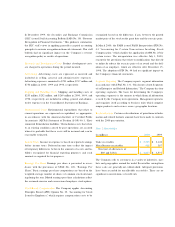

Assumed healthcare cost trend rates have a significant eff e c t

on the amounts re p o rted for the healthcare plans. A one per-

centage point change in assumed healthcare cost trend rates

would have the following eff e c t s :

1 % 1 %

i n c re a s e d e c re a s e

E ffect on total service and interest

cost components $ 6 $ ( 4 )

E ffect on postre t i rement benefit

o b l i g a t i o n 8 3 ( 5 2 )

Note 14: Stock Option And Compensation Plans

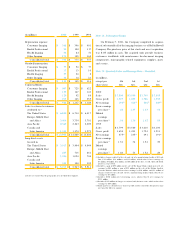

The Company’s stock incentive plans consist of the 2000

Omnibus Long-Te rm Compensation Plan (the 2000 Plan), the

1995 Omnibus Long-Te rm Compensation Plan (the 1995 Plan),

and the 1990 Omnibus Long-Te rm Compensation Plan (the 1990

Plan). The Plans are administered by the Executive Compensation

and Development Committee of the Board of Dire c t o r s .

Under the 2000 Plan, 22 million shares of the Company’s

common stock may be granted to a variety of employees between

J a n u a ry 1, 2000 and December 31, 2004. The 2000 Plan is sub-

stantially similar to, and is intended to replace, the 1995 Plan

which expired on December 31, 1999.

Under the 1995 Plan, 22 million shares of the Company’s

common stock were eligible for grant to a variety of employees

between Febru a ry 1, 1995 and December 31, 1999. Option

prices are not less than 100% of the per- s h a re fair market value

on the date of grant, and the options generally expire ten years

f rom the date of grant, but may expire sooner if the optionee’s

employment terminates. The 1995 Plan also provides for Stock

A p p reciation Rights (SARs) to be granted, either in tandem with

options or freestanding. SARs allow optionees to receive pay-

ment equal to the diff e rence between the Company’s stock mar-

ket price on grant date and exercise date. At December 31, 2000,

229,215 freestanding SARs were outstanding at option prices

ranging from $56.31 to $71.81.

Under the 1990 Plan, 22 million shares of the Company’s

common stock were eligible for grant to key employees between

F e b ru a ry 1, 1990 and January 31, 1995. Option prices could not

be less than 50% of the per- s h a re fair market value on the date

of grant; however, no options below fair market value were

granted. The options generally expire ten years from the date of

grant, but may expire s ooner if the optionee’s employment term i-

nates. The 1990 Plan also provided that options with dividend

equivalents, tandem SARs and freestanding S ARs could be

granted. At December 31, 2000, 106,754 freestanding SARs

w e re outstanding at option prices ranging from $32.50 to $44.50.

In April 1998, the Company made a grant of 100 stock

options for common stock to most employees of the Company at

that date (8,468,100 shares under options). The options were

granted at fair market value on the date of grant and expire ten

years from the grant date. The options have a two-year vesting

period. The Executive Compensation and Development Commit-

tee of the Board of Directors approved the grant. A second grant

of 100 stock options for common stock was made on March 13,

2000 to most employees of the Company at that date (7,004,400

s h a res under options). The options were granted at fair market

value on the date of grant and expire ten years from the grant

date. The options have a two-year vesting period.

56